Top ASX Dividend Stocks To Consider In June 2024

Over the past week, the Australian market has shown stability with no significant changes, while it has experienced an 8.9% rise over the past year. With earnings expected to grow by 14% annually, investors might consider dividend stocks that can potentially offer both steady income and capital appreciation in this evolving economic landscape.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.07% | ★★★★★☆ |

Lindsay Australia (ASX:LAU) | 6.86% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.07% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.06% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.78% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.78% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.02% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.28% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.23% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.00% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ampol

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, with a market cap of A$7.85 billion, engages in the purchasing, refining, distribution, and marketing of petroleum products across Australia, New Zealand, Singapore, and the United States.

Operations: Ampol Limited generates revenue through three primary segments: Z Energy with A$5.51 billion, Convenience Retail at A$5.99 billion, and Fuels and Infrastructure contributing A$33.63 billion.

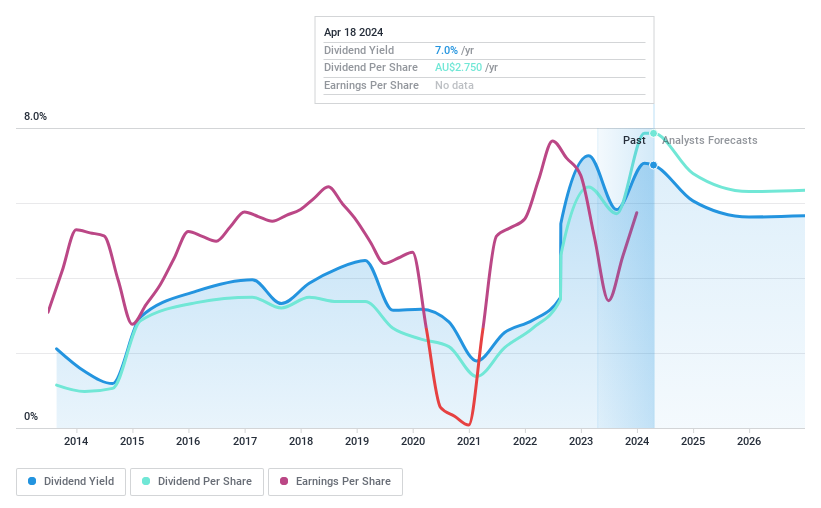

Dividend Yield: 8.3%

Ampol's dividend yield of 8.35% ranks in the top 25% in Australia, reflecting a decade of growth despite its volatility and high payout ratio of 93.3%. Although dividends are covered by cash flows (68.6%), they are poorly supported by earnings, indicating potential sustainability issues. Recent leadership changes with the departure of director Mark Chellew may impact future strategies. Earnings are expected to grow at 8.95% annually, but Ampol's significant debt level poses a financial challenge.

Accent Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchising of lifestyle footwear, apparel, and accessories across Australia and New Zealand, with a market capitalization of approximately A$1.11 billion.

Operations: Accent Group Limited generates A$1.40 billion from its multi-channel retail operations focusing on performance and lifestyle footwear.

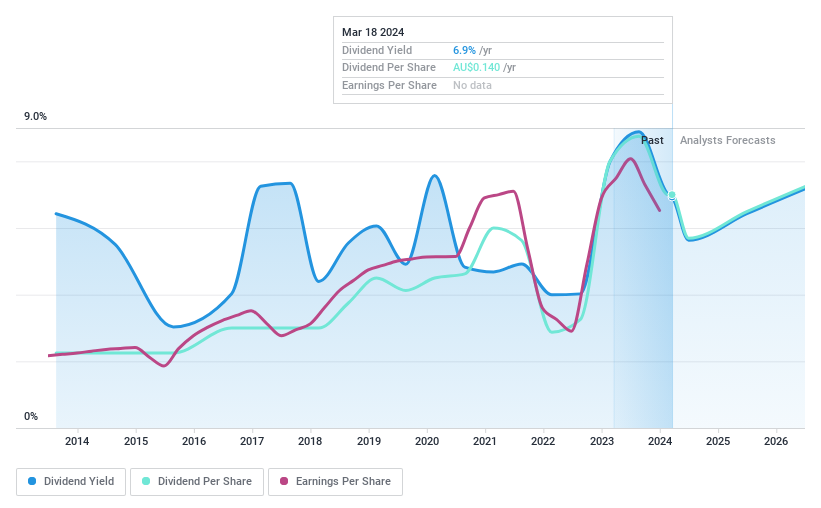

Dividend Yield: 7.1%

Accent Group's dividend yield of 7.07% places it among the top 25% of Australian dividend payers. However, the sustainability of these dividends is questionable, with a high payout ratio of 107.2% and coverage issues both by earnings and cash flow, despite a low cash payout ratio of 39%. Dividend payments have shown volatility over the past decade but have increased overall. The company's stock is trading at a significant discount, valued at 69.5% below its estimated fair value, and earnings are projected to grow by 11.86% annually. Recent executive changes include James Anderson joining as Chief Information Officer to enhance technological capabilities.

Lindsay Australia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors like food processing and horticulture, with a market capitalization of approximately A$273.37 million.

Operations: Lindsay Australia Limited generates revenue primarily through its transport and rural segments, with A$571.38 million from transport services and A$158.73 million from rural supplies.

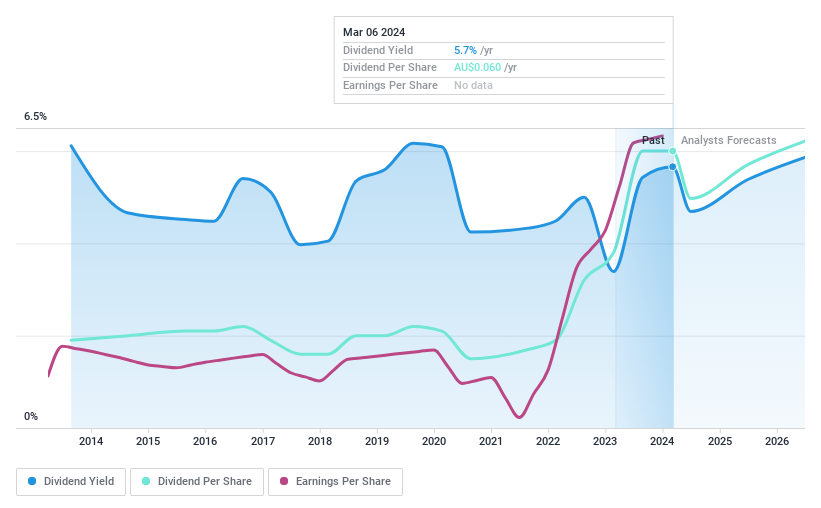

Dividend Yield: 6.9%

Lindsay Australia offers a dividend yield of 6.86%, ranking it in the top quarter of Australian dividend stocks. Despite a volatile dividend history over the past decade, dividends have grown, supported by earnings and cash flows with payout ratios of 43.7% and 38.9% respectively. The stock trades at a 9.3% discount to estimated fair value, with earnings expected to grow by 9% annually, indicating potential for sustained returns despite past instability in payouts.

Seize The Opportunity

Access the full spectrum of 28 Top ASX Dividend Stocks by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ALDASX:AX1 and ASX:LAU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance