Top 3 UK Stocks Estimated To Be Undervalued In July 2024

Amidst the backdrop of heightened volatility and upcoming elections, the United Kingdom's financial markets, particularly the FTSE 100, are displaying cautious movements. In such a climate, identifying stocks that appear undervalued could present opportunities for investors seeking potential in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £26.15 | £48.93 | 46.6% |

LSL Property Services (LSE:LSL) | £3.27 | £6.47 | 49.4% |

WPP (LSE:WPP) | £7.192 | £13.93 | 48.4% |

BATM Advanced Communications (LSE:BVC) | £0.1655 | £0.33 | 49.6% |

Mercia Asset Management (AIM:MERC) | £0.31 | £0.58 | 46.8% |

Ricardo (LSE:RCDO) | £4.86 | £9.50 | 48.9% |

Entain (LSE:ENT) | £6.296 | £12.24 | 48.6% |

Accsys Technologies (AIM:AXS) | £0.544 | £1.05 | 48.3% |

Tortilla Mexican Grill (AIM:MEX) | £0.59 | £1.11 | 47% |

Auction Technology Group (LSE:ATG) | £4.765 | £8.98 | 46.9% |

We're going to check out a few of the best picks from our screener tool

Keywords Studios

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market capitalization of approximately £1.85 billion.

Operations: The company generates revenue through three primary segments: Create (€336.07 million), Engage (€164.89 million), and Globalize (€279.49 million).

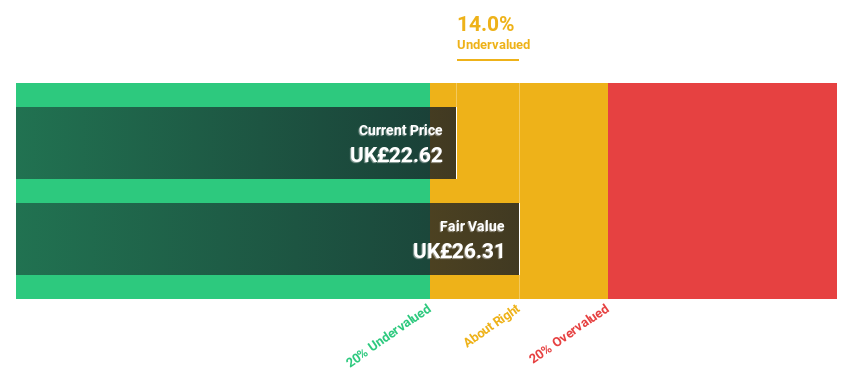

Estimated Discount To Fair Value: 16.9%

Keywords Studios, currently trading at £23.08, is perceived as undervalued against a fair value of £27.79 based on discounted cash flow analysis. Despite a recent net profit margin decline to 2.6% from last year's 6.9%, the company's revenue growth outlook remains robust at 9.6% annually, outpacing the UK market forecast of 3.5%. Earnings are expected to surge by approximately 31.62% per year over the next three years, indicating potential for significant value appreciation despite current share price volatility and recent one-off financial impacts.

Moonpig Group

Overview: Moonpig Group PLC operates an online platform for greeting cards and gifts, primarily serving the Netherlands and the United Kingdom, with a market capitalization of approximately £640.51 million.

Operations: The company's revenue is generated through three main segments: Greetz contributing £51.24 million, Moonpig at £241.33 million, and Experiences bringing in £48.58 million.

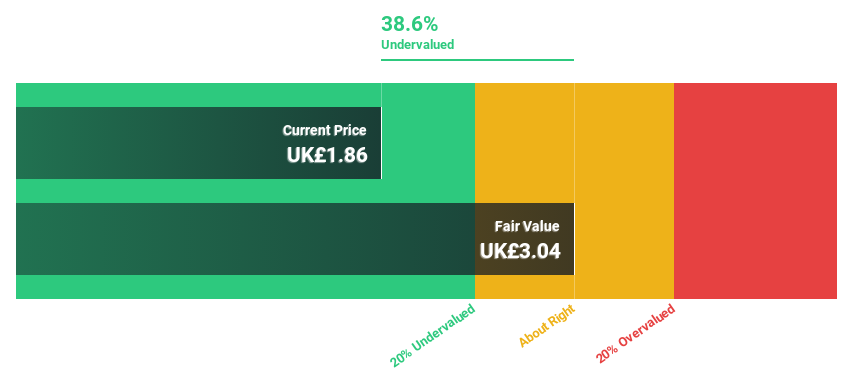

Estimated Discount To Fair Value: 38.6%

Moonpig Group PLC, priced at £1.86, is significantly undervalued with a fair value estimate of £3.04, reflecting a 38.6% discount based on cash flow analysis. The company's revenue and earnings are expected to grow at 7.5% and 20% per year respectively, outperforming the UK market projections of 3.5% and 12.6%. Despite high debt levels and share price volatility, Moonpig's strong operating cash generation supports strategic M&A activities while maintaining potential for shareholder returns.

Sage Group

Overview: Sage Group plc, a technology solutions provider for small and medium businesses across the U.S., the U.K., France, and globally, has a market capitalization of approximately £10.72 billion.

Operations: Sage Group's revenue is primarily generated from Europe (£0.60 billion), North America (£1.01 billion), and the United Kingdom & Ireland (£0.49 billion).

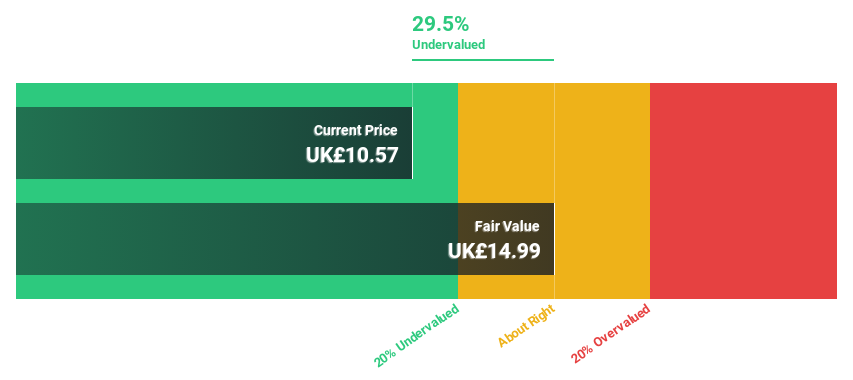

Estimated Discount To Fair Value: 32.1%

Sage Group, valued at £10.74, trades 32.1% below its estimated fair value of £15.81, highlighting its undervaluation based on cash flows. Despite high debt levels, Sage's earnings are projected to grow by 14.3% annually, outpacing the UK market's expectation of 12.6%. Recent product enhancements in Sage Estimating and Intacct aim to boost operational efficiency and financial insight, further supporting the company’s growth trajectory amidst competitive market conditions.

Turning Ideas Into Actions

Click this link to deep-dive into the 59 companies within our Undervalued UK Stocks Based On Cash Flows screener.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:KWS LSE:MOON and LSE:SGE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance