Traders Ditch USDT on Curve, Uniswap, Pushing Key Exchange Pools Into Imbalance

Traders sold Tether’s USDT in droves Thursday on key stablecoin exchange pools on Curve and UniSwap.

USDT dropped to as low as 99.76 cents and traded slightly below its $1 peg for most of the day.

Crypto traders appeared to ditch Tether’s USDT in droves Thursday in key stablecoin pools on Curve Finance and Uniswap decentralized exchanges, pushing the pools into heavy imbalances.

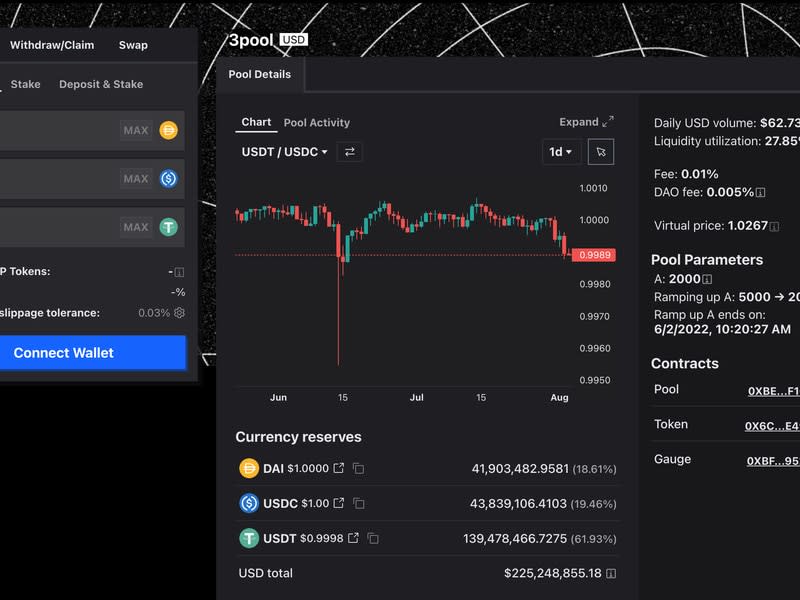

Data shows that the USDT balance surged to 62% in the Curve 3pool, which consists of USDT, USDC and DAI stablecoins, while USDC and DAI comprised roughly 19-19% of all assets in the pool.

In the USDT-USDC trading pool on Uniswap, one of the most liquid pairs on the platform, the USDT balance stood at $105.4 million compared to just $6.5 million of USDC.

The current imbalances suggest that investors increasingly prefer to hold DAI or USDC instead of USDT, as there are more USDT sellers in the pool.

USDT’s price has been trading slightly below its $1 peg during the day, according to CoinDesk and CoinMarketCap data, a consequence of the selling pressure. The token dropped as low as 99.76 cents, per CoinDesk Indices.

The Curve and Uniswap pools are popular venues for traders to swap one stablecoin for another quickly. Most of the time, the tokens are in balance in the pools. Imbalances indicate distress in the markets as investors seek ways to ditch an asset en masse.

Similar imbalances happened during Terra’s implosion in May 2022 and this March when the Silicon Valley Bank crisis hit the USDC issuer Circle.

Paolo Ardoino, chief technology officer of Tether, hinted at potential foul play in an X (formerly Twitter) post late Thursday, which some observers interpreted as a thinly veiled jab against crypto exchange giant Binance and its chief executive Changpeng "CZ" Zhao.

"Isn't it interesting that USDt is being pressured down (slightly, within 10bps, just to push market makers to react), and USDc, the main competitor that you would expect being gaining from the situation, is redeemed heavily nevertheless, while suddenly a competitor born 2 days ago is getting it all?," he posted. "It feels definitely organic and not manipulative at all."

The competitor cited in the post could be Hong Kong-based First Digital's new stablecoin FDUSD, which Binance quickly embraced recently.

The exchange listed the token on July 26 by allowing to trade BNB, Binance USD and Tether's USDT with it. The platform is also set to open bitcoin (BTC) and ether (ETH) trading with FDUSD and to boost trading with the stablecoin by waiving trading fees starting Friday.

The market capitalization of FDUSD mushroomed to $258 million from $20 million in the last two days, according to CoinMarketCap.

UPDATE (August 3, 2023, 19:29 UTC): Adds background about imbalances.

UPDATE (August 3, 2023, 21:35 UTC): Adds Tether CTO comment and context about FDUSD and Binance.

Yahoo Finance

Yahoo Finance