Top Three Chinese Dividend Stocks In June 2024

As of June 2024, the Chinese stock market has shown signs of weakening, with major indices like the Shanghai Composite and the CSI 300 experiencing slight declines amid economic slowdown concerns. This backdrop sets a cautious stage for investors looking at dividend-paying stocks in China. In such an environment, selecting strong dividend stocks often hinges on finding companies with robust fundamentals that can sustain payouts even during economic uncertainties.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.63% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.65% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.96% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.65% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.08% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.64% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.80% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.43% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.55% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.67% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

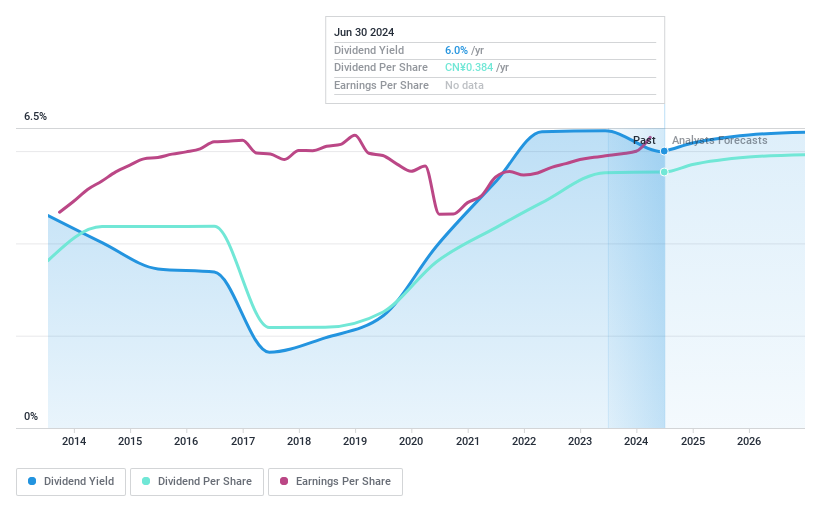

Hua Xia Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hua Xia Bank Co., Limited operates as a commercial bank in China and Hong Kong, with a market capitalization of approximately CN¥101.86 billion.

Operations: Hua Xia Bank Co., Limited generates its revenue primarily through commercial banking services in China and Hong Kong.

Dividend Yield: 6%

Hua Xia Bank is trading at 63.3% below its estimated fair value, indicating potential undervaluation. Despite a volatile dividend history over the past decade, its current payout ratio of 24.8% suggests dividends are well-covered by earnings. Forecasted earnings growth of 6.1% per year could support future dividend sustainability, although the bank's past performance shows only a modest increase in net income and earnings per share as evidenced in Q1 2024 results with net interest income declining from CNY 17.61 billion to CNY 15.96 billion year-over-year.

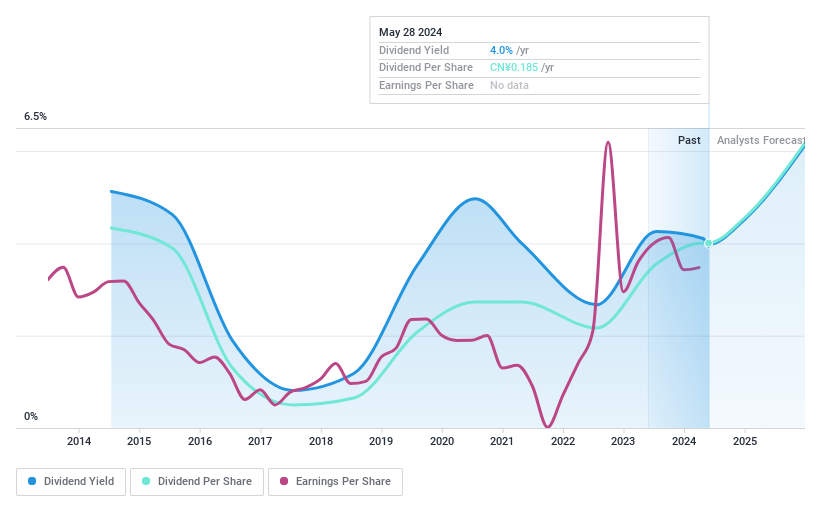

Inner Mongolia MengDian HuaNeng Thermal Power

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia MengDian HuaNeng Thermal Power Corporation Limited operates primarily in the thermal power generation sector and has a market capitalization of approximately CN¥30.28 billion.

Operations: Inner Mongolia MengDian HuaNeng Thermal Power Corporation Limited generates its revenue primarily from thermal power generation.

Dividend Yield: 4%

Inner Mongolia MengDian HuaNeng Thermal Power's dividend yield of 3.99% ranks in the top 25% in the Chinese market, but its history of dividend payments has been inconsistent over the past decade. Despite a decrease in revenue from CNY 23.07 billion in 2023 to CNY 22.53 billion, net income rose from CNY 1.77 billion to CNY 2.00 billion year-over-year, supporting a sustainable payout with a cash payout ratio of 44.4% and earnings coverage at 62.9%. However, dividends have not shown growth over this period, reflecting potential concerns for long-term dividend investors.

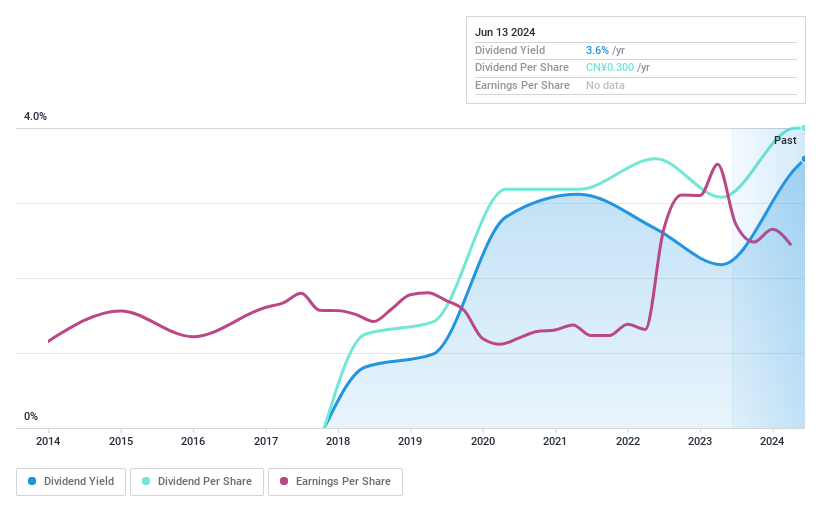

Qingdao Weflo Valve

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Weflo Valve Co., Ltd. specializes in designing and manufacturing valve and fire hydrant products globally, with a market capitalization of approximately CN¥1.72 billion.

Operations: Qingdao Weflo Valve Co., Ltd.'s revenue is derived from its global operations in the design and production of valve and fire hydrant products.

Dividend Yield: 3.7%

Qingdao Weflo Valve Co., Ltd. has demonstrated a commitment to maintaining its dividend distributions, with recent affirmations including a CNY 3.00 final cash dividend for 2023 and a quarterly dividend of CNY 0.50 in the first quarter of 2024. Despite this, the company's net profit margin declined from 28% to 19.6% year-over-year, reflecting potential pressure on future payouts despite current earnings and cash flow coverage ratios (61.2% and 60.6%, respectively) supporting these dividends. The firm's dividends are relatively new, lacking a long track record which might concern some investors looking for established consistency in dividend payments.

Take a closer look at Qingdao Weflo Valve's potential here in our dividend report.

Our valuation report here indicates Qingdao Weflo Valve may be undervalued.

Next Steps

Take a closer look at our Top Dividend Stocks list of 236 companies by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600015 SHSE:600863 and SZSE:002871

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance