Top 5 Books to Read if You Want to Build Wealth and Stay Wealthy (With Insights and Quotes)

Did you know Warren Buffet spends 80% of his work time reading and thinking?

Reading isn’t just for him, we can still build that habit. It’s like a workout for your brain, boosting focus, vocabulary, and memory. And hey, it’s good for reducing stress and managing sleep, too.

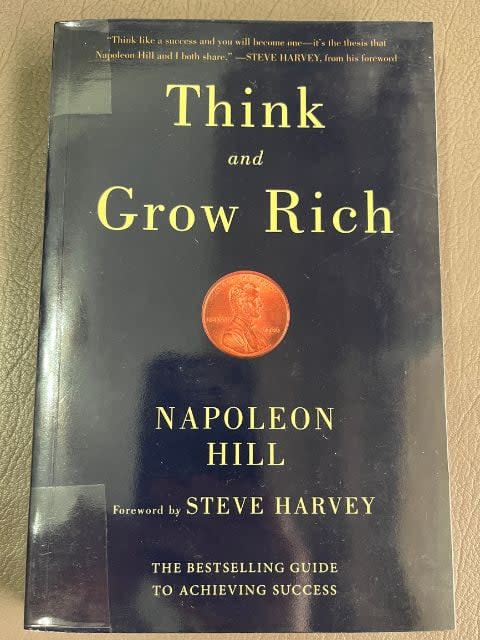

I’ve already read 32 books this year (not bad, right?). Most of the books I read are self-help, psychology, personal development, business and personal finance and investments, spirituality, startups, and productivity books. Nonfiction tickles my mind, and I rarely read fiction. The last time I read one was two years ago.

Today, I’m sharing my top 5 picks for levelling up your finances and mastering money rather than being enslaved by it. I vetted these myself and read all of them last year, so you’re in for a treat.

Book | Purpose | Recommended For | Why I love it |

Explores the psychological factors that influence financial decisions and behaviour | Anyone interested in understanding their relationship with money and making better financial choices | Easy to read and filled with stories that give me “Aha” moments | |

Provides a framework for building good habits and breaking bad ones through small, incremental changes | Anyone looking to make positive lifestyle changes and develop productive habits | I love how the author writes and explains concepts. He breaks them down and provides personal anecdotes, scientific/psychological explanations. | |

Outlines principles and strategies for achieving success and accumulating wealth | Entrepreneurs, business owners, anyone seeking motivation and a mindset for success | There’s always something to learn about the stories of successful people. They inspire me to be better and reach for the stars. | |

Promotes financial literacy, investing in assets, and developing an entrepreneurial mindset | Those seeking financial independence, especially younger readers starting their wealth-building journey | This book challenges my existing beliefs and knowledge about investments and money matters. The author uses storytelling to explain his thoughts and choices in life. | |

Teaches value investing principles and strategies for long-term, risk-averse investing | Investors of all levels, especially those interested in a conservative, fundamentals-based approach | This book gives me the basic tenets of investments and provides examples and stories to explain concepts. |

1. The Psychology of Money by Morgan Housel

The Psychology of Money unpacks 19 stories that unravel how we view wealth, greed, and happiness. Morgan Housel goes beyond numbers to show how our minds shape our financial choices. It’s a must-read for understanding the human side of money.

Money isn’t a math problem to solve; it’s a psychological one. This book discusses psychological biases, emotional factors, and irrational behaviours that often derail even the smartest investors and savers.

My takeaway from this book—if you can master your emotions and thoughts, you will change the way you save, spend, and invest.

What’s unique about this book?

The Psychology of Money is light on jargon and math. Instead, the author uses an engaging narrative style with real-world stories to illustrate profound truths about wealth. Housel’s counterintuitive insights challenge conventional wisdom and open your minds to a new perspective on money and make a better sense of it.

I love how it was written because it’s easy to read and conversational—as if you’re just talking to Morgan himself.

My favourite quote:

“The ability to do what you want, when you want, with who you want, for as long as you want is priceless. It is the highest dividend money pays.”

Overall rating: ★ ★ ★ ★ ★

Reading difficulty (1 easy to 5 difficult): ★ ☆ ☆ ☆ ☆

Writing style: ★ ★ ★ ★ ☆

Practical impact: ★ ★ ★ ★ ★

2. Atomic Habits by James Clear

Atomic Habits isn’t technically a personal finance book, but it outlines a proven system to build good habits and break bad ones. The core idea is that small, incremental habit changes compound into remarkable results over time—this is the meaning of “atomic habits.”

Instead of focusing on lofty goals, the book teaches you to focus on improving your habits and systems by following four laws:

Make it obvious

Make it attractive

Make it easy

Make it satisfying

By applying these laws to your desired habits, you can make meaningful behaviour changes in a manageable way.

This book offers a game plan for embedding habits—whether in personal finance, business, or studying—by making small, lasting tweaks instead of just counting on willpower. The magic lies in the snowballing impact of steady financial routines.

What’s unique about this book?

While most self-help books focus on setting audacious goals, Atomic Habits flips the script by emphasising small habit changes as the pathway to big life changes. It’s a refreshingly practical and sustainable approach grounded in behavioural science.

I love that the book provides specific tactics for each of the four laws to make habits stick. It’s easy to digest and, I’ve already read this twice. I even sneak in an audio version when I’m free to refresh my memory on some principles.

My favourite quote:

“You do not rise to the level of your goals. You fall to the level of your systems.”

Overall rating: ★ ★ ★ ★ ★

Reading difficulty (1 easy to 5 difficult): ★ ★ ☆ ☆ ☆

Writing style: ★ ★ ★ ★ ☆

Practical impact: ★ ★ ★ ★ ★

3. Think and Grow Rich by Napoleon Hill

Think and Grow Rich is a classic self-help gem by Napoleon Hill from 1937. It condenses insights from 500+ millionaires like Carnegie, Ford, and Edison into 13 principles for achieving personal and financial success.

This book is essential for financial savviness because it zooms in on the psychological and emotional aspects of building wealth. The author’s principles teach you how to harness the power of your thoughts and beliefs to achieve financial success.

One of the things I learned from this book is the importance of having a clear, burning desire, unwavering faith, and persistent effort to achieve my goals.

What’s unique about this book?

What sets Think and Grow Rich apart is its focus on the mental and emotional foundations of success. Unlike many financial guides which concentrate solely on practical advice, Hill’s book zooms into the mindset required to achieve wealth.

What I like about the book is how the timeless principles are derived from real-life success stories, presented in an inspirational and actionable way. If you want to learn how the world’s wealthiest and most influential people have done it, then it’s a must-read.

My favourite quote:

“The starting point of all achievement is desire. Keep this constantly in mind. Weak desire brings weak results, just as a small fire makes a small amount of heat.”

Overall rating: ★ ★ ★ ☆ ☆

Reading difficulty (1 easy to 4 difficult): ★ ★ ★ ★ ☆

Writing style: ★ ★ ☆ ☆ ☆

Practical impact: ★ ★ ★ ★ ☆

4. Rich Dad, Poor Dad by Robert Kiyosaki

Rich Dad Poor Dad contrasts Kiyosaki’s two father figures: his “poor dad” favoured job security and savings, while his “rich dad” pursued wealth through assets and financial know-how.

Kiyosaki says wealthy individuals let money work for them via asset investments. He also emphasises financial literacy, such as being savvy in accounting, investing, taxes, and asset-liability distinctions.

This book emphasises the importance of financial education from an early age—something most people lack. It challenges conventional wisdom about the path to wealth and provides a mindset shift essential for building long-term assets over simply trading time for money.

What’s unique about this book?

This book tells a captivating story, comparing life lessons from Kiyosaki’s two dads. It’s easy to read, breaking down tricky money ideas with clear examples and stories, so everyone can grasp it.

From this book, I learned that assets bring in money, and liabilities take it out. For Kiyosaki, a home you live in is a liability as it drains cash for expenses. In contrast, a rental property that earns income is an asset. This view differs from the standard accounting I was taught back in college, which sees assets as valuable items with future benefits.

But of course, some financial experts disagree on how he unpacks accounting concepts in this book like his tactics in real estate and view on taxes and extreme negative portrayal on being an employee and conventional school system. So, if you’re just starting out in honing in investing and personal finance, take some of his writings with a grain of salt.

Favourite quote:

“In school, we learn that mistakes are bad, and we are punished for making them. Yet, if you look at the way humans are designed to learn, we learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk.”

Overall rating: ★ ★ ★ ☆ ☆

Reading difficulty (1 easy to 4 difficult): ★ ★ ☆ ☆ ☆

Writing style: ★ ★ ☆ ☆ ☆

Practical impact: ★ ★ ★ ☆ ☆

5. The Intelligent Investor by Benjamin Graham

Benjamin Graham’s The Intelligent Investor is a seminal work on value investing, a strategy that focuses on identifying undervalued stocks with strong fundamentals and investing in them with a margin of safety.

The book teaches you to be smart, not impulsive, and think long-term when investing. The author simplifies the market by giving an allegory that personifies it. Picture the stock market as a moody person named “Mr. Market,” and you buy low and sell high with his mood swings.

You also have a choice: to play it safe and keep what you have or work harder for more gains.

What’s unique about this book?

Unlike many investment books that promise quick riches or complex trading strategies, This book offers a timeless and rational approach to investing. Here’s what I’ve learned:

Importance of investor psychology and emotional discipline

Clear distinction between investing and speculating

Practical strategies for defensive and enterprising investors

Enduring principles that have withstood market cycles and trends and thinking long-term gains

My favourite quote:

“Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal.”

Overall rating: ★ ★ ★★ ☆

Reading difficulty (1 easy to 5 difficult): ★ ★ ★ ★ ☆

Writing style: ★ ★ ☆ ☆ ☆

Practical impact: ★ ★ ★ ☆ ☆

Final thoughts

There you have it: these five books will transform your mindset about money and help you build wealth and stay wealthy.

More than anything else, when it comes to our money problems and challenges, I learned that earning more doesn’t solve those problems.

What will help us get out of, let’s say, cycles of bad debt, poor money management, irresponsible credit card use, and mindless shopping is understanding the psychological factors that make us take those actions.

Everything begins with the mindset and habits that, if we intentionally make that small change each day, like 1% better, the compounding effects are tremendous. Personally, crushing my reading goals this year is the best thing I’ve ever achieved, and it’s just half of the year. I know there’s more to improve and learn, but I’m always heading on to the next opportunity to grow.

As you read these books, they will also empower you to rethink how you view and handle money and improve your relationship with it.

Have you read one of these? Drop what you learned in the comments below.

Share these with friends who need to read these books.

The post Top 5 Books to Read if You Want to Build Wealth and Stay Wealthy (With Insights and Quotes) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Top 5 Books to Read if You Want to Build Wealth and Stay Wealthy (With Insights and Quotes) appeared first on MoneySmart Blog.

Original article: Top 5 Books to Read if You Want to Build Wealth and Stay Wealthy (With Insights and Quotes).

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance