Top 3 ASX Stocks Estimated To Be Trading Below Intrinsic Value In July 2024

Amidst a fluctuating Australian market, influenced by the Reserve Bank of Australia's contemplation of interest rate hikes, investors are keenly observing opportunities where value might be hidden. In such a climate, identifying stocks trading below their intrinsic value could provide prudent investment avenues.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

Name | Current Price | Fair Value (Est) | Discount (Est) |

GTN (ASX:GTN) | A$0.445 | A$0.85 | 47.4% |

Ansell (ASX:ANN) | A$25.96 | A$49.22 | 47.3% |

MaxiPARTS (ASX:MXI) | A$2.05 | A$3.95 | 48.1% |

ReadyTech Holdings (ASX:RDY) | A$3.20 | A$6.25 | 48.8% |

Regal Partners (ASX:RPL) | A$3.19 | A$6.17 | 48.3% |

Strike Energy (ASX:STX) | A$0.23 | A$0.44 | 48% |

IPH (ASX:IPH) | A$6.25 | A$12.01 | 48% |

Core Lithium (ASX:CXO) | A$0.086 | A$0.17 | 49% |

Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

SiteMinder (ASX:SDR) | A$5.10 | A$10.01 | 49.1% |

Let's dive into some prime choices out of from the screener

Life360

Overview: Life360, Inc. is a technology company that provides a platform for locating people, pets, and things across multiple regions including North America, Europe, the Middle East, Africa, and internationally, with a market capitalization of approximately A$3.47 billion.

Operations: The company generates its revenue primarily through its software and programming segment, which amounted to $314.60 million.

Estimated Discount To Fair Value: 38.5%

Life360, currently trading at A$15.68, is considered highly undervalued based on cash flows with a fair value estimated at A$25.51. The company is expected to become profitable within the next three years, supported by an anticipated revenue growth of 15.3% annually—outpacing the Australian market forecast of 5.3%. However, its Return on Equity is projected to be low at 14.4% in three years, and recent activities include significant insider selling and shareholder dilution through a follow-on equity offering of A$155.25 million.

Ansell

Overview: Ansell Limited is a global company that designs, develops, and manufactures protection solutions across various regions including the Asia Pacific, Europe, the Middle East, Africa, Latin America, and North America with a market capitalization of A$3.76 billion.

Operations: The company generates revenue primarily through two segments: Healthcare, which brings in $837.70 million, and Industrial (Including Specialty Markets), contributing $767 million.

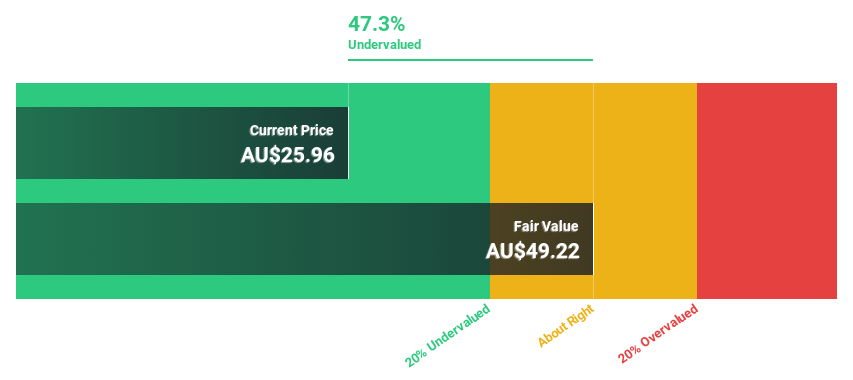

Estimated Discount To Fair Value: 47.3%

Ansell, priced at A$25.96, is significantly undervalued with a fair value of A$49.22, suggesting a potential upside. Its earnings are expected to surge by 23.06% annually over the next three years, outperforming the Australian market's 13%. However, recent shareholder dilution and large one-off items have impacted its financial results. Additionally, Ansell has been active in capital markets with follow-on equity offerings totaling A$475 million and acquiring assets from Kimberly-Clark's Personal Protective Equipment business.

Regis Healthcare

Overview: Regis Healthcare Limited operates in Australia, providing residential aged care services with a market capitalization of approximately A$1.30 billion.

Operations: The company generates its revenue primarily from residential aged care services, totaling approximately A$882.29 million.

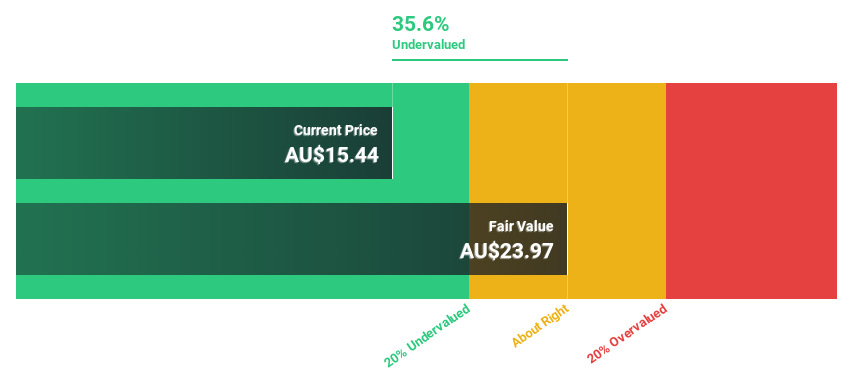

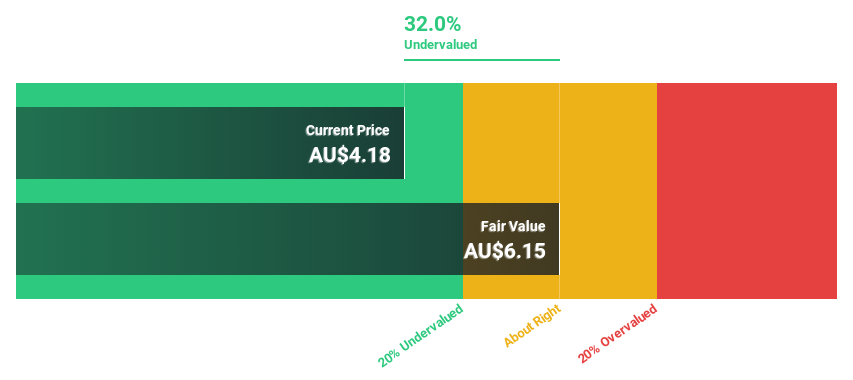

Estimated Discount To Fair Value: 35.7%

Regis Healthcare, currently priced at A$4.31, trades well below the estimated fair value of A$6.70, indicating significant undervaluation based on cash flows. Analysts predict a robust turnaround with an expected profitability within three years and a very high forecasted return on equity of 184%. Despite these positives, there has been notable insider selling in the past quarter, and revenue growth projections are modest at 9.1% annually compared to faster market averages.

Taking Advantage

Click here to access our complete index of 49 Undervalued ASX Stocks Based On Cash Flows.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:360 ASX:ANN and ASX:REG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance