Top US Growth Companies With High Insider Ownership In May 2024

As of May 2024, the U.S. stock market is experiencing fluctuations with a notable decline on Wall Street and mixed reactions to economic data suggesting the Federal Reserve may maintain current interest rates. In such an environment, growth companies with high insider ownership can be particularly appealing as these insiders often have a deep commitment to the company's success and a unique insight into its operations and potential.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 24.4% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 27.2% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

ZKH Group (NYSE:ZKH) | 17.7% | 102.8% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Establishment Labs Holdings (NasdaqCM:ESTA) | 11.2% | 68.2% |

Let's review some notable picks from our screened stocks.

Southern California Bancorp

Simply Wall St Growth Rating: ★★★★★☆

Overview: Southern California Bancorp, functioning as the holding company for Bank of Southern California, N.A., has a market capitalization of approximately $263.27 million.

Operations: The primary revenue source for the bank is its commercial banking segment, which generated $92.58 million.

Insider Ownership: 23.1%

Earnings Growth Forecast: 70.9% p.a.

Southern California Bancorp, with high insider ownership, is poised for robust growth. The company's revenue is expected to increase by 40.4% annually, outpacing the US market's 8.4%. Similarly, its earnings are forecasted to surge by 70.9% per year, significantly above the market average of 14.6%. Despite a recent dip in quarterly earnings and net interest income, these projections suggest strong future performance. Additionally, the impending merger with California BanCorp could further enhance prospects pending shareholder approval and final closing conditions.

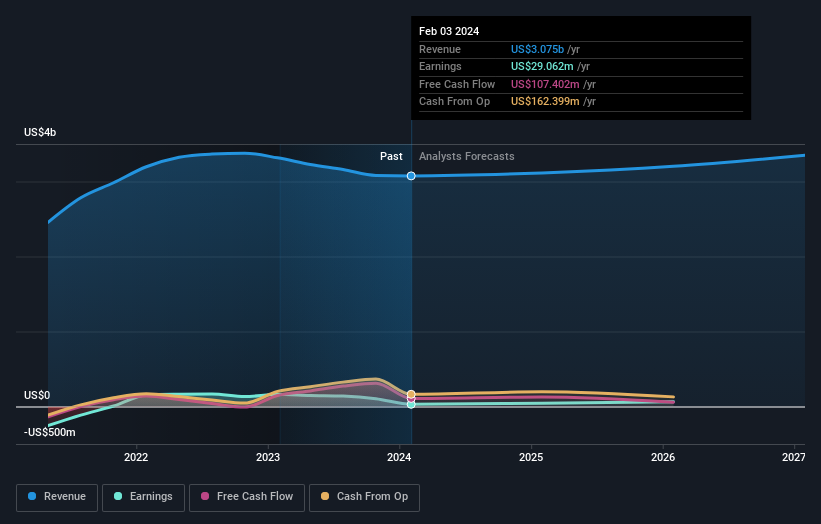

Designer Brands

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Designer Brands Inc. operates primarily in the United States and Canada, focusing on the design, production, and retailing of footwear and accessories for women, men, and kids with a market cap of approximately $534.31 million.

Operations: The company's revenue is primarily generated from its U.S. Retail segment, which brought in $2.53 billion, followed by the Canada Retail and Brand Portfolio segments with revenues of $264.23 million and $348.98 million respectively.

Insider Ownership: 20.4%

Earnings Growth Forecast: 38.3% p.a.

Designer Brands, despite high insider ownership, faces challenges and opportunities. Expected to grow earnings by 38.3% annually, it outpaces the US market forecast of 14.6%. However, its revenue growth at 2.5% yearly lags behind the market's 8.4%. Recent substantial insider buying suggests confidence among insiders, yet profit margins have declined from last year’s 4.9% to just 0.9%. Additionally, interest payments are poorly covered by earnings, indicating potential financial strain despite a robust return on equity forecast of 20.7%.

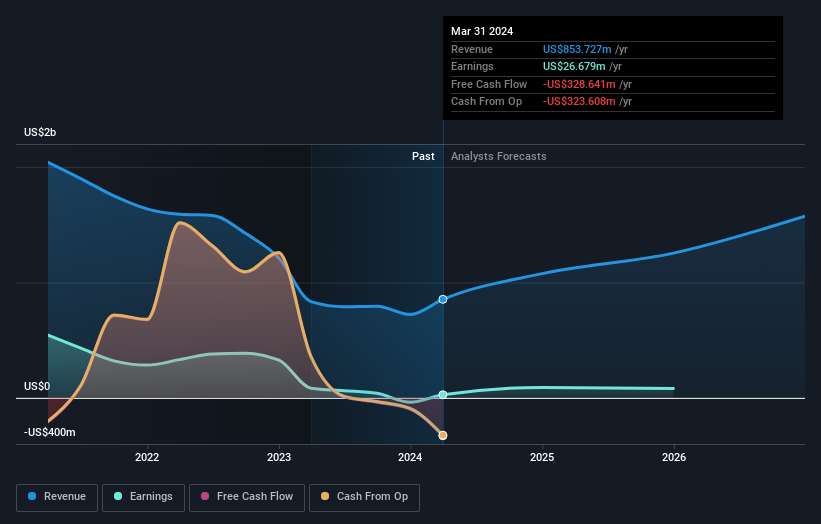

Guild Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guild Holdings Company, operating in the United States, focuses on originating, selling, and servicing residential mortgage loans with a market capitalization of approximately $874.16 million.

Operations: The company's revenue is primarily generated from two segments: originating loans, which brought in $555.18 million, and loan servicing, which contributed $190.68 million.

Insider Ownership: 11.6%

Earnings Growth Forecast: 46.4% p.a.

Guild Holdings, trading at a significant discount to its estimated fair value, is poised for robust growth with earnings expected to increase by 46.4% annually over the next three years, outpacing the US market's 14.6%. Recent financials show a turnaround from a net loss last year to a net income of US$28.5 million in Q1 2024, alongside declaring a special dividend. However, concerns linger due to low profit margins and insufficient coverage of interest payments by earnings.

Seize The Opportunity

Navigate through the entire inventory of 177 Fast Growing US Companies With High Insider Ownership here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:BCAL NYSE:DBI and NYSE:GHLD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance