Trust Credit Card – Moneysmart Review 2022

The latest kid on the block, Trust credit card was just launched barely two weeks ago on the 5 September. It’s actually issued by a new digital bank (means they don’t have any physical shopfront or branch) called Trust Bank formed by Standard Chartered Bank and NTUC.

There’s a new NTUC credit card again?

Yes. You may remember the OCBC NTUC Plus! credit cards that were heavily marketed over the past two Covid years (lots of sign up banners lining the SafeEntry queues). However, last August, NTUC announced that they will phase out these credit cards. If you hold an OCBC NTUC Plus! credit card, you won’t be able to use them from 1 February 2023.

Then how?

Then, you either switch to a OCBC 365 credit card which will be issued to you by OCBC, or you switch to NTUC’s latest credit card, the Trust credit card.

Similar to the OCBC NTUC Plus! credit card, the Trust credit card gives you NTUC discounts and allows you to earn LinkPoints.

I’ve been using the Trust credit card for the past 2 weeks, wondering if it fits into my current credit card ecosystem (my bills, insurance etc. are set up with other banks), and my lifestyle – go office, get groceries from NTUC, go home, and occasional eat out. Normal Singaporean lifestyle, minus the kids.

Honestly, the Trust credit card was great at the start. Then, I struggled getting bonus points, ran into problematic dining coupons, and a very slow and dysfunctional customer service.

Here’s how my two weeks with Trust credit card went:

Contents

1. Trust Credit Card Review

Trust credit card is rewards credit card (in the form of NTUC LinkPoints).

This credit card suits you if you do your weekly grocery shopping at NTUC FairPrice, FairPrice Finest, FairPrice Xtra, and FairPrice Warehouse Club.

Other than that, there are limited dining coupons that you can access in the mobile app.

It’s fully mobile app-based, although you do receive a physical credit card a week after your online application which you can use to make payments and scan at NTUC to receive LinkPoints.

Some of the key selling points of the Trust credit card were:

numberless physical credit card (although you still have your credit card number in the mobile app),

7% NTUC rewards point, and

$25 NTUC sign-up voucher.

2. Trust Credit Card Annual Fee, Minimum Income

The Trust Credit Card is an entry level credit card with a minimum salary requirement of $30,000 per year.

To apply for a Trust credit card, you’ll have to download the Trust bank mobile app, and sign up with your SingPass. Your personal details and income history will be automatically retrieved by the app. Then, you’ll receive a “personalised” credit limit that commensurates your income.

Trust Credit Card | |

Annual Fee | $0 |

Annual Fee Waiver | – |

Supplementary Card Annual Fee | – |

Interest Free Period | – |

Interest Rate | 26.9% p.a. |

Late Payment Fee | $100 |

Minimum Monthly Repayment | ? |

Foreign Currency Transaction Fee | $0 |

Cash Advance Transaction Fee | $0 |

Overlimit Fee | $0 |

Minimum Income | $30,000 p.a. |

Card Association | Visa |

Contactless Payment | Visa PayWave, other contactless methods such as Apple Pay |

The Trust credit card is compatible with mobile contactless payment methods such as Apple Pay and PayWave.

3. Trust Credit Card Rewards Points

Trust credit card is primarily a rewards credit card. However, the reward points are stated in 0.22%, 0.5%, and 7% “savings” which can be very misleading and easily mistaken for cashback.

Here are its base and bonus reward points earn rates:

Trust Credit Card | LinkPoints | Minimum Spend |

Base Reward Points | 0.5% at Fairprice, 0.22% for Visa | – |

Bonus Reward Points | 7.5% at Fairprice | $450 per month (all except Fairprice transactions), capped 5,500 LinkPoints |

Extra Bonus Reward Points | 7% at Fairprice (per quarter) | $450 per month for 3 consecutive months (all except Fairprice transaction), capped 7,500 LinkPoints |

Confusing? Very.

So, if you want to get the 7% reward points from NTUC, you have to first spend $450 outside of NTUC FairPrice.

Huh, but I spend most of my money at NTUC on groceries leh. You’re telling me my NTUC spend is not eligible. How?!

Jialat lor.

If you are in a hybrid office and WFH arrangement, and still mostly cook at home (groceries from NTUC), or takeaway hawker centre with cash, this $450 is not that easy to hit – at least I’ve tried to delegate all miscellaneous expenses to this Trust credit card but so far I’m still at a measly $176. And I’ve given up trying to hit this $450 minimum spend.

Other bills, insurance etc. payments that I have are mostly paid via GIRO and are not going to be eligible to contribute to the $450 eligible Visa minimum spend.

It seems like this Trust credit card works well for someone who eats out, pays via Visa, or shops around in stores quite a lot from day to day. If your household expenditure surrounds groceries, pre-paid quarterly tuition fees, and other structured GIRO payments, this credit card may not work for you.

4. Trust Credit Card LinkPoints

When you use the Trust credit card, you earn your reward points in the form of NTUC LinkPoints. NTUC LinkPoints are very useful if you frequently redeem them while you shop at NTUC (don’t let them expire!).

Anyway, take a look at the LinkPoints I’ve earned so far with $176 spend on this Trust credit card:

Merchant & Category | Expenses | LinkPoints |

[Han’s] HCC NVS Singapore (Food & Dining) | $6.60 | 1.45 |

SingPost (Business Service) | $3 | 0.66 |

SingPost (Business Service) | $11.50 | 2.53 |

IKEA (Shopping) | $6 | 1.32 |

Daiso (Shopping) | $10.70 | 2.35 |

The Fullerton Hotel (Travel) | $120.05 | 26.41 |

Medi-Ya (Groceries) | $18.90 | 4.16 |

KFC (Food & Dining) | $9.80 | 2.15 |

In your transaction statement, Trust credit card automatically classifies your transaction (into MCC categories) for you.

The classification is quite odd, although there are no immediate repercussions for the reward points you earn. For example, my dinner at Fullerton’s restaurant was classified as Travel. My lunch at IKEA restaurant was classified as Shopping.

How to redeem NTUC LinkPoints? Honestly, I’m not sure. I have 38.88 LinkPoints on my Trust credit card now (that’s $0.38) but there’s no option to redeem or transfer it to my main NTUC Link Membership.

I also have an existing NTUC Link membership. When I was doing groceries at NTUC, I was given the choice to tap my Trust credit card (physical card with a new Link membership ID) or my existing Link membership mobile app upon checkout to earn the LinkPoints on that card instead.

Then I realised I have duplicated NTUC LinkPoint accounts thanks to this Trust credit card! You can supposedly write in to Trust bank to merge your accounts. But I have no plans to do that – not yet.

Read on and you’ll see why.

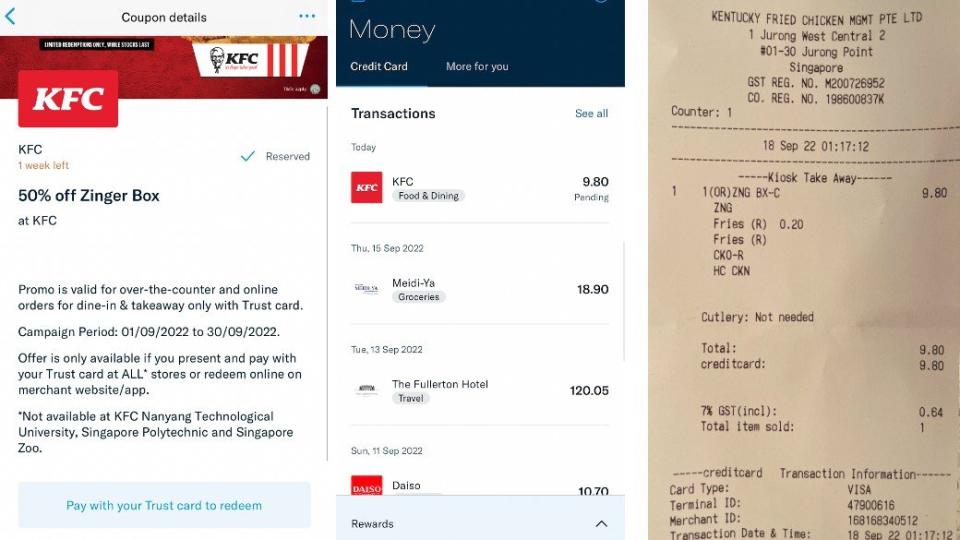

5. Trust Credit Card: Dining Discounts

In the Trust mobile app, you’ll be able to swipe to a Coupons section where you’ll be able to click into a couple of dining vouchers. Dining deals include:

$2 off Starbucks with minimum $10 spend (8,000 redemptions)

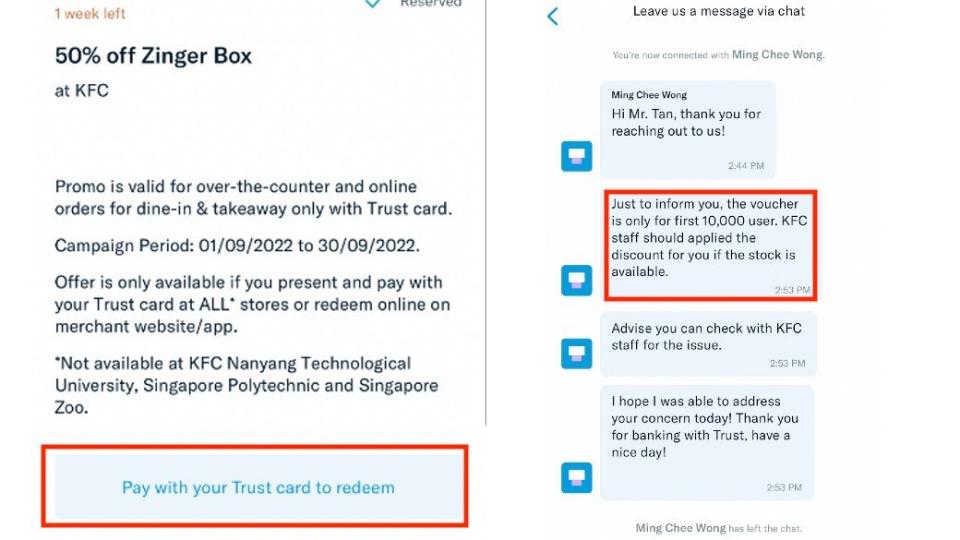

50% off KFC Zinger Box

$6 off foodpanda delivery with minimum $35 spend (promo code TRUST22SEP, max 5,000 redemptions)

$3 off deliveroo with minimum spend $12 (new customers only, with promo code VISANEW22)

Again, I wanted to test all functions of this Trust credit card and see if their dining perks work. So, I decided to go for the KFC deal cause it’s the cheapest.

Unfortunately, it didn’t work. And, in fact, the process revealed poor customer service.

Here’s a picture of the voucher. Full price of a Zinger Box is $9.80 stated in my Trust card statement. I paid with my Trust card but didn’t get my discount! Horror!

Now, maybe they’re new and it’s a little hiccup right? No at all, it was quite dysfunctional.

I called the customer service hotline right after I left, which I waited on the line for 17 minutes before someone picked up.

Customer service staff on the line took a long time to read and understand the KFC voucher’s terms and conditions, and explained that the 50% discount will be credited back to my account within 24 hours. Halfway through the call, the customer service hung up on me. I waited for them to call back, but I didn’t receive any calls. It’s been 2 days, and I still have not received the promised 50% discount back in my account.

Later, I realised there was no written confirmation. So, I wrote in via the in-app chat as well to confirm what was conversed. The reply that I got was vastly different:

“the voucher is only for first 10,000 user. KFC staff should applied the discount for you if the stock is available. Advise you can check with KFC staff for the issue.”

Wait a minute! Eh, cannot cheat people like that one lah. Read these terms and conditions stated on the KFC voucher again:

The terms and conditions did not state there was a 10,000 redemption limit.

And the redemption method was literally to “Pay with your Trust card to redeem” – but that button couldn’t be “pressed” or “clicked” into. So, I paid with my Trust credit card but then the discount didn’t go through.

It was such a frustrating experience using the Trust credit card. More so, I felt like an idiot walking out of KFC afterwards in a terrible mood.

Honestly, there are aplenty credit card promotions out there with proven reliability and more robust customer service. I’d save my time and use a trusted credit card (aha!) until Trust credit card smoothen their operations and discount mechanics out.

Here are some great and proven credit cards that you can try instead:

Online Shopping

DBS Woman's Card

More Details

Key Features

5X DBS Points per S$5 online spend

Online shopping promotions with Fayth, Her Velvet Vase, The Closet Lover, Senreve etc.

Beauty deals with Laneige, Skin Inc, Strip, Browhaus, High Brow etc.

Staycation hotel deals with Agoda and Klook

Activate SimplyGo to use your card as an EZ-Link. Bus and MRT fares are charged directly to your card, so you don’t have to set up auto top-up arrangements

DBS Points earned can be redeemed for Apple products via the DBS Apple Rewards Store, Income, and Takashimaya vouchers, Golden Village movie tickets, and more

UOB EVOL Credit Card

More Details

Key Features

Enjoy first year fee waiver and subsequently no annual fee with 3 transactions monthly

Up to 2.5% p.a. interest with your UOB One Account when you spend on UOB YOLO (Insured up to S$75k by SDIC)

Southeast Asia’s first bio-sourced card with a suite of sustainable deals

Online Promo

Earn Points for Everyday Spending

HSBC Revolution Credit Card

Online Promo:

Get Samsonite Prestige 69cm Spinner Exp with built-in scale (worth SGD670) or SGD200 cashback for new HSBC cardmembers. Existing HSBC cardmembers receive $50 cashback. Min. spends of S$500 upon card approval required. T&Cs apply.

Supplementary Card Promo:

Get up to S$150 cash back (S$30 per supplementary card, up to maximum of 5 cards).

Valid until 31 Dec 2022

More Details

Key Features

Receive up to S$200 cashback and a chance to play the Sure-Win Hong Bao game to win prizes like the OSIM massage chair, Dyson fan, shopping vouchers and more! T&Cs apply

No annual credit card fees

Get 10X Rewards Points, equivalent to 4 air miles per dollar spent

Redeem your rewards points for home, dining, retail, travel, or charity cash vouchers online or offset cash rebates on transactions online via rewards catalogue or the HSBC mobile app

Travel Insurance: Enjoy up to S$300,000 coverage when you charge travel expenses to card

6. How to cancel Trust Credit Card?

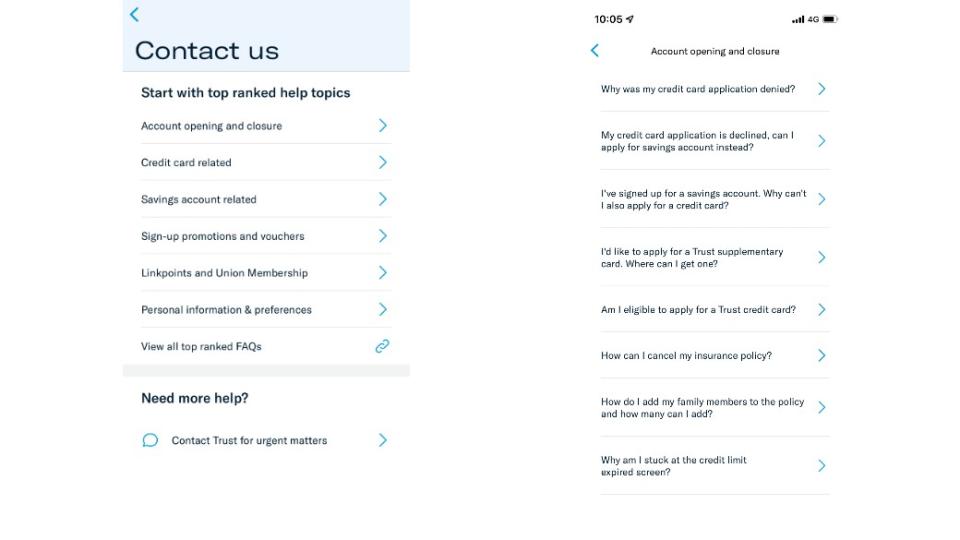

How to cancel my Trust credit card?

In the Trust mobile app, you’ll actually find this Account Opening and Closure section. However, once you click in, you’ll find no option nor any information about account closure.

In the end, I had to contact the customer service again to find out how to go about closing and cancelling my Trust credit card.

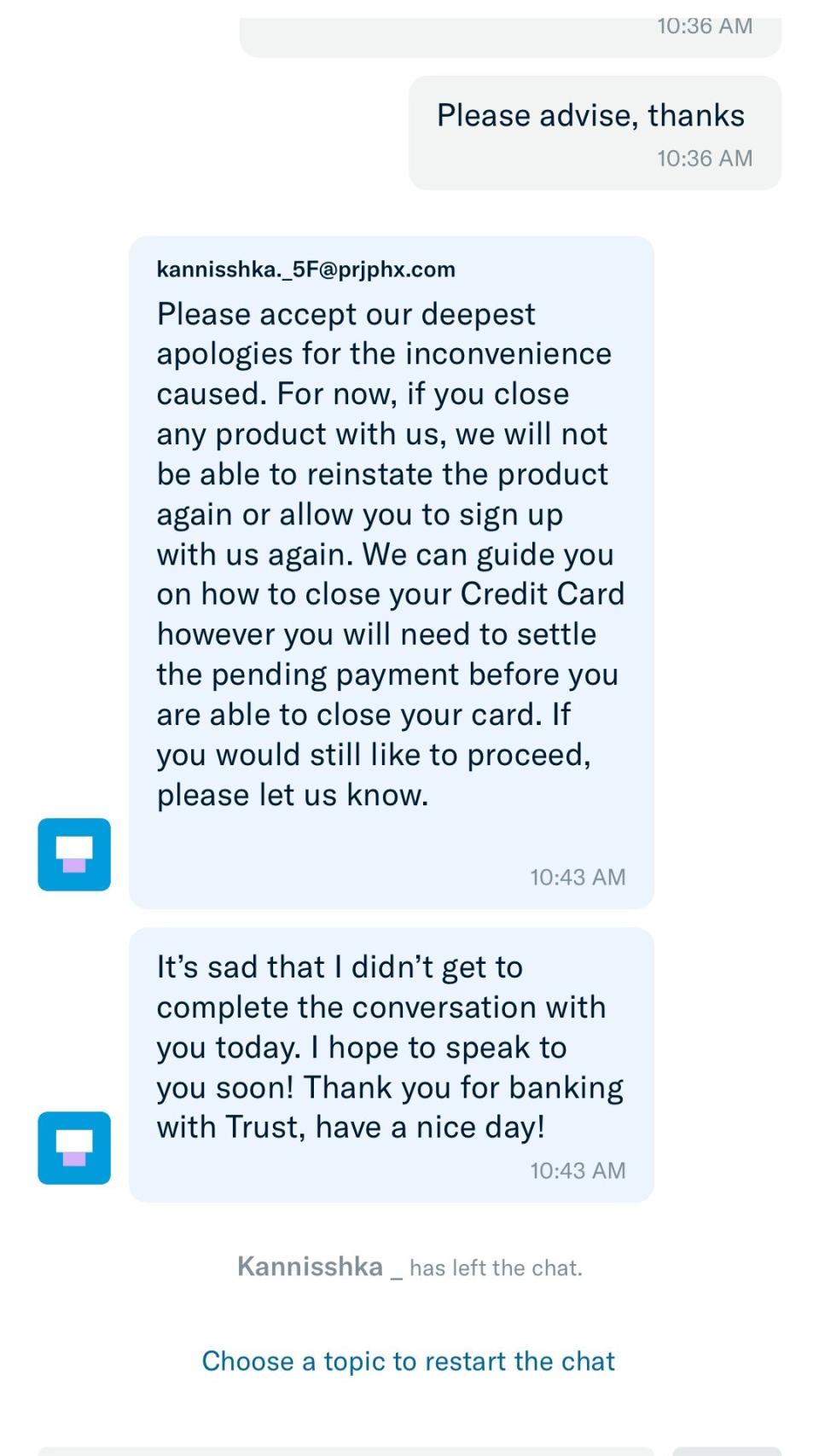

Customer service has… yet to reply with the actual steps. Instead, they warned me that:

“For now, if you close any product with us, we will not be able to reinstate the product again or allow you to sign up with us again.”

There could be a nicer way for Trust Bank to communicate and retain their clients.

If you were to notice, the customer service staff closed my ticket within the same minute – not giving me any time to reply. I had to submit a fresh ticket again and again. This has happened multiple times.

Keep watching this space, I’ll put up a step by step guide once I have some sort of reply.

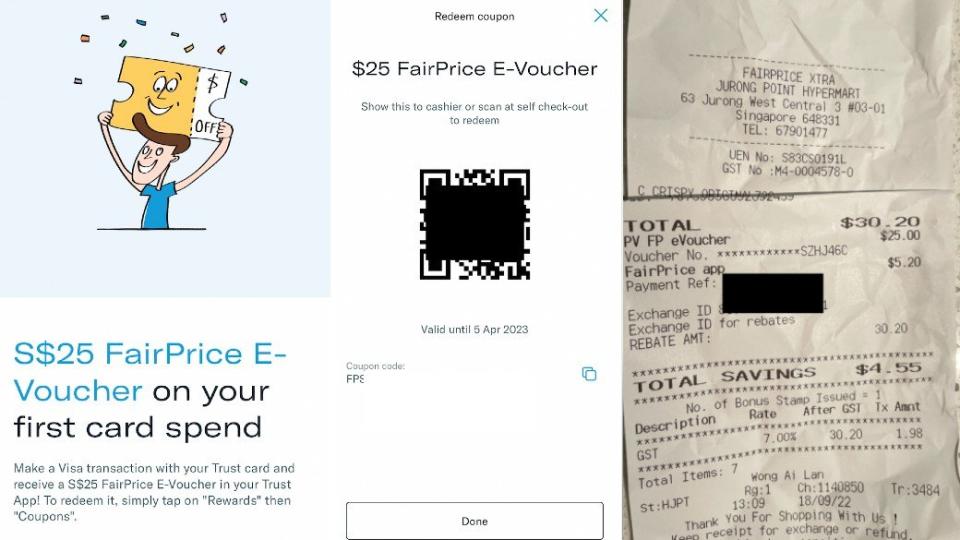

7. Trust Credit Card Promotion

One of the key things that attracted me to sign up for the Trust credit card was the $25 NTUC voucher sign up promotion. You need to first make 1 transaction on your Trust card before this $25 NTUC voucher appears on your Trust app. You get the NTUC cashier aunty to scan it, and yay, it works!

8. Should I get the Trust Credit Card?

Who is the Trust Credit Card suitable for? Trust credit card is suitable for you if you tend to tap your credit card or PayWave in stores while shopping, dining out, or for entertainment and movies etc.

The card will only work for you if you spend more than $450/month on these miscellaneous Visa expenses day to day, and you if you also tend to spend on NTUC groceries (because you will be rewarded in NTUC LinkPoints).

While there are dining discount coupons offered alongside in the Trust mobile app, you will need to be eagle-eyed to watch out for those terms and conditions and have all the patience to wrestle with their customer service team.

Again, this is a completely new credit card product and it’s only natural there are aplenty hiccups. If you love the novelty and have the patience, go for it. If you’re time starved and have a family to operate, try at your own risk.

Looking for a new credit card? Make sure to nab yourself an ongoing sign-up credit card promotion!

The post Trust Credit Card - Moneysmart Review 2022 appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Trust Credit Card – Moneysmart Review 2022 appeared first on MoneySmart.sg.

Original article: Trust Credit Card – Moneysmart Review 2022.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance