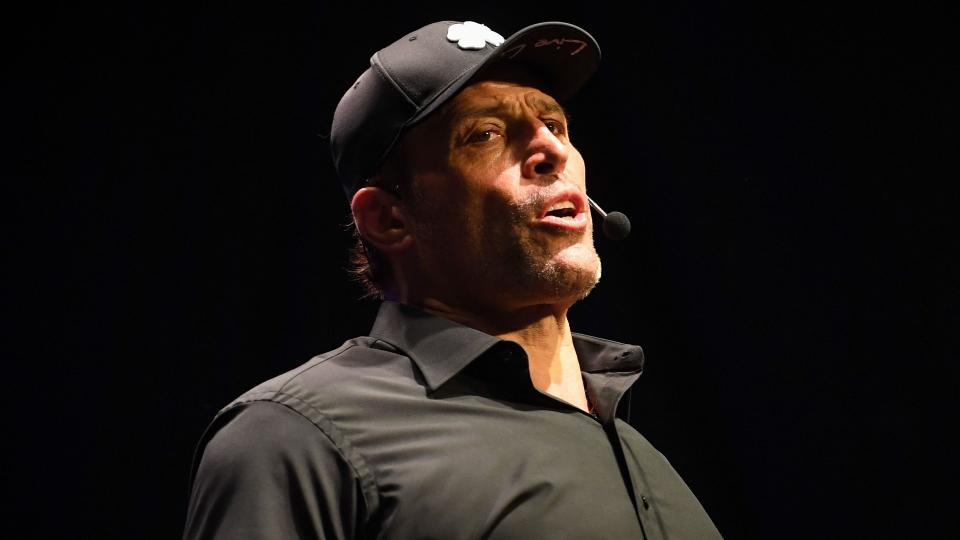

Tony Robbins: Rich People Have These 6 Things in Common

Being wealthy can take on a lot of meanings depending on who you ask. But considering high inflation and rising costs, the amount of money you need to be considered wealthy is up. USA Today reported that $2.2 million is the net worth that an American needs to be considered wealthy in 2023.

See: 65 Splurges of the Filthy Rich

Find: 3 Things You Must Do When Your Savings Reach $50,000

Tony Robbins, a famous American author, coach, and speaker, has interviewed some remarkable individuals — some of whom are also some of the wealthiest. These include people like Charles Schwab, the founder of Charles Schwab Corporation, John Bogle, the Founder of Vanguard and the “father of the index fund,” and Mary Callahan Erdoes, who is considered by many as one of the most powerful women in finance.

Through these conversations, he discovered the principles that guide the decision-making and, ultimately, the success of the ultra-wealthy.

Grant Cardone: Passive Income Is the Key To Building Wealth — Here’s My No. 1 Tip

Six Habits of Wealthy People

Tony Robbins breaks down the six things that all successful wealthy people do:

They all give back: It turns out that giving back is one common behavior of wealthy people. Truly wealthy people understand that being wealthy is about more than just the money in your bank account. After you achieve your financial goals and decide that you’ve “made it,” you may be left pondering what else there is to life. Giving back, whatever that means to you, is a way to feel more fulfilled.

They are focused on not losing money: One thing that all ultra-wealthy people seem to have in common? They are not afraid of failing. But, they hate losing. Overall, there’s a focus and a common desire to not lose. That desire also translates into not wanting to lose money.

“Virtually everybody that I interviewed, they all are completely obsessed with not losing. Not losing to them is as important as winning,” said Robbins.

Robbins referenced one of Warren Buffet’s most famous quotes: “Rule No 1: Don’t lose money. Rule No. 2: Never forget rule No. 1.” The ultra-wealthy live by this virtue and they also understand the true cost of losing. The reality is that If you lose 50% of your money, it takes 100% more to get it back. Why? It’s because now, you have less money to invest. For the wealthy, losing money is not an option if they want to stay wealthy.

They know they’ll be wrong at some point: While rich people don’t like to be wrong, they also understand that they will be wrong at some point. Sometimes, poor decisions will cause them to lose money. But, there’s a difference between losing and failing. A small loss may not have a major impact in the long term, but it’s different than making a wrong decision that destroys their entire financial future. The wisest wealthy people protect their assets by structuring their portfolios in such a way that they will make money elsewhere, even when they’re wrong.

They are all hungry for knowledge: Another trait that all wealthy people have in common? They have a strong desire to learn — and their thirst for both knowledge and growth is never quenched. Similarly to athletes who always want to improve their physical performance, wealthy people aim for constant self-improvement, which includes how to earn and keep money.

“They’re all learning machines. One thing they have in common is none of them will ever settle,” explained Robbins. “They’re always studying, they’re always learning, they’re always growing, and they’re always trying to figure out a new insight or a new strategy to do things better.”

Wealthy people become wealthy by gaining knowledge. For example, they read books and listen to podcasts to learn the ways of the wealthy. By surrounding themselves with greatness, they work towards their greatness and success. Learning more about what rich people have in common allows you to become wealthy yourself.

They understand the value of asymmetrical risk and reward: Often, people think those deemed successful generally have a high-risk tolerance. In reality, this is not the case. One thing that most rich people have in common is that they are risk-averse. At the same time, they always think big. Becoming wealthy means taking as little risk as possible to achieve as great a reward as possible.

Per Robbins, Paul Tudor Jones, one of the top 10 financial traders in history, will only risk a 1:5 ratio. In other words, Jones will only risk one dollar to make five, which means a 500% return. On the contrary, most investors go ahead and risk everything in hopes of getting an 8-10% return, or perhaps even less. When you leverage asymmetrical risk and reward in this way, you can be wrong 10 or 15 times and only be right once, and you will still make money.

They understand the importance of tax strategy: David Swensen, the man who grew Yale’s endowment fund from $1 billion to $31.2 billion in just over 35 years, explained to Robbins that there are only a few things that grow wealth: diversifying assets, tax efficiency, and equities.

“You have to have tax efficiency because you don’t get the dollars you earn, you get the dollars you keep,” explained Robbins.

To add, the one thing that all rich people have in common when it comes to taxes is that they all invest in a way that allows them to legally keep as much of their money as possible. IRS rules dictate some very specific ways you can legally keep more of your money, then invest it — and then compound it. Not everyone takes advantage of these rules. But by leveraging these rules, wealthy people are making money out of money. There are ways to defer money or make money tax-free — and it’s all legal. Overall, when you keep more money, you reach your financial goals faster.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Tony Robbins: Rich People Have These 6 Things in Common

Yahoo Finance

Yahoo Finance