Top Growth Companies With High Insider Ownership On Chinese Exchanges In June 2024

As of June 2024, Chinese equities have shown resilience amidst global economic fluctuations, with recent data indicating a challenging yet stable growth environment. This context sets the stage for evaluating growth companies in China, particularly those with high insider ownership which can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's review some notable picks from our screened stocks.

IKD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IKD Co., Ltd. is a company engaged in researching, developing, producing, and selling automotive aluminum alloy precision die castings across the United States, Europe, and Asia, with a market capitalization of approximately CN¥16.86 billion.

Operations: The company generates approximately CN¥6.34 billion from its automotive parts and accessories segment.

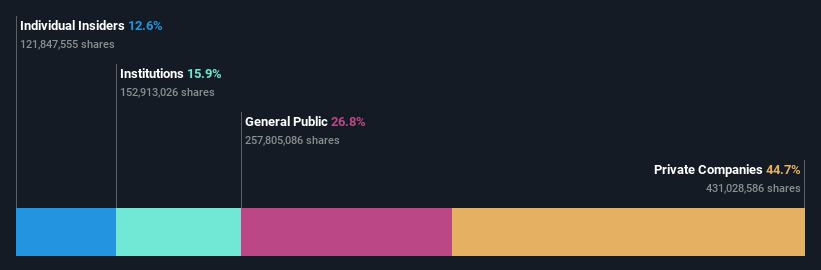

Insider Ownership: 12.6%

Earnings Growth Forecast: 21.7% p.a.

IKD Co., Ltd. has demonstrated robust financial performance, with a notable increase in yearly sales and revenue, rising to CNY 5.96 billion and net income to CNY 913.4 million as of December 2023. Despite high earnings growth expectations of over 20% annually, the company's Return on Equity is forecasted to be low at 17.4%. Additionally, recent private placements have diluted shareholder value despite raising substantial funds (CNY 1.19 billion). Analysts predict a potential price increase of 57.4%, reflecting optimism about future revenue growth exceeding market averages.

Shanghai OPM Biosciences

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd., operating both domestically and internationally, specializes in providing cell culture media and CDMO services, with a market capitalization of approximately CN¥4.14 billion.

Operations: The company generates its revenue primarily from the sale of cell culture media and the provision of CDMO services.

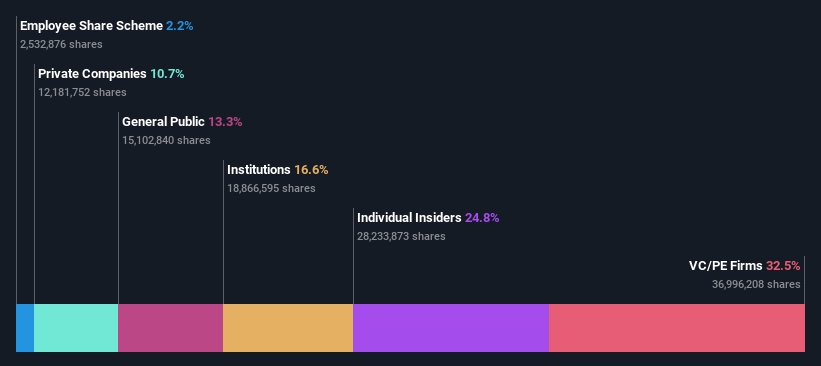

Insider Ownership: 24.8%

Earnings Growth Forecast: 48.6% p.a.

Shanghai OPM Biosciences, despite a dip in net profit margin from 36% to 19.4%, continues to show strong revenue growth, forecasted at 35.1% annually, outpacing the Chinese market average of 14%. The company's earnings are also expected to surge by 48.6% per year. However, its return on equity is projected to remain low at 7.1%. Recent activities include a share buyback of CNY 40 million and an upcoming Annual General Meeting scheduled for May 20, 2024.

Eaglerise Electric & Electronic (China)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eaglerise Electric & Electronic (China) Co., Ltd. is a company specializing in the manufacturing of electrical and electronic products, with a market capitalization of approximately CN¥8.69 billion.

Operations: The company generates its revenue from the manufacturing of electrical and electronic products.

Insider Ownership: 32.2%

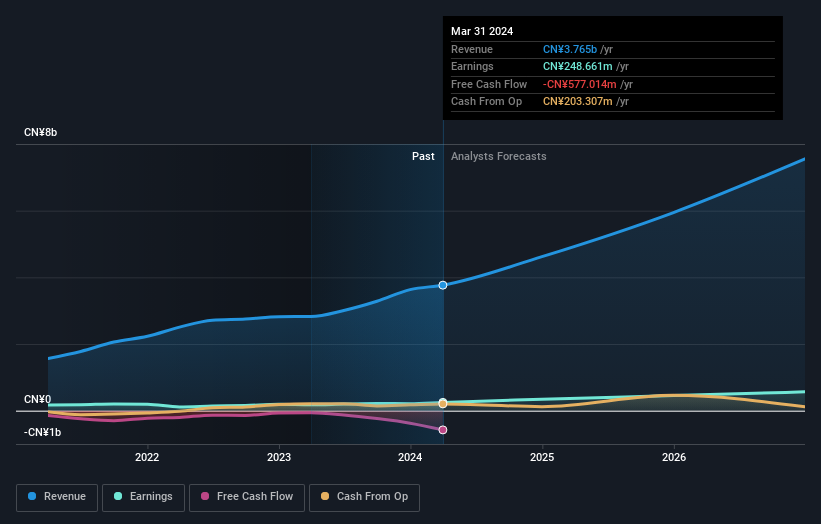

Earnings Growth Forecast: 28.6% p.a.

Eaglerise Electric & Electronic (China) Co. Ltd. is experiencing robust earnings growth, with a forecast increase of 28.6% per year, outstripping the broader Chinese market's 23%. Despite this, its return on equity is expected to be modest at 13.1% in three years. Recent financial disclosures show a significant revenue jump to CNY 773.85 million in Q1 2024 from CNY 639.27 million the previous year, alongside a substantial rise in net income to CNY 58.37 million from CNY 19.03 million, reflecting strong operational performance and market confidence.

Turning Ideas Into Actions

Discover the full array of 398 Fast Growing Chinese Companies With High Insider Ownership right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:600933SHSE:688293 SZSE:002922

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance