Top US Growth Companies With High Insider Ownership In July 2024

As the U.S. stock market enters the third quarter with a positive uptick, investors are keenly watching for sustainable growth amidst ongoing debates about interest rate cuts and sector-specific performances. In this environment, growth companies with high insider ownership may offer a unique appeal, potentially aligning shareholder interests with robust corporate governance and long-term strategic vision.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

We're going to check out a few of the best picks from our screener tool.

Bank of Marin Bancorp

Simply Wall St Growth Rating: ★★★★☆☆

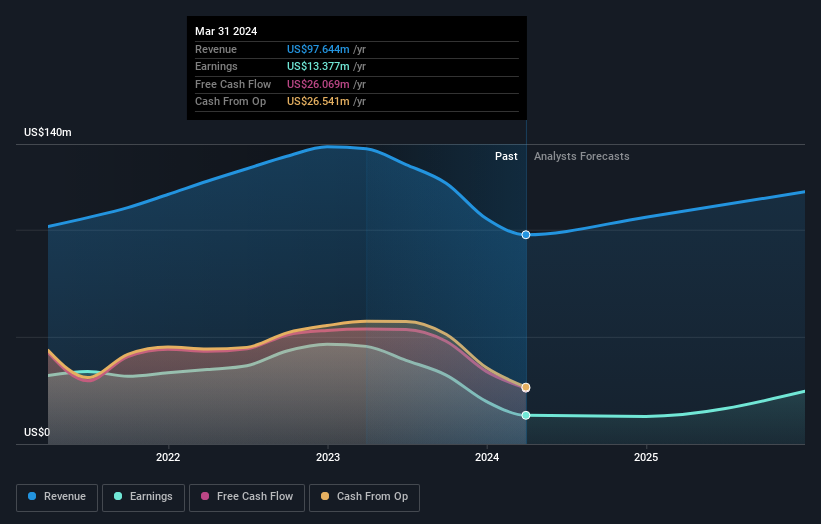

Overview: Bank of Marin Bancorp, serving as the holding entity for Bank of Marin, offers financial services mainly to small and medium-sized businesses, not-for-profit organizations, and commercial real estate investors in the United States, with a market capitalization of approximately $261.93 million.

Operations: The company generates its revenue primarily through banking activities, totaling approximately $97.64 million.

Insider Ownership: 10.9%

Bank of Marin Bancorp, a firm with significant insider leadership, faces mixed financial dynamics. Recently appointed Tani Girton as Principal Accounting Officer underscores stable governance. Despite a notable drop in Q1 2024 earnings to US$2.92 million from US$9.44 million the previous year and reduced net interest income, the company maintains a consistent dividend payout, declaring its 76th consecutive quarterly dividend at $0.25 per share. Forecasted earnings growth is strong at 39.2% annually, outpacing the broader US market's expectations.

PureCycle Technologies

Simply Wall St Growth Rating: ★★★★★☆

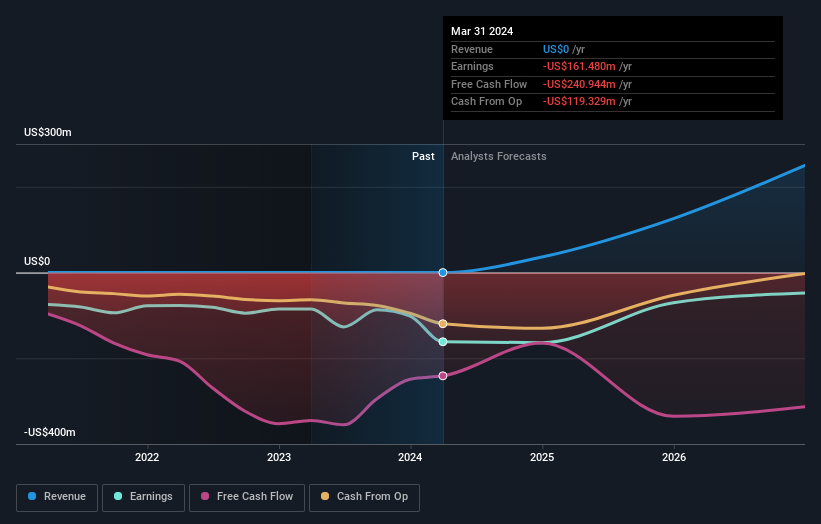

Overview: PureCycle Technologies, Inc. specializes in the production of recycled polypropylene, with a market capitalization of approximately $974.61 million.

Operations: The company specializes in generating revenue through the recycling of polypropylene.

Insider Ownership: 11.1%

PureCycle Technologies, amidst legal challenges with a proposed US$12 million settlement, shows promise with its innovative PureFive Ultra-Pure Recycled resin approved by the FDA for broader food-contact applications. Despite a significant Q1 net loss of US$85.61 million, the company is poised for substantial growth with expected revenue increases of 50% per year and anticipated profitability within three years. However, its current financial position indicates less than one year of cash runway, underscoring potential liquidity risks.

Allegiant Travel

Simply Wall St Growth Rating: ★★★★☆☆

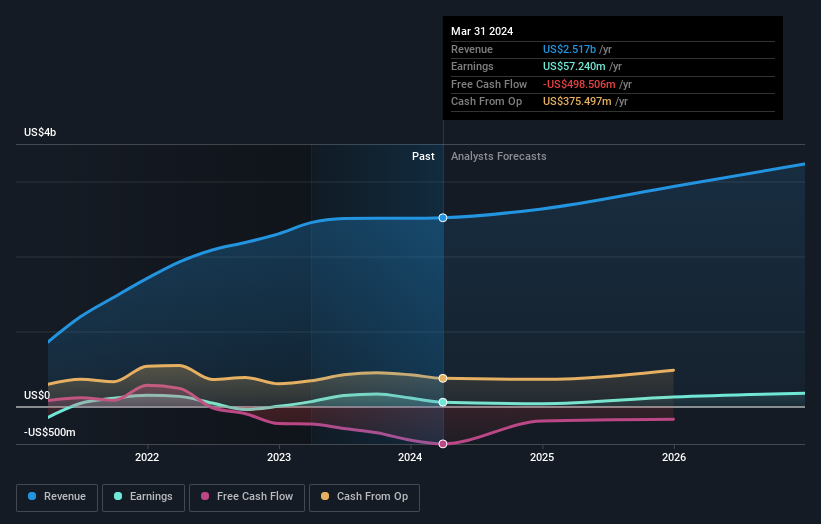

Overview: Allegiant Travel Company operates as a leisure travel company offering services and products to residents of under-served cities in the United States, with a market capitalization of approximately $885.30 million.

Operations: The company generates revenue primarily through its airline segment, which brought in $2.49 billion, and the Sunseeker Resort, contributing $26.77 million.

Insider Ownership: 17.2%

Allegiant Travel, with a significant insider buying trend over the past three months, demonstrates a strong commitment from its leadership. The company’s earnings are projected to grow by 48.3% annually, outpacing the US market's growth rate. Despite this robust profit outlook and a Price-To-Earnings ratio below the US average, Allegiant faces challenges with high debt levels and a low forecasted Return on Equity of 10.6%. Recent operational results show slight passenger growth but a decrease in available seat miles year-over-year.

Summing It All Up

Click through to start exploring the rest of the 180 Fast Growing US Companies With High Insider Ownership now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:BMRC NasdaqCM:PCT and NasdaqGS:ALGT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance