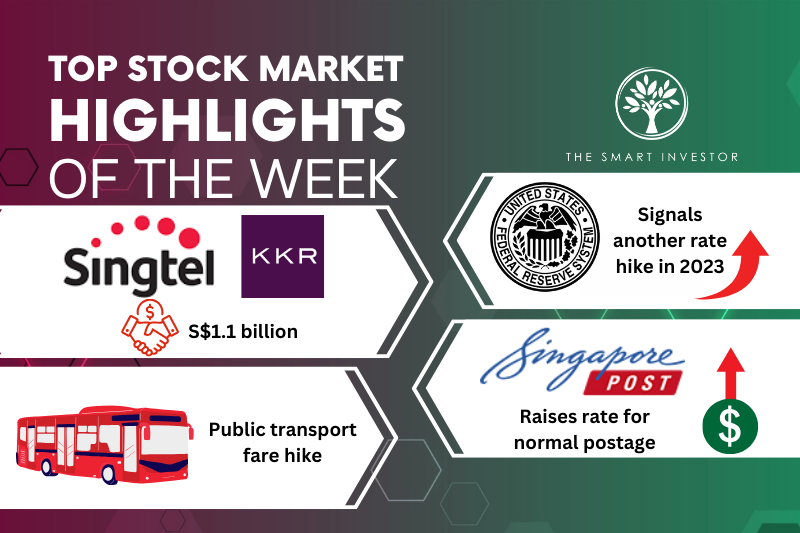

Top Stock Market Highlights of the Week: US Federal Reserve, Singtel, Singapore Post and Public Transport Fare Hikes

Welcome to this week’s edition of top stock market highlights.

US Federal Reserve

At the US Federal Reserve’s latest meeting, interest rates were held steady at 22-year highs.

Investors heaved a sigh of relief as the benchmark was kept between 5.25% and 5.5%.

However, the central bank signalled that one more rate hike was needed for the remainder of 2023 to bring inflation under control.

This proclamation meant that rates would end at 5.5% to 5.75% by the end of this year.

Meanwhile, officials also pencilled in a 0.5% rate cut in 2024, a change of stance compared to June when they expected to cut rates by a full percentage point.

This new development implies that interest rates will be held high for a longer time.

US core inflation rose 4.3% in August, down from 4.7% in July, but still above the Federal Reserve’s long-term target of 2%.

The central bank continues to weigh incoming data on economic growth, unemployment, and inflation before deciding on its next move.

Chairman Jerome Powell is determined to restore price stability once and for all rather than have the central bank come back to raise interest rates again in the future.

Singtel (SGX: Z74)

Last week, Singtel announced that it has inked a deal with global investment firm KKR (NYSE: KKR) in which the latter will commit up to S$1.1 billion for a 20% stake in Singtel’s regional data centre business.

This investment gives the data centre business an enterprise value of S$5.5 billion, with KKR offering the option to increase its stake to 25% at the same valuation by 2027.

The first collaboration of its kind, the cash infusion will allow the blue-chip telco to tap into KKR’s expertise to accelerate the expansion of its regional data centre business across ASEAN markets.

Singtel has been steadily growing its data centre and its portfolio will deliver a total combined capacity of 155 MW once all projects are operational by 2025, with room to scale this to 200 MW.

Southeast Asia’s data centre market is projected to grow by 17% per annum over the next five years with around US$9 billion to US$13 billion expected to flow into the region.

Despite capacity growing by 19% per annum over the same period, demand is expected to outpace supply with the rise of artificial intelligence and cloud computing.

KKR’s acquisition will close by the fourth quarter of this year.

Singapore Post (SGX: S08)

Singapore Post, or SingPost, has announced that rates for its standard regular mail will rise by S$0.20, or 64.5%, to S$0.51 from the current S$0.31.

This sharp increase is in line with the higher costs of maintaining the postal service and the group will work with the Infocomm Media Development Authority (IMDA) to jointly review its costs and operating model.

The rate adjustment will help to offset the fall in mail volumes and defray some of the higher costs associated with labour, utilities, and fuel.

The last time SingPost initiated a postage increase was back in 2014 when postage rates increased from S$0.22 to S$0.30.

These new rates will be effective from 9 October and will help the postal service provider to reduce its revenue decline from falling postal volumes.

SingPost will also issue a first local stamp booklet (comprising 10 stamps) to each household to help defray the higher costs from the end of October.

Public transport fare hike

Commuters on public buses and the MRT have to contend with another fare increase come 23 December.

The Public Transport Council (PTC) has mandated that adult commuters will pay S$0.10 to S$0.11 more per journey, an overall year-on-year fare increase of 7%.

Last year, the increase was just 2.9%, with adult card fares increasing by S$0.04 to S$0.05 per journey.

This 7% fare increase is just a fraction of the maximum allowable fare adjustment, which hit 22.6% because of a deferred increase of 10.6% from 2022 along with this year’s 12%.

What this means is that commuters should be prepared to fork out even more in train and bus fares from 2024 onwards as most of the rise will be pushed to later years to help people cope with rising inflation.

Public transport operators SBS Transit (SGX: S61) and SMRT Trains will enjoy an annual revenue increase of S$20.9 million and S$42.4 million, respectively.

SBS Transit’s revenue increase will translate to just 1.4% of 2022’s total revenue of S$1.5 billion, so it should not move the needle much for the bus and train operator.

Another beneficiary of these fare hikes is ComfortDelGro Corporation (SGX: C52), which owns a 74.43% stake in SBS Transit as of 1 March 2023.

However, it remains to be seen if this fare increase can help offset the higher expenses associated with staff, utility, and fuel costs.

We’ve just released a new Special FREE Report: “How to Make Your Child a Millionaire.” It’s a simple, no-nonsense guide for parents who care for their child’s financial future. You’ll also find 3 stocks (one even had a 55.8% jump in dividends) you can consider today to kickstart your child’s “piggy bank.” Click HERE to download now.

Disclosure: Royston Yang does not own shares in any of the companies mentioned.

The post Top Stock Market Highlights of the Week: US Federal Reserve, Singtel, Singapore Post and Public Transport Fare Hikes appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance