Can TSMC Join the Trillion Dollar Club?

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) has had a stellar start since the beginning of 2024.

TSMC’s share prices have soared by over 83% year to date, riding the wave of the booming semiconductor industry.

To put it into context, the broader market index, the S&P 500 Index (^SPX) experienced a more modest year-to-date growth of 17.5%.

TSMC caught the market’s attention when its share price surged to an all-time high of US$192.80 on 8 July 2024.

At the time of writing, TSMC’s share price hovered at US$186.63 giving the company a market capitalisation of US$967.9 billion, narrowly missing out on the one trillion dollar market cap.

This positions TSMC as the second-largest firm in the semiconductor industry, right behind the juggernaut Nvidia (NASDAQ: NVDA).

An introduction to TSMC

TSMC is the world’s first dedicated semiconductor foundry company.

Semiconductor foundries are companies established to manufacture microchips for companies that develop and design semiconductors.

Since TSMC’s founding in 1987, the chip manufacturer has evolved to produce chips that power the many technologies that make up our daily activities.

In 2023, TSMC served 528 customers and manufactured nearly 12,000 products.

TSMC currently operates 12 fabrication plants across Taiwan, China, and the US, with the majority in Taiwan.

Apart from these plants, the company is in the midst of opening up new plants in the US, Germany, and Japan.

The strength of TSMC’s business model

Being the world’s first dedicated foundry has proven advantageous for TSMC.

As a pure-play foundry, TSMC can focus exclusively on manufacturing, thus benefitting from economies of scale.

Compared to Integrated Device Manufacturers (IDMs), firms that design and manufacture their chips, TSMC can scale more efficiently.

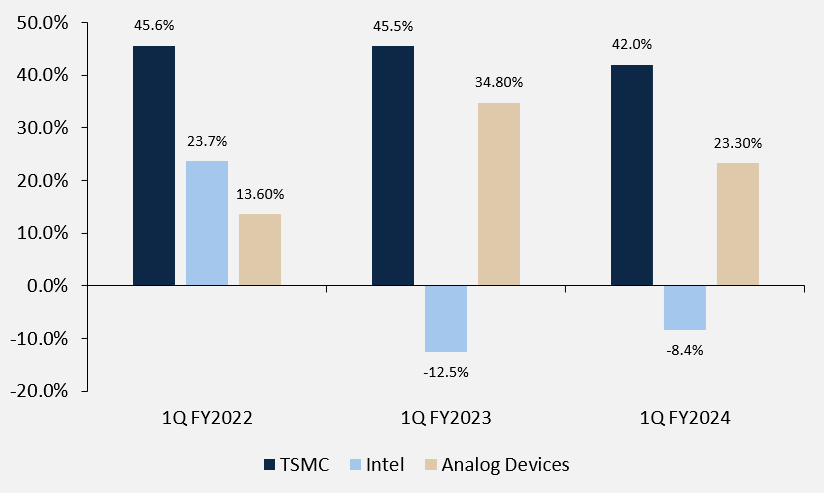

Notable IDMs include Intel (INTC: NASDAQ) and Analog Devices (NASDAQ: ADI)

This improved efficiency is demonstrated by TSMC’s superior operating margins compared to IDM peers.

Source: Author’s Calculation

However, operating margins have flatlined in recent years, suggesting that TSMC may be close to achieving maximum economies of scale.

Furthermore, TSMC does not have to face the intensive competitive pressure typical of fabless semiconductor companies.

Fabless semiconductor companies specialise solely in the design of chips and semiconductors.

Some fabless companies include Nvidia, Qualcomm (NASDAQ: QCOMM) and Advanced Micro Devices (NASDAQ: AMD)

These companies must continuously innovate to maintain their market edge and employ strategies to stay ahead.

As they continuously release new products to outpace one another, foundries like TSMC will see higher demand for chip manufacturing, allowing the company to stand out as the real winner.

A monopoly in advanced chip-making

Being the world’s first foundry has granted TSMC a significant first-mover advantage.

The company has fully capitalised on this advantage, leading to a strong monopoly.

According to the US Government of Commerce, it is estimated that TSMC manufactures over 90% of logic chips, one of the world’s most advanced microchips.

TSMC’s dominance in chip-making is evident in its clientele.

Several of the largest technology companies rely on TSMC’s chip-making capability, including Nvidia, Apple (NASDAQ: AAPL), and Meta Platforms (NASDAQ: META).

Logic chips, now increasingly referred to as “Artificial Intelligence or AI Chips”, are still in their infancy.

As the integration of artificial intelligence (AI) into our daily lives deepens, demand for these chips is expected to rise.

TSMC has already experienced a surge in demand for AI chips.

For April 2024, TSMC reported a 59.6% year on year surge in sales.

May 2024 also saw a double-digit percentage gain with a 30.1% year on year increase.

The company continues to tighten its grip on advanced chip-making.

As of 2022, TSMC began manufacturing one the most advanced microchips to date, the 3 nanometre (nm) chips.

Looking ahead, TSMC is setting its ambitions on 2nm chips, with plans for mass-volume production by 2025.

TSMC’s monopoly in advanced chip-making has resulted in resilient earnings that are able to weather adverse economic conditions.

While 2023 proved to be a tough year for the semiconductor industry, with global sales declining by 8.2% year on year, TSMC performed better than the market.

In 2023, the foundry’s net sales declined slightly by just 4.5% year on year.

2024 is projected to enjoy a 16% year on year growth in global semiconductor sales

McKinsey expects the global semiconductor industry to grow into a trillion-dollar industry by 2030, offering ample growth opportunities for TSMC to continue growing its revenue and profits.

Strong earnings and healthy prospects

Looking at TSMC’s latest earnings report for the first quarter of 2024 (1Q 2024), the company delivered a strong set of financial numbers.

Net revenue grew by 12.9% year on year, reaching US$18.9 billion.

Net profit increased from US$6.8 billion to US$7.2 billion, marking a respectable 5.5% year on year rise

Free cash flow saw a significant jump, increasing by 208.2% year on year to US$8.1 billion.

Expectations for the second quarter of 2024 are set even higher, following the strong revenue performances in April and May.

Over a broader timeframe, TSMC’s top and bottom lines have shown considerable improvement.

Net revenue has grown at a five-year compound annual growth rate (CAGR) of 21.6%.

Likewise, net profit has shot up at a five-year CAGR of 29.2%.

The company generated US$13.9 billion in operating cash flow for 1Q 2024, representing a 13.3% year on year increase.

Positive operating cash flow is a boon for TSMC, given the substantial capital expenditure needed to build manufacturing plants and research new technologies.

For example, constructing a manufacturing plant can easily cost over US$10 billion.

With a dedicated commitment to expanding its manufacturing capacity, TSMC has progressively increased its debt levels over the years.

Total loans grew at a three-year CAGR of 51.1% to NTD 955.5 billion as TSMC took on more debt to fund various developments.

However, investors should feel assured by TSMC’s strong financial health.

As of 1Q 2024, TSMC holds a substantial balance in cash and cash equivalents amounting to US$53.7 billion.

In addition, the company’s interest coverage ratio as of 1Q 2024 stands at an impressive 92.6x, displaying prudent financial management.

Get Smart: Riding the semiconductor wave

As the saying goes, “In a gold rush, don’t dig for gold, sell shovels”.

Amid the semiconductor and AI boom, you should avoid speculating on which company will release the latest and fastest chips.

Instead, you can choose to invest in the company which is guaranteed to benefit from the sharp increase in chip demand.

TSMC is poised to maintain its reputation as the most dominant company in chip manufacturing.

As the industry expands, the world’s first-ever foundry looks well-positioned to eventually join the trillion-dollar club.

Attention Growth Investors: Our latest report, “The Rise of Titans,” gives you a front-row seat on the 7 most influential US stocks today. If you’re passionate about tech and growth, you can’t go wrong with our research. Downloading this FREE report could be the most strategic move you make this year. Click here to get started now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Aw Kai Rui does not own any of the stocks mentioned in this article.

The post Can TSMC Join the Trillion Dollar Club? appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance