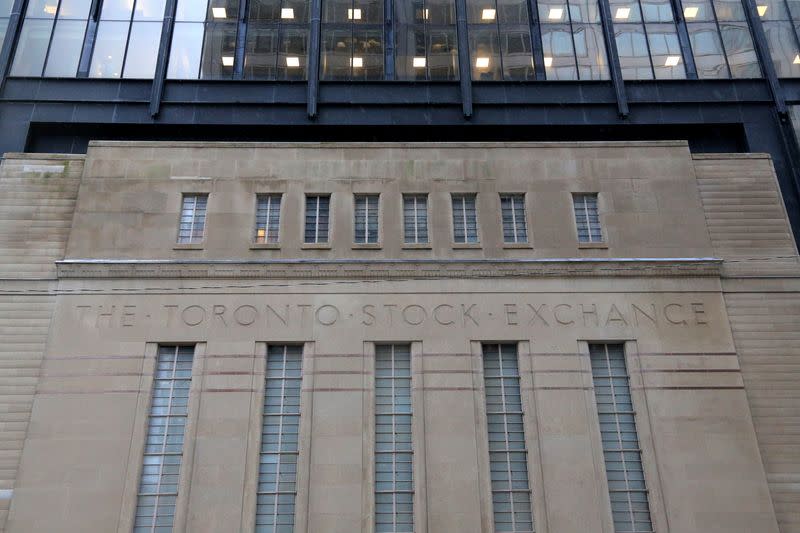

Mining shares help lift TSX to near 2-year high

By Fergal Smith

(Reuters) -Canada's main stock index rose on Wednesday to a near two-year high, led by gains for the materials sector, as the Bank of Canada and the Federal Reserve continued to signal a move to lower interest rates ahead.

The Toronto Stock Exchange's S&P/TSX composite index ended up 68.03 points, or 0.3%, at 21,593.96, its highest closing level since April 2022.

There was a lack of "hawkish" surprises from the BoC and the Fed, said Ian Chong, a portfolio manager at First Avenue Investment Counsel Inc.

"They seem to communicate a very consistent message that rates should come down later in the year should economic data continue to be supportive of that," Chong said.

Federal Reserve Chair Jerome Powell told lawmakers that the Fed still expects to reduce interest rates later this year, while the Bank of Canada reiterated that the discussion at the central bank has shifted from whether the rates were restrictive enough to how long they needed to stay at their current level.

The materials group, which includes precious and base metals miners and fertilizer companies, rose 1.3% as gold added to its record-setting rally.

Energy was also up, rising 0.2%, as the price of oil settled 1.25% higher at $79.13 a barrel.

Pipeline operator Enbridge Inc raised its short-term profit growth forecast and said it will spend $500 million expanding pipeline and storage assets to improve its U.S. Gulf Coast presence. The company's shares rose 0.2%.

The consumer-related sectors also posted gains, with consumer staples rising 0.6% and consumer discretionary up 0.9%.

(Reporting by Fergal Smith in Toronto and Purvi Agarwal in Bengaluru; Editing by Shilpi Majumdar and Marguerita Choy)

Yahoo Finance

Yahoo Finance