Top Undervalued Small Caps With Insider Actions In Australia July 2024

Amidst a fluctuating Australian market where the ASX200 has seen a slight decline and sectors like IT have struggled significantly, small-cap stocks continue to present unique opportunities. Particularly, certain undervalued small caps are drawing attention with insider actions suggesting potential unrecognized value in this turbulent economic landscape. In such conditions, discerning investors might look for stocks that not only show promising fundamentals but also exhibit positive insider engagements, hinting at confidence from those who know the company best.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.5x | 2.7x | 47.31% | ★★★★★★ |

Nick Scali | 13.7x | 2.5x | 45.54% | ★★★★★★ |

Healius | NA | 0.6x | 43.37% | ★★★★★☆ |

Codan | 28.6x | 4.2x | 27.32% | ★★★★☆☆ |

Dicker Data | 20.8x | 0.8x | 3.61% | ★★★★☆☆ |

Eagers Automotive | 9.6x | 0.3x | 33.24% | ★★★★☆☆ |

Tabcorp Holdings | NA | 0.7x | 19.38% | ★★★★☆☆ |

RAM Essential Services Property Fund | NA | 5.8x | 40.26% | ★★★★☆☆ |

Smartgroup | 17.5x | 4.3x | 49.61% | ★★★☆☆☆ |

Coventry Group | 295.6x | 0.4x | -21.34% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Codan

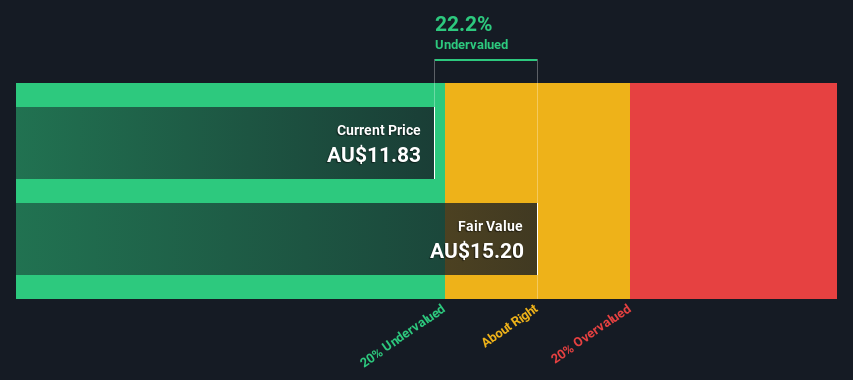

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications and metal detection, with a market capitalization of approximately A$1.37 billion.

Operations: Communications and Metal Detection are the primary revenue contributors, generating A$291.50 million and A$212.20 million respectively. The company's gross profit margin has shown a trend of fluctuation, with recent figures around 54.42% for the latest reported period.

PE: 28.6x

Codan, a notable player in the Australian market, recently saw insider confidence demonstrated through share purchases, signaling strong belief in the company's prospects. With earnings expected to grow by 16% annually, this reflects positively on its financial trajectory. Despite relying solely on external borrowing—a riskier funding method—these strategic moves suggest a robust foundation for future growth. This blend of insider activity and solid growth forecasts paints Codan as an appealing prospect for those eyeing potential in lesser-known entities.

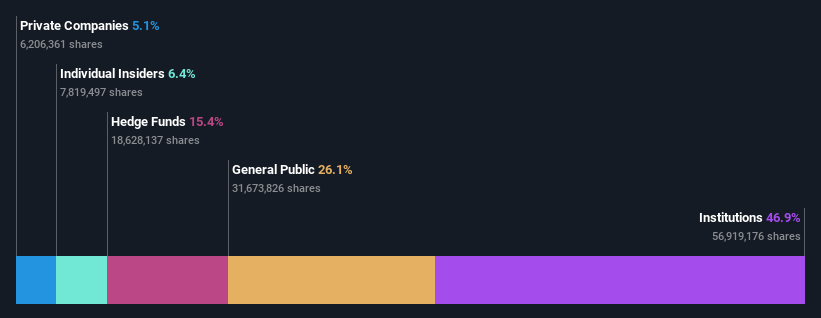

Lifestyle Communities

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lifestyle Communities is a company engaged in property development and management, with a market capitalization of approximately A$1.5 billion.

Operations: In recent financial data, the company reported a gross profit margin of 21.02% and a net income margin of 32.38%. This performance is derived from its primary operation in property development and management, which generated A$239.11 million in revenue.

PE: 19.6x

Lifestyle Communities, a notable player in the Australian market, recently showcased at the Macquarie Australia Conference. With earnings expected to climb by 22% annually, this reflects strong future prospects. Despite relying on higher-risk funding with no customer deposits, they maintain a good financial stance with significant non-cash earnings. Notably, insiders have recently demonstrated their confidence through share purchases, underscoring a belief in the company’s potential growth and current market positioning as undervalued.

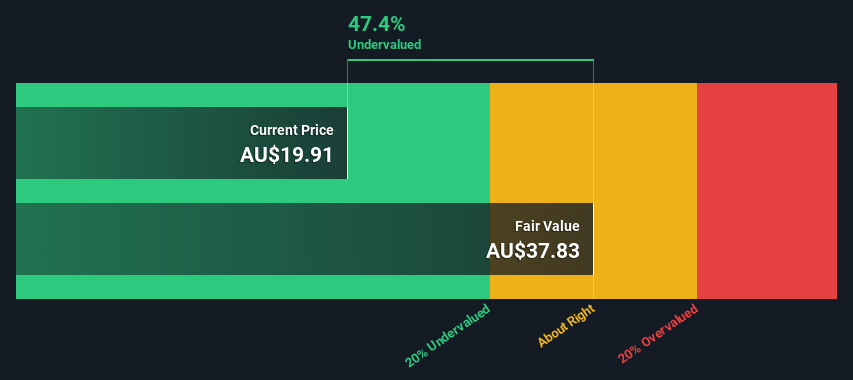

Neuren Pharmaceuticals

Simply Wall St Value Rating: ★★★★★★

Overview: Neuren Pharmaceuticals is a company focused on the development of pharmaceutical products, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generated A$231.94 million in revenue, with a gross profit margin of 88.47%. The company's operating expenses were A$5.95 million.

PE: 16.4x

Neuren Pharmaceuticals, a lesser-known entity in the Australian market, recently showcased promising Phase 2 clinical trial results for NNZ-2591, targeting Pitt Hopkins syndrome—a condition with no approved treatments. This development could significantly enhance its market position. With revenue projected to increase by over 10% annually, and backed by insider confidence demonstrated through recent share purchases, Neuren's strategic moves suggest a potential upward trajectory in its valuation amidst small-cap peers.

Make It Happen

Take a closer look at our Undervalued ASX Small Caps With Insider Buying list of 27 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:LIC and ASX:NEU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance