Top Cathie Wood Stock Poised for Explosive Upside: Key Level to Watch

Agree or disagree with her approach, Cathie Wood has remained steadfast through it all, unwavering in her strategy during one of the worst bear markets for growth stocks in history.

Her set of ARK ETFs are off to a hot start in 2023 after a year to forget last year. Despite a notable drawdown from the high in early February, the ARK Fintech Innovation ETF ARKF is still up nearly 18% year-to-date, handily outperforming the major U.S. indices. ARKF is an actively managed ETF that seeks long-term growth of capital by investing in companies that introduce technologies aimed at changing the way the financial sector operates.

The ARK Fintech Innovation ETF contains several well-known market leaders that innovate in fields such as mobile payments, blockchain technology, digital wallets, and peer-to-peer lending. One such company is MercadoLibre MELI, a Latin American e-commerce giant that has risen more than 90% off the bear market lows. To put that into context, the S&P 500 is only up about 8% from the lows of last year.

Image Source: Zacks Investment Research

The stock has recently met resistance at about $1,265/share, which coincides with the April high point last year. A break above this level would indicate another leg higher.

MELI makes up nearly 6% of the total ARKF holdings. MercadoLibre operates an online e-commerce platform that enables businesses, merchants, and individuals to list merchandise and conduct sales and purchases online. Through Mercado Shops, users can setup, manage, and promote their own digital stores. The MELI platform boasts nearly 670 million monthly visitors.

The company’s retail sales and fintech payments have exploded through its Pago feature. Mercado Pago is a financial platform that enables transactions via the company’s marketplaces, allowing users to virtually send and receive funds. Mercado Crédito extends loans and credit to individuals and businesses.

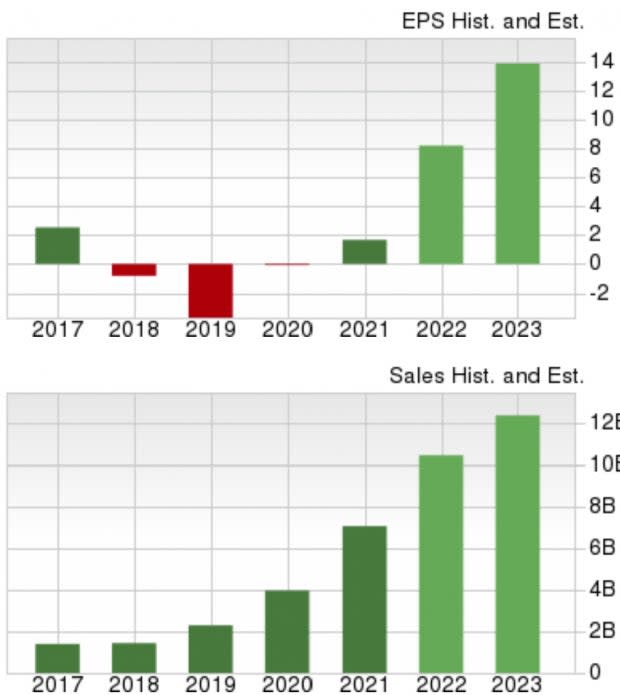

MELI, a Zacks Rank #1 (Strong Buy), has exceeded earnings estimates in three of the past four quarters. The company most recently announced fourth-quarter earnings back in February of $3.25/share, a 54.03% surprise over the $2.11 Zacks Consensus Estimate. The EPS figure compared favorably to the -$0.92/share loss during the same quarter in the prior year. Sales of $3 billion grew 41% year-over-year and also beat projections.

Image Source: Zacks Investment Research

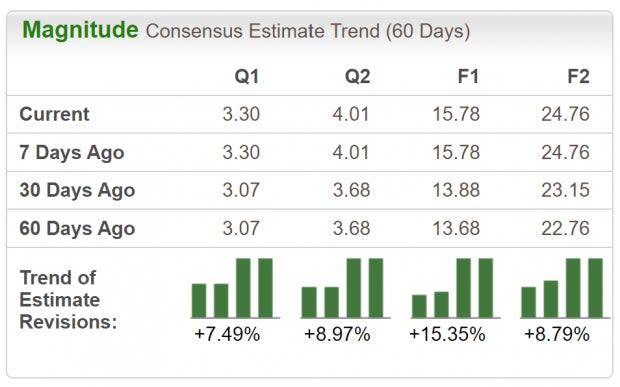

MercadoLibre has delivered a trailing four-quarter average earnings surprise of 21.95%. Earnings estimates are on the rise, with analysts in agreement in terms of revisions. For the current year, analysts have raised earnings estimates by 15.35% in the past 30 days. The 2023 Zacks Consensus Estimate now stands at $15.78/share, translating to potential growth of 65.58% relative to last year. Sales are anticipated to climb 22.66% to $12.93 billion.

Image Source: Zacks Investment Research

MELI is ranked favorably by our Zacks Style Scores, with a top-rated ‘A’ mark in our Growth category. This indicates further upside is likely based on promising sales and earnings growth forecasts.

MercadoLibre is benefitting form strength in commerce and fintech businesses. Robust product offerings and credit portfolio expansion are driving revenues. A well-established e-commerce giant, MELI is poised to take advantage of increasing internet penetration in Latin America.

Make sure to keep an eye on MELI and the fintech innovation space.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

ARK Fintech Innovation ETF (ARKF): ETF Research Reports

Yahoo Finance

Yahoo Finance