Time to Buy Lululemon's (LULU) Stock After Beating Q1 Earnings Expectations?

Apparel giants like Lululemon LULU and Nike NKE are not immune to concerns about a slowdown in consumer spending with both stocks down roughly -8% over the last year. However, Lululemon continued to reaffirm its attractive growth prospects are still intact after beating Q1 top and bottom-line expectations on Wednesday with Nike set to report its quarterly results later in the month.

Seeing that LULU has dropped -37% year to date, investors may be wondering if it’s time to buy stock in the popular yoga-themed athletic apparel company for a rebound considering its blazing historical performance.

Image Source: Zacks Investment Research

Q1 Review & Revenue Guidance

Illustrating that its brand loyalty remains strong, Lululemon's Q1 sales of $2.2 billion rose 10% from the comparative quarter and slightly edged estimates of $2.19 billion. Furthermore, Q1 EPS of $2.54 came in 7% better than expected and spiked 11% from a year ago. It’s also noteworthy that Lululemon has now surpassed earnings expectations for 16 consecutive quarters dating back to September of 2020.

Image Source: Zacks Investment Research

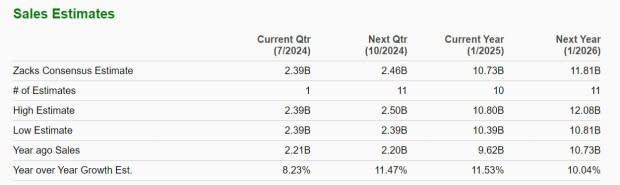

For the second quarter, Lululemon expects 9%-10% revenue growth which came in slightly above the current Zacks Consensus of 8.23% growth or sales of $2.39 billion (Current Qtr below). The company still expects full-year revenue growth in the range of 10%-11% with expectations calling for 11.53% growth (Current Year).

Image Source: Zacks Investment Research

EPS Outlook

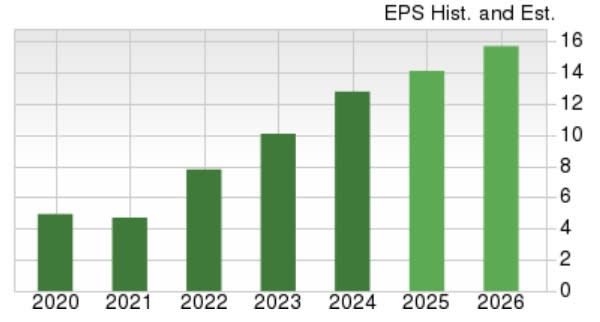

Based on Zacks estimates, Lululemon’s annual earnings are expected to rise 11% in its current fiscal 2025 to $14.14 per share versus EPS of $12.77 in FY24. Better still, FY26 EPS is forecasted to jump another 11% to $15.68.

Image Source: Zacks Investment Research

Takeaway

Despite linguring concerns of slower consumer spending, especially among premium apparel items, Lululemon’s stock lands a Zacks Rank #3 (Hold). To that point, Lululemon’s Q1 results helped reconfirm what is still an attractive earnings outlook.

Plus, LULU trades near its cheapest P/E valuation since going public at 22.9X and longer-term investors could be rewarded from current levels although there may still be better buying opportunities ahead.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance