TotalEnergies (TTE) Signs Exploration Deal, Expands in Africa

TotalEnergies TTE recently announced that it has signed a deal to acquire a 60% interest and operatorship in Block STP02, offshore African island nation Sao Tome and Principe, from the Agência Nacional do Petroléo de S. Tomé e Principé (ANP-STP). The remaining interest in the offshore block is held by Sonangol (30%) and ANP-STP (10%).

Block STP02 is located nearly 37.2 miles (60 Km) off the coast of Principe. This block covers an area of 1,918.5 sq miles (4,969 sq km). Block STP02 is located adjacent to the Block STP01 license operated by TotalEnergies (55%) together with Sonangol (30%) and ANP-STP (15%).

The encouraging 3D seismic data on adjacent Block STP01 has prompted TotalEnergies to continue its exploration and production in other areas of Sao Tome and Principe.

TotalEnergies Focus on New Regions

TotalEnergies has one of the best production growth profiles among the oil majors, which is characterized by an upstream portfolio with above industry-average exposure to the faster-growing hydrocarbon-producing regions in the world. The company benefits from solid production from new startups.

The acquisition of an exploration license in offshore Sao Tome and Principe is in sync with TTE’s long-term objective to increase its hydrocarbon production volumes by exploring new assets globally.

Multi-Energy Offering

A transition toward clean sources to produce energy is quite evident in the energy space. TotalEnergies is gradually positioning itself to meet the energy needs of the future by diversifying its energy mix.

TTE is reducing the proportion of its oil products and strengthening the company’s position in natural gas and clean electricity through solar and wind projects. TotalEnergies’ presence across the entire value chain of LNG allows the company to easily supply clean energy to its customers across the globe.

By 2030, the company aims to produce more than 100 terawatt hours of renewable electricity. TotalEnergies is also targeting 150,000 recharging points for electric vehicles. The company has plans to install 5 GW of storage capacity worldwide to support its renewable projects.

TotalEnergies expects to invest in the range of $17-$18 billion in 2024, of which $5 billion will be dedicated to Integrated Power. The systematic investment should enable the company to expand its multi-energy production across the globe with a special focus on clean renewable energy.

Given the prospects in clean energy development, apart from TotalEnergies, other oil and gas companies like ExxonMobil XOM, Chevron CVX and Shell SHEL, among others, have already started to develop other energy sources.

Long-term (three to five years) earnings growth of ExxonMobil, Chevron and Shell are currently pinned at 3%, 5% and 4.6%, respectively.

The Zacks Consensus Estimate for 2024 earnings per share of XOM, CVX and SHEL has moved up by 5.4%, 0.5% and 3.6%, respectively, in the past 90 days.

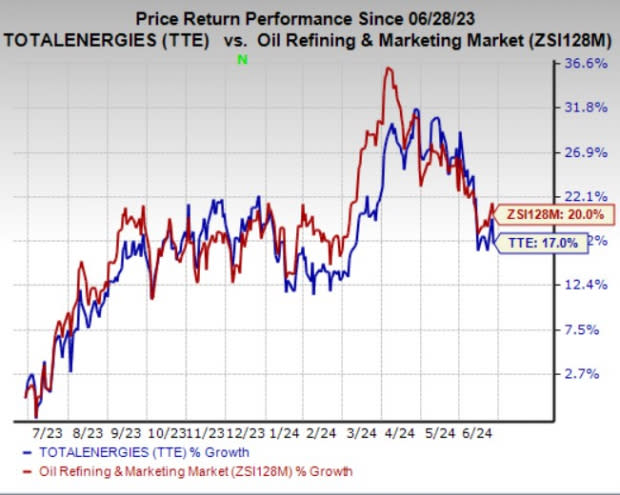

Price Performance

In the past year, shares of TotalEnergies have risen 17% compared with the industry’s 20% growth.

Image Source: Zacks Investment Research

Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance