Top Swiss Dividend Stocks To Consider In June 2024

Amid fluctuating market conditions and cautious investor sentiment in Switzerland, as highlighted by recent movements in the SMI index and economic forecasts from SECO, it's crucial for investors to consider stability and potential returns. In this context, dividend stocks often attract attention for their potential to provide steady income streams during uncertain times.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.58% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.22% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.30% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.35% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.41% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.91% | ★★★★★☆ |

EFG International (SWX:EFGN) | 4.37% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.05% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Carlo Gavazzi Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carlo Gavazzi Holding AG specializes in designing, manufacturing, and selling electronic control components for the building and industrial automation industries, with a market capitalization of approximately CHF 213.92 million.

Operations: Carlo Gavazzi Holding AG generates its revenue primarily from the sale of electronic control components tailored for the building and industrial automation sectors.

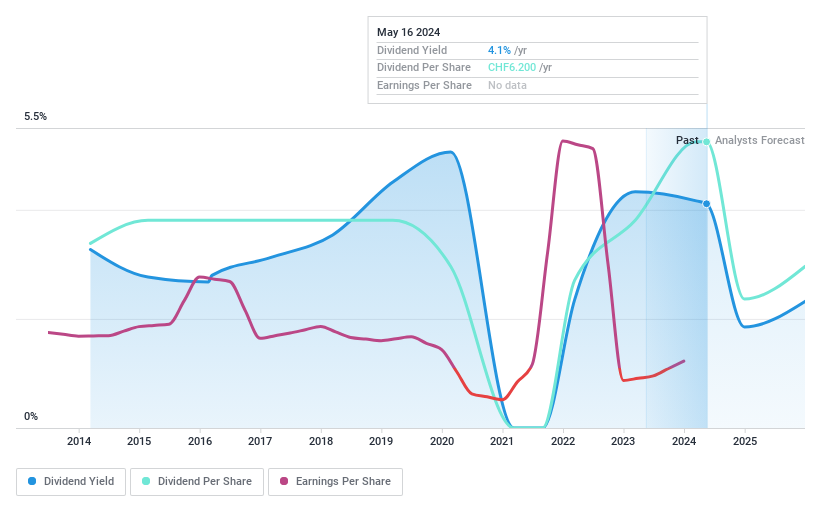

Dividend Yield: 4%

Carlo Gavazzi Holding exhibits a stable dividend coverage, with a payout ratio of 31.8% and a cash payout ratio of 47.6%, indicating that dividends are well-supported by both earnings and cash flows. However, the company's dividend history shows volatility and unreliability over the past decade, with significant fluctuations in annual payments. Additionally, its current dividend yield of 3.99% is below the top quartile average of Swiss dividend stocks at 4.29%.

Helvetia Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helvetia Holding AG operates in the life and non-life insurance and reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France, and other international markets with a market capitalization of CHF 6.36 billion.

Operations: Helvetia Holding AG generates CHF 1.81 billion from its life insurance segment and CHF 7.09 billion from its non-life insurance operations.

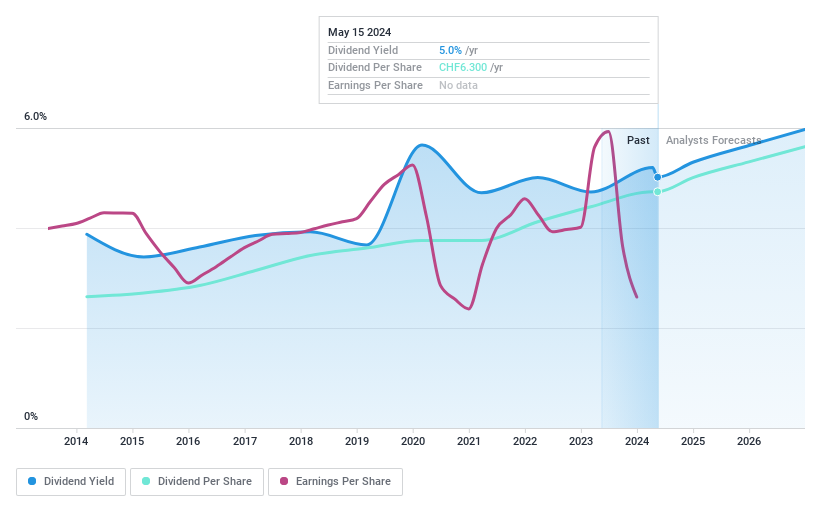

Dividend Yield: 5.2%

Helvetia Holding AG recently proposed a nearly 7% dividend increase to CHF 6.3, reflecting a commitment to enhancing shareholder returns despite a challenging year with net income dropping to CHF 283.2 million from CHF 438.8 million. The company's dividend yield stands at a competitive 5.23%, ranking in the top quartile of Swiss stocks, though its payout ratio at 120.3% raises concerns about sustainability given the earnings coverage gap. Helvetia's dividends have shown stability over the past decade, supported by cash flows with a cash payout ratio of just 36.5%.

TX Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG is a Swiss company that operates various platforms and participations offering information, orientation, entertainment, and support services, with a market capitalization of approximately CHF 1.70 billion.

Operations: TX Group AG's revenue is generated through several segments: Tamedia contributes CHF 446.40 million, Goldbach adds CHF 274.70 million, 20 Minutes generates CHF 118.40 million, TX Markets brings in CHF 133.80 million, and Groups & Ventures accounts for CHF 159.40 million.

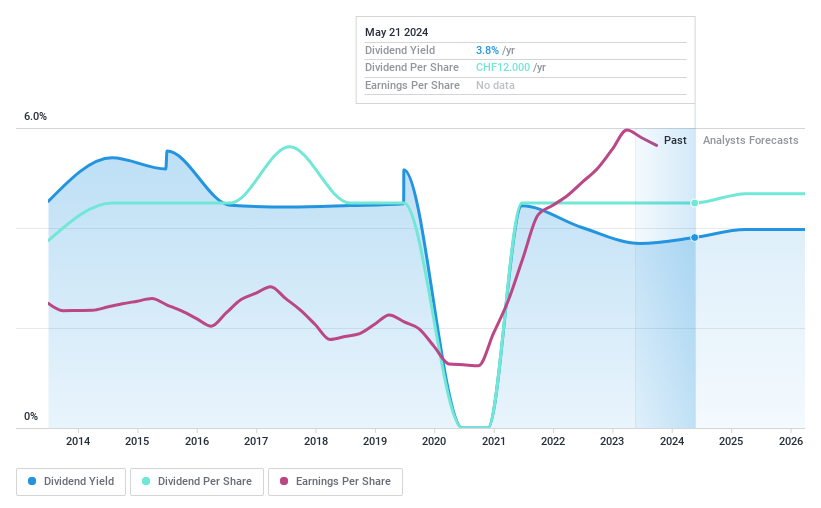

Dividend Yield: 3.9%

TX Group exhibits a mixed dividend profile. While the company's stock is trading at 73.3% below our fair value estimate, its dividend history over the past decade has been marked by volatility and unreliability. Despite this, dividends have grown and are currently supported by both earnings and cash flows, with payout ratios of 86.9% and 42.1%, respectively. However, its current yield of 3.87% remains below the top quartile average of 4.29% in the Swiss market.

Click here to discover the nuances of TX Group with our detailed analytical dividend report.

Our valuation report unveils the possibility TX Group's shares may be trading at a premium.

Summing It All Up

Click this link to deep-dive into the 28 companies within our Top Dividend Stocks screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:GAVSWX:HELNSWX:TXGN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance