TSX Growth Leaders With High Insider Stakes June 2024

As the Canadian market experiences a phase of stabilization and potential recovery, influenced by recent rate cuts from the Bank of Canada, investors may find opportunities in growth companies with high insider ownership. These companies often benefit from aligned interests between shareholders and management, which can be particularly advantageous in navigating the evolving economic landscape.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Payfare (TSX:PAY) | 15% | 57.7% |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 65.5% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Here we highlight a subset of our preferred stocks from the screener.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.58 billion.

Operations: Colliers International Group's revenue is segmented into the Americas generating CA$2.53 billion, Asia Pacific at CA$616.58 million, Investment Management with CA$489.23 million, and Europe, Middle East & Africa (EMEA) contributing CA$730.10 million.

Insider Ownership: 14.2%

Return On Equity Forecast: N/A (2027 estimate)

Colliers International Group is experiencing robust growth, with earnings expected to increase by 38.3% annually over the next three years, outpacing the Canadian market's forecast of 14.5%. Despite this strong growth projection, revenue is anticipated to grow at a slower rate of 9.5% annually. Recent activities include a $57.62 million Shelf Registration for ESOP-related offerings and a steady dividend affirmation at US$0.15 per share, underscoring ongoing shareholder returns despite some level of insider selling and shareholder dilution over the past year.

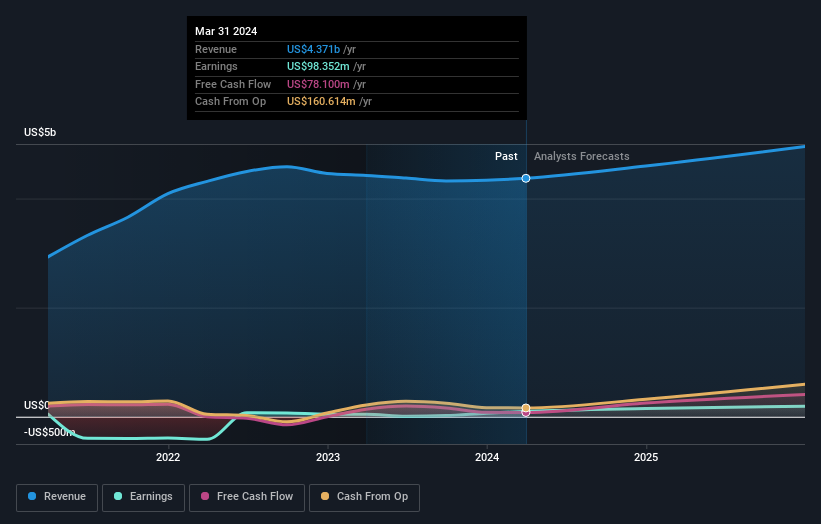

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services in Canada with a market cap of approximately CA$3.18 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.7%

Return On Equity Forecast: 24% (2027 estimate)

goeasy Ltd. is positioned for notable growth with revenue expected to increase by 32.7% annually, outstripping the Canadian market forecast of 7.1%. Despite a dividend yield of 2.47%, cash flows do not adequately cover this, suggesting potential sustainability issues. Insider transactions have not been substantial in volume recently, indicating mixed confidence from those closest to the company's operations. The firm's debt levels are concerning as they are poorly covered by operating cash flow, posing financial stability risks despite a high forecasted return on equity of 24.3% in three years' time and trading at a significant discount to estimated fair value.

Click here to discover the nuances of goeasy with our detailed analytical future growth report.

Our valuation report here indicates goeasy may be undervalued.

VersaBank

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VersaBank operates as a bank offering a range of financial products and services in Canada and the United States, with a market capitalization of approximately CA$378.04 million.

Operations: The institution generates revenue through various banking products and services across Canada and the United States.

Insider Ownership: 12.6%

Return On Equity Forecast: N/A (2027 estimate)

VersaBank, a Canadian entity, exhibits promising growth with earnings projected to increase by 24.05% annually, surpassing the national market's average. Despite a lower-than-ideal forecasted revenue growth rate of 17.4% per year, it still outpaces the broader Canadian market projection of 7.1%. The bank maintains a low allowance for bad loans at 16%, signaling robust risk management practices. Recent insider activities show more buying than selling, albeit not in significant volumes, reflecting cautious optimism among insiders about the bank's future prospects.

Delve into the full analysis future growth report here for a deeper understanding of VersaBank.

Our expertly prepared valuation report VersaBank implies its share price may be too high.

Next Steps

Navigate through the entire inventory of 30 Fast Growing TSX Companies With High Insider Ownership here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:GSY and TSX:VBNK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance