Tron Founder Justin Sun Unstakes $30M of Ether from Lido, Sends Tokens to Huobi

Crypto billionaire and Tron network founder Justin Sun withdrew $29.7 million of ether (ETH) from liquid staking platform Lido Finance, then sent the tokens to crypto exchange Huobi, blockchain data shows.

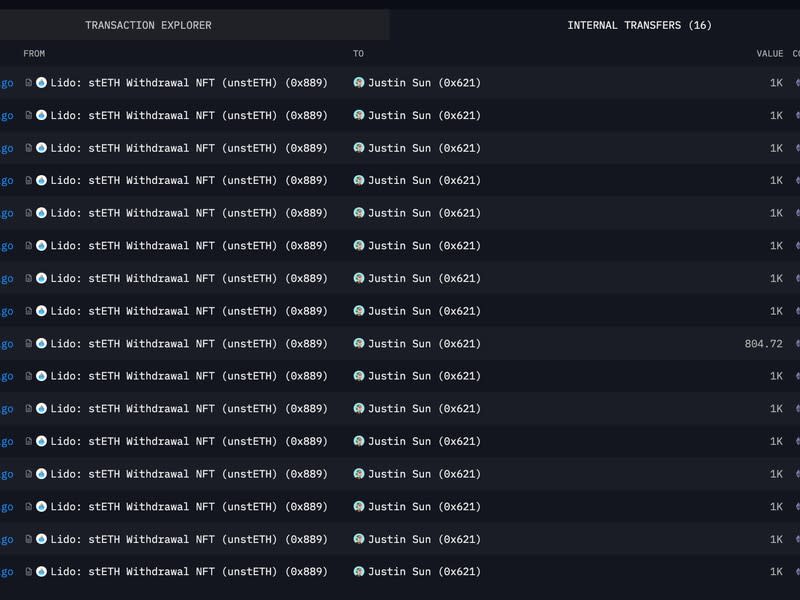

Sun’s crypto wallet received a total of 15,805 ETH from Lido’s withdrawal address on Thursday after requesting to unstake the tokens the day before, data by blockchain monitoring platform Arkham Intelligence shows.

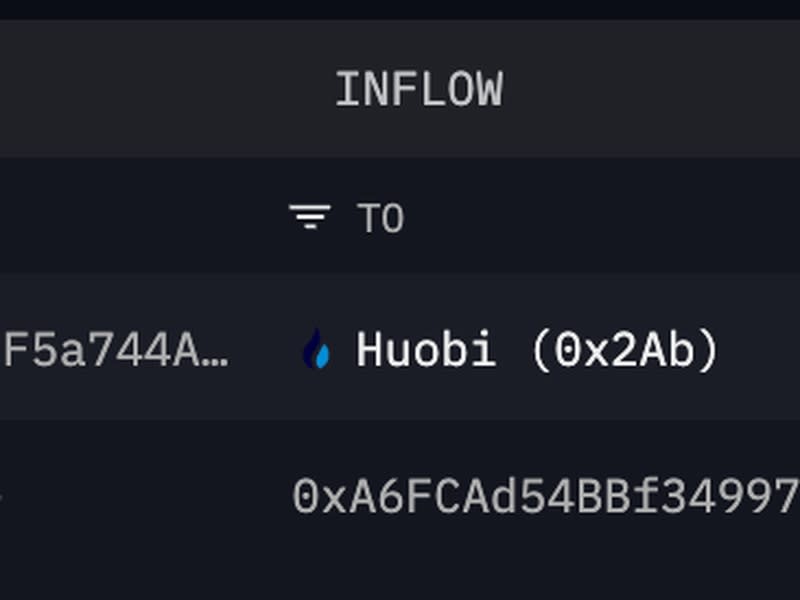

A few minutes later, the wallet deposited 15,815 ETH to Huobi through an intermediary address, according to Arkham. Sending tokens to an exchange often signals intention to sell.

The transactions happened as ETH, the second largest cryptocurrency by market capitalization, gained almost 16% through the week, surging past $1,900 from a low of $1,630, CoinDesk data shows.

Crypto markets, led by bitcoin (BTC), rallied through the week as investors cheered the news that a slew of traditional financial institutions took steps to get more involved with digital assets. BlackRock, the world’s largest asset manager, filed to register a much-coveted spot BTC exchange-traded fund (ETF) last Thursday. This week, banking giant Deutsche Bank applied for a crypto custody license in Germany, while new crypto exchange EDX Markets, backed by Fidelity Digital Assets, Charles Schwab and Citadel Securities, launched its trading platform.

Meanwhile, BTC's price broke the $30,000 level for the first time since April and was up 19.5% on the week. Blockchain data shows that Sun also deposited 1,000 BTC to Huobi early Wednesday, when the token was trading near $29,000.

Sun’s digital asset holdings in labeled crypto wallets were worth $1.2 billion, per Arkham. After the transaction, the wallets still held 287,855 of Lido’s staked ether (stETH) tokens, worth some $543 million.

UPDATE (Jun. 22, 19:45 UTC): Adds context about the crypto market rally and Sun's previous BTC transaction.

Yahoo Finance

Yahoo Finance