Top Growth Companies With High Insider Ownership In July 2024

As global markets navigate through a landscape marked by fluctuating interest rates and mixed economic signals, investors are keenly observing the performance trends across various sectors. In such a climate, growth companies with high insider ownership can offer unique insights into firm confidence and potential resilience, aligning closely with broader market dynamics where growth stocks have recently found favor.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 58.7% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Vow (OB:VOW) | 31.8% | 97.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Adocia (ENXTPA:ADOC) | 11.9% | 59.8% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Here's a peek at a few of the choices from the screener.

Guangzhou Kingmed Diagnostics Group

Simply Wall St Growth Rating: ★★★★☆☆

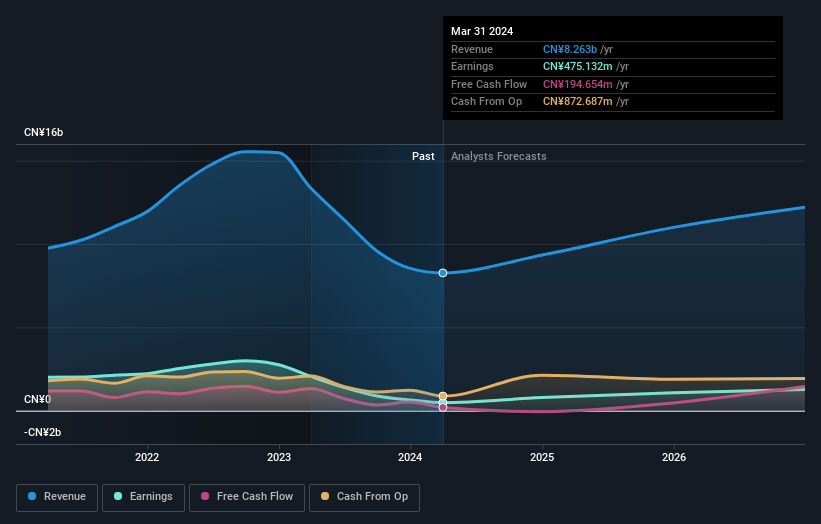

Overview: Guangzhou Kingmed Diagnostics Group Co., Ltd. operates in the healthcare sector, providing diagnostic services with a market capitalization of approximately CN¥12.79 billion.

Operations: The company's primary revenue of CN¥8.26 billion is generated from third-party medical diagnostic services.

Insider Ownership: 17.6%

Guangzhou Kingmed Diagnostics Group has shown a mixed financial performance with a recent net loss in Q1 2024, contrasting sharply with its previous year's profit. Despite this setback, the company is expected to see significant earnings growth over the next three years, outpacing the broader Chinese market. This growth potential is coupled with high insider ownership which typically signals confidence in the company’s future from those closest to it. However, recent share buybacks and a dividend that isn’t well covered by free cash flows suggest caution regarding its capital management strategies.

SICC

Simply Wall St Growth Rating: ★★★★★☆

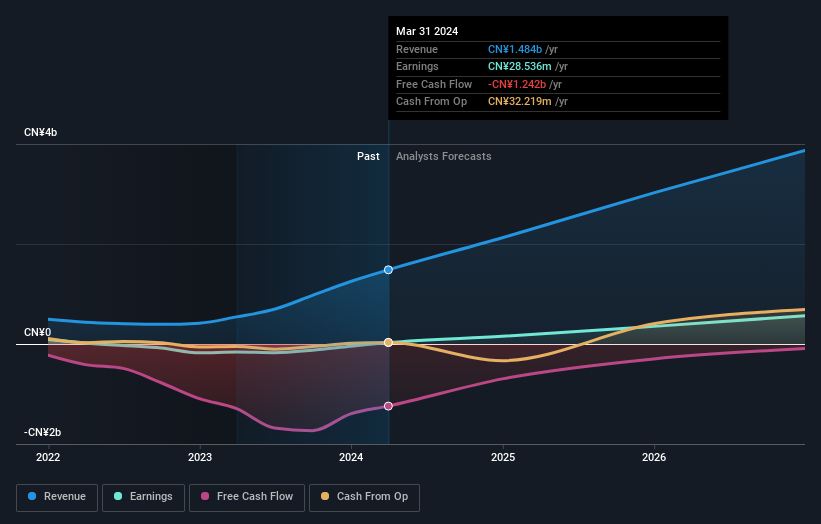

Overview: SICC Co., Ltd., operating both domestically and internationally, focuses on the research, development, production, and sale of silicon carbide semiconductor materials, with a market capitalization of approximately CN¥20.74 billion.

Operations: The company generates revenue primarily from the sale of silicon carbide semiconductor materials, totaling CN¥1.48 billion.

Insider Ownership: 30.2%

SICC Co., Ltd. recently transitioned from a net loss to reporting substantial profits, with first-quarter earnings showing a significant revenue increase to CNY 426.07 million from CNY 193.08 million year-over-year and net income of CNY 46.1 million compared to a previous loss. This growth is supported by projections of annual earnings increasing by 37% per year, outperforming the broader Chinese market forecast of 22.1%. Despite these positive indicators, the company's return on equity is expected to remain low at around 11.1% in three years’ time, suggesting potential concerns about long-term profitability and efficiency.

Delve into the full analysis future growth report here for a deeper understanding of SICC.

Our expertly prepared valuation report SICC implies its share price may be too high.

Merida Industry

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Merida Industry Co., Ltd. is a Taiwan-based company that manufactures and sells bicycles and components across regions including Taiwan, China, Hong Kong, Japan, and Europe, with a market capitalization of approximately NT$66.22 billion.

Operations: The company generates revenue primarily through the manufacturing and sales of bicycles and their parts, amounting to NT$24.72 billion.

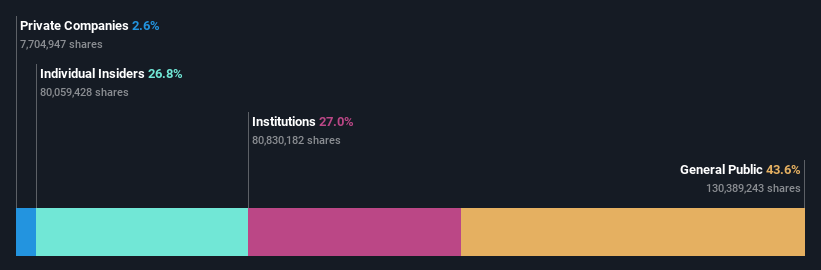

Insider Ownership: 26.8%

Merida Industry's earnings are poised for significant growth, forecasted at 31.9% annually, outpacing the broader Taiwanese market's 18.2%. However, its revenue growth projections of 13.3% annually suggest a slower pace compared to its earnings surge. Insider ownership remains stable with no major buying or selling reported recently. Recent corporate adjustments include dividend cuts and leadership changes, potentially impacting governance dynamics but underscoring active management engagement as it navigates challenging market conditions and aims for operational efficiencies.

Seize The Opportunity

Navigate through the entire inventory of 1437 Fast Growing Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603882 SHSE:688234TWSE:9914 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance