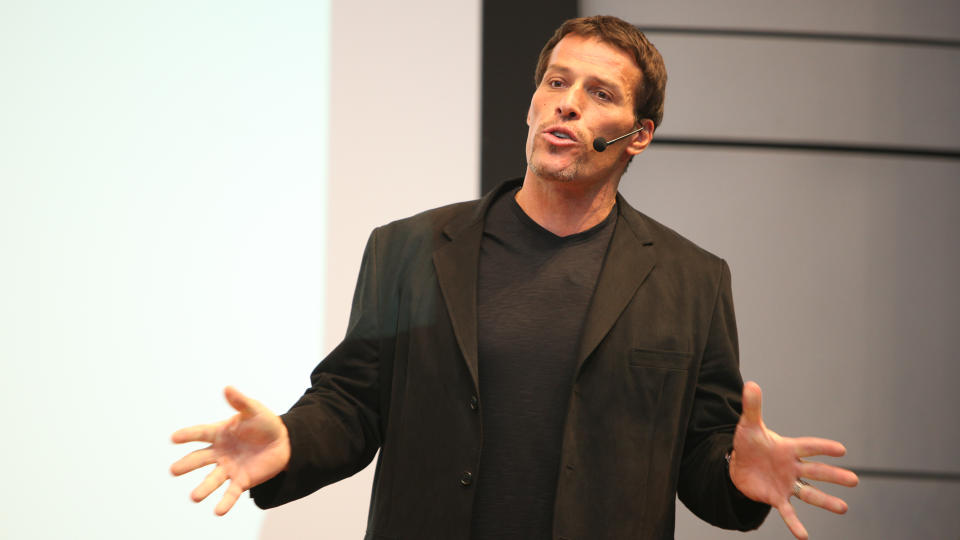

Tony Robbins: Here’s Where the Top Wealth Managers Are Putting Their Money

Tony Robbins, an American coach, speaker and author, is enjoying the recent success of his newest book, “The Holy Grail of Investing.” This recent addition to Robbins’s collection is a New York Times Bestseller and explains how a handful of most intelligent investors used private equity to reel in billions of dollars. It contains some spectacular advice for anyone trying to learn how the ultra-wealthy invest their money.

On an episode of the Candy Valentino show that aired earlier this year, Robbins revealed why he decided to write his newest book and what financial advice he offers the average investor in his book.

Check Out: I’m a Self-Made Millionaire: Here’s What My Salary Looked Like Over the Years

Learn More: 4 Genius Things All Wealthy People Do With Their Money

Wealthy people know the best money secrets. Learn how to copy them.

What the Top Investors Are Doing

Robbins says success leaves clues. This led him to study how the most successful investors allocate their assets to give him an idea of where his own money should go. A common misconception about the ultra-wealthy is that they took some giant risks to get where they are. Robbins points out that those who make billions by taking extreme risks usually don’t stay billionaires by taking more risks.

No matter how much you have to invest, Robbins says every investor is going to make the wrong choice sometime. What protects investors in the long term is their investing philosophy.

Before investing in anything, you need to determine what percentage of your money will go into something low-risk that will slowly grow over time. Likewise, you need to decide how much of your portfolio you will put toward a risky investment that could result in fast gains or losses.

Understanding where the best investors are putting their money and how they identify the most valuable investments is vital for success. While researching and interviewing the top wealth managers, Robbins uncovered some common threads.

Read Next: I Earn Over $30K a Week in Semi-Passive Income on Amazon – Here’s How

Asymmetrical Risk Reward

Asymmetrical risk reward is when an investment has a disparity between the risk and reward and the most successful investors swear by it.

What this concept breaks down to is taking the smallest amount of risk with the most amount of upside. Robbin’s friend Kyle Bass used asymmetrical risk reward to turn $20 million into $2 billion in 2008, the worst market in the past 80 years. Robbins explained that because of the asymmetrical risk reward, Bass could’ve been wrong 13 times and still made money.

Robbins breaks down a formula from his client, Paul Tudor Jones, to better explain the concept. When Jones invests, his ideal asymmetrical ratio is five to one. That means Jones risks one dollar that he believes can turn into five dollars over time. If he’s wrong, he can risk a second dollar to make four dollars. If he’s wrong four times out of five, he would still make money.

One out-of-the-box example of asymmetrical risk reward comes from Bass. Bass found that investing in nickels would allow him to forego ever losing money and still have the potential to gain profits. Robins said that every nickel is worth five cents and they will never lose value. However, each nickel costs eleven cents to make. So, there is a good possibility that, like pennies, the government will change the makeup of a nickel in the future to balance the value and cost of production.

This gives Bass an upside that nickels bought today could rise significantly in value in the future, but they will always retain the value of his initial investment.

Reducing Risk

Another way smart investors reduce their risk is diversification. Putting all of your money into one stock or asset opens you up to a great deal of risk if it drops in value.

While this might not be a groundbreaking realization to many, Robbins found a diversification formula that significantly reduces risk and maintains a potential to make a lot in profits. Robbins spoke with Ray Dalio, a veteran investor who manages $195 billion, who explained the diversification formula.

Dalio discovered a way to get the highest returns with the least amount of risk. To do this, you need to find and put your money into eight to 12 uncorrelated investments. By doing this, you’ll reduce your risk by 80% and maintain the same upside or greater. The most important thing to remember is that these assets have to remain uncorrelated, meaning one asset’s rise and fall in the markets doesn’t affect another’s position.

Investing in Private Equity

Finding uncorrelated assets is a challenge, as most things are interrelated. After some investigation and thought, Robbins came to a realization. He says 98% of companies are private and for 35 years in a row, private equity has produced greater returns than every stock market in the world.

The 13 investors that Robbins interviewed for his book have averaged 20% or more over the past few decades. On average, they’ve put 46% of their investments into private equity.

For example, the S&P500, an index of the top 500 companies in the stock market, has averaged 9.2% of compounded returns over the past 35 years. In contrast, the compound returns of private equity have averaged 14.2% over that same period. This means if you invest in private equity over the S&P500, you’re making 50% more money every year compounded.

The Best Way To Invest

There are multiple things Robbins would do if he had to start over with nothing but his wealth of knowledge. He said any diverse investments into the public stock will produce returns over the long term. While this is great, he pointed to private equity as an asset with very little volatility over the past 35 years.

In the past, private equity investments were only for accredited investors. Accredited investors used to mean individuals with at least a million dollars of net worth or an income of at least $200,000 a year. However, Robbins explains that things have changed. Congress is in the process of passing a law that allows you to become an accredited investor without a million dollars. To do so, you’ll need to pass a test, and afterward you can invest in private equity in small increments.

Think Like an Expert

To get the most out of your money, you’ll want to start investing like the experts do. Seek investments with asymmetrical risk reward and always minimize risk when you can. If you’re able to meet the qualifications for private equity investment, that can be a great way to maximize your returns.

Once you’re well versed in strategies like these, your investment portfolio will be poised to reach new heights.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Tony Robbins: Here’s Where the Top Wealth Managers Are Putting Their Money

Yahoo Finance

Yahoo Finance