Top German Dividend Stocks To Consider In July 2024

As of July 2024, Germany's economic landscape reflects a mix of challenges and resilience, with recent data indicating unexpected weakening in its manufacturing sector. Amidst this backdrop, investors might consider the stability offered by dividend-paying stocks, which can provide potential income and a degree of protection in uncertain market conditions.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.26% | ★★★★★★ |

OVB Holding (XTRA:O4B) | 4.66% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 5.18% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.29% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.80% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.19% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.78% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.23% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.20% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.01% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

We'll examine a selection from our screener results.

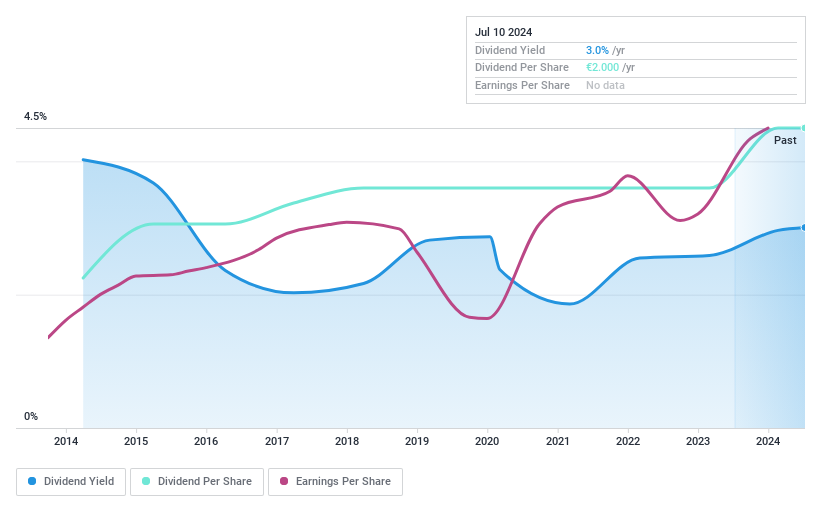

FRoSTA

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft operates in the frozen food sector, developing, producing, and marketing its products across Germany, Poland, Austria, Italy, and Eastern Europe with a market capitalization of approximately €0.44 billion.

Operations: FRoSTA Aktiengesellschaft generates its revenues by developing, producing, and selling frozen food products across key European markets including Germany, Poland, Austria, Italy, and Eastern Europe.

Dividend Yield: 3%

FRoSTA Aktiengesellschaft, with a modest dividend yield of 3.01%, falls below the top quartile of German dividend stocks which average at 4.66%. Despite this, the company maintains a strong financial foundation for its dividends, evidenced by a low payout ratio of 40% and an even lower cash payout ratio of 13.9%, ensuring that dividends are well-covered by both earnings and cash flows. Recent earnings reports from July 10, 2024, confirm stable financial performance with slight fluctuations in sales and net income year-over-year.

Delve into the full analysis dividend report here for a deeper understanding of FRoSTA.

Our valuation report unveils the possibility FRoSTA's shares may be trading at a premium.

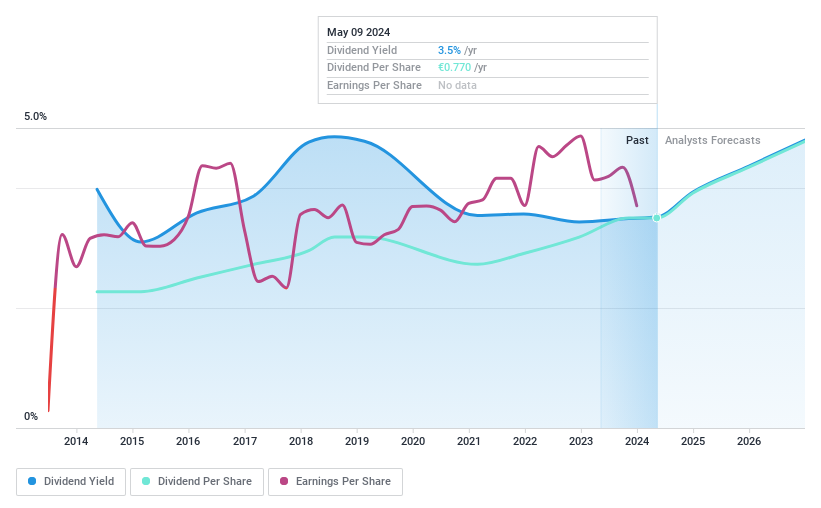

Deutsche Telekom

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Deutsche Telekom AG operates as a provider of integrated telecommunication services and has a market capitalization of approximately €117.72 billion.

Operations: Deutsche Telekom AG generates its revenue primarily from three segments: €72.18 billion from the United States, €25.34 billion from Germany, and €11.97 billion from Europe, along with smaller contributions of €3.94 billion from Systems Solutions and €2.27 billion from Group Headquarters & Group Services.

Dividend Yield: 3.2%

Deutsche Telekom's dividend yield of 3.23% is below the top German dividend stocks, yet its sustainability is supported by a low cash payout ratio of 19.3% and an earnings payout ratio of 87%. Despite carrying high levels of debt, the firm has demonstrated reliable dividend growth over the past decade. Recent financials show a slight increase in sales to €28.59 billion and net income at €1.98 billion, with dividends well-covered by both earnings and cash flow. Additionally, recent share buybacks totaling €700 million underscore ongoing shareholder returns management.

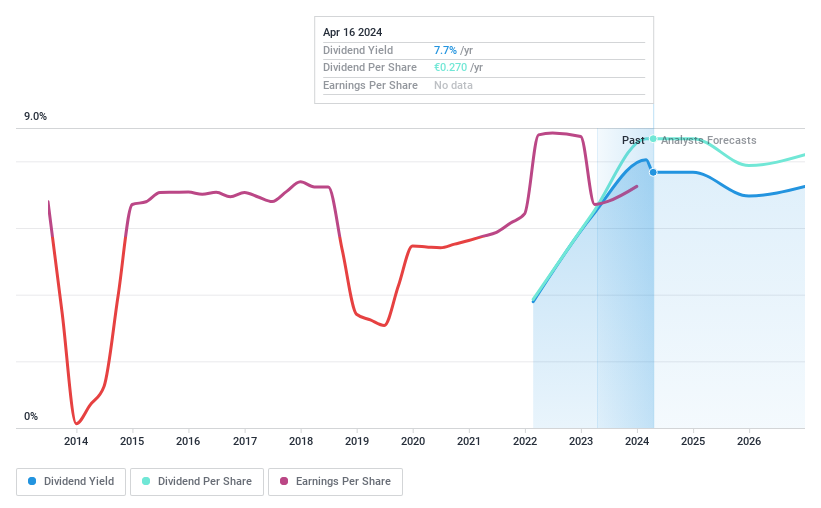

MPC Münchmeyer Petersen Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager, operating with a market capitalization of approximately €144.52 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue through three primary segments: Management Services (€30.83 million), Transaction Services (€7.73 million), and Miscellaneous (€0.36 million).

Dividend Yield: 6.6%

MPC Münchmeyer Petersen Capital AG, with a dividend yield of 6.59%, ranks in the top 25% of German dividend payers. The company's recent financial performance shows robust growth, with sales increasing to €9.6 million and net income rising to €5.88 million in Q1 2024. Dividends are well-supported by a payout ratio of 72.6% from earnings and 73.6% from cash flow, indicating sustainability despite the firm's relatively short history of dividend payments under ten years and an upcoming CEO transition on June 13, which introduces some uncertainty regarding future policy continuity.

Key Takeaways

Dive into all 32 of the Top German Dividend Stocks we have identified here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:NLMXTRA:DTE and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance