Top Health Care Stocks Beating the S&P 500 This Year

Tech stocks continue to dominate the returns in 2024. But as part of a diversified portfolio, we need to look elsewhere and gain exposure to other areas with significant profit potential.

Luckily for investors, the systems used at Zacks Investment Research consistently identify big market winners, regardless of which pocket of the market they may reside.

Adding to the bullish theme, it’s never been easier to find these winners, with the power of the Zacks Rank literally right at your fingertips.

Zacks Industry Rank: Improve Your Stock-Picking Success

Zacks Investment Research employs several proprietary methodologies to make it easier for investors to detect top stocks at any given point in time. One such method is the Zacks Industry Rank, which is a great starting point to begin building out your portfolio. Using this investment tactic, we’ll start with a leading industry group in the current market environment.

This system harnesses the power of the Zacks Rank, meaning that the top-ranked industries contain more stocks that are receiving upward earnings estimate revisions. Simply put, your most profitable stocks will be those with upward earnings estimate revisions in the industries enjoying the same.

Our industry ranking system sorts companies into more than 250 industry groups. The Zacks Industry Rank is calculated by averaging the Zacks Rank for all individual stocks within a specific industry. A recent 10-year backtest has shown that stocks within the top 50% of all Zacks Ranked Industries outperformed the bottom half by a factor of more than 2 to 1.

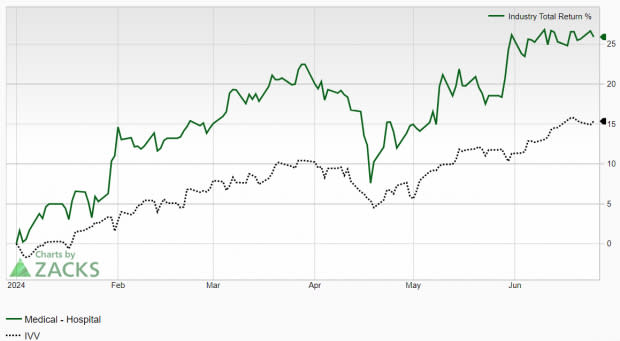

Let’s take a look at an example. The Zacks Medical – Hospital industry currently ranks in the top 6% out of more than 250 Zacks Ranked Industries. We’ll start with this industry group that has been significantly outperforming the market over the last 3 months:

Image Source: Zacks Investment Research

Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. Focusing on stocks within the top-performing industries provides a constant tailwind to our investing results. Including this step in our selection process also allows us to filter our investment list and select stocks with the best profit potential.

Narrow Down the Investment Universe with the Zacks Rank

Once the top industry groups are identified, we can peel back the curtain to find stocks with the highest Zacks Rank. Stocks with rising earnings estimate revisions have significantly outperformed the S&P 500 year after year. This ranking system uses five different ranks: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell), and #5 (Strong Sell).

Our top-down process narrows the investable universe, starting with the Zacks Medical – Hospital industry. Let’s dive deeper into two leading stocks contained within this top industry.

Tenet Healthcare THC, a Zacks Rank #1 (Strong Buy), operates as a diversified health care services company in the United States. The company owns and operates general hospitals and health care facilities, and also boasts one of the largest investor-owned health care delivery services.

As we can see below, Tenet Healthcare garners the top Zacks Rank due to positive earnings estimate revisions. The company has surpassed earnings estimates in each of the past four quarters, delivering a 56.5% average earnings surprise over that timeframe. Analysts covering THC have increased their EPS estimates for the current fiscal year by a whopping 39.48% in the past 60 days. The Zacks Consensus Estimate now stands at $8.55/share, which would equate to a 22.5% improvement relative to last year.

Image Source: Zacks Investment Research

United Health Services UHS is another stock contained within the aforementioned industry group. A Zacks Rank #2 (Buy), United Health Services owns and operates acute care hospitals, behavioral health centers, surgical hospitals, and oncology sites. The King of Prussia, PA-based health care giant provides a range of services such as general and specialty surgery, internal medicine, radiology, diagnostic care, and pharmacy solutions.

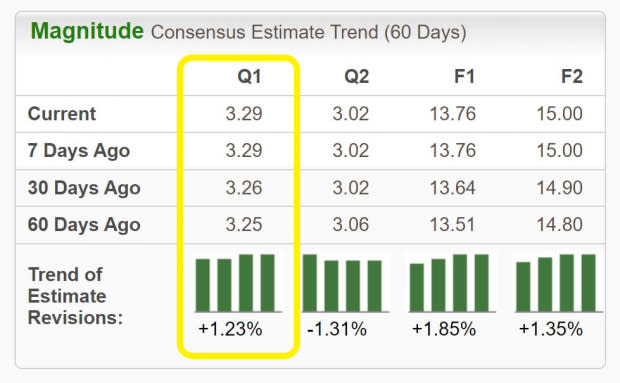

The company is also experiencing upward earnings estimate revisions. United Health Services has exceeded earnings estimates in each of the past four quarters, posting an 8.1% average earnings surprise over that timeframe. Analysts covering UHS have increased their EPS estimates for the current quarter by 1.23% in the past 60 days. The Zacks Consensus Estimate now stands at $3.29/share, which would mark a 30% jump relative to year-ago period.

Image Source: Zacks Investment Research

What the Zacks Model Unveils

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently seen positive earnings estimate revision activity. The idea is that this recent information can serve as a more accurate predictor of the future, which can give investors a leg up during earnings season.

The technique has proven to be quite useful in finding positive surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks delivered a positive surprise 70% of the time according to our 10-year backtest.

UHS stock is a Zacks Rank #2 (Buy) and boasts a +2.91% Earnings ESP. Another earnings beat may be in the cards when the company is reports its Q2 results in late July.

Health Care Leaders Show Relative Strength

We can confirm our selections by ensuring that the portfolio candidates are showing signs of outperformance. We want to look for stocks that are breaking out to the upside and are experiencing high levels of buying pressure.

THC stock certainly fits the bill with shares remaining in a strong uptrend and making a series of 52-week highs. Tenet Healthcare has widely outperformed the market this year with a nearly 80% return:

Image Source: StockCharts

Similarly, UHS stock has climbed nearly 25% this year alone, steadily outpacing the general market:

Image Source: StockCharts

Bottom Line

Identifying leading stocks doesn’t need to be complicated and can be accomplished in any type of market environment. The health care space is a good point to begin that contains several market leaders.

The various systems employed at Zacks can help investors easily locate top-ranked industry groups and individual stocks. Make sure that you’re taking full advantage of all that Zacks has to offer as we make our way into the second half of the year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance