Tidewater: Capitalizing on Booming Oil Rigs and the OSV Market

The market for offshore oil rigs rigs and offshore supply vessels has experienced a significant increase over the past three years, mainly driven by higher oil prices. The favorable market conditions have led to a higher demand for OSVs, leading to increased usage rates as well as daily rates across the industry. Consequently, the share price of Tidewater Inc. (NYSE:TDW), the worldwide leader of OSV operations, has surged 665% in just three years.

Even though Tidewater's stock has recently experienced a significant increase, I still consider it to be an attractive option for investors.

Large global player in the current fast-growing demand

The market for OSVs is currently driven by several key factors, with the main drivers being deepwater exploration capital expenditure and the utilization rates of oil rigs. High oil prices recently have made it financially feasible to explore as well as produce oil and gas offshore, resulting in an increase in significant investment in deep-water projects. Rystad Energy predicts investments in offshore oil and gas exploration as well as production will amount to $228 billion by 2026. It is also roughly estimated that the offshore final investment decision is going to reach a total of $103 billion between April and December 2024. OSVs continue to be in high demand as large oil companies allocate significant resources to explore deep-water areas, relying on support services provided by these vessels.

Oil rig demand and utilization rates are crucial indicators of the OSV market's health. With the high utilization rate and day rates, the need for OSVs to support these rigs remains robust. This high demand is driven by increased drilling activities and the need for towing mobile offshore drilling units, handling rig anchors and providing logistical support for offshore exploration and production activity. The strong utilization rates not only reflect the high demand for oil rigs, but also highlight the critical role OSVs play in ensuring the efficiency and effectiveness of offshore operations. In 2023, Tidewater's utilization rate hovered around 81.20% while the average vessel day rates surpassed $16,800.

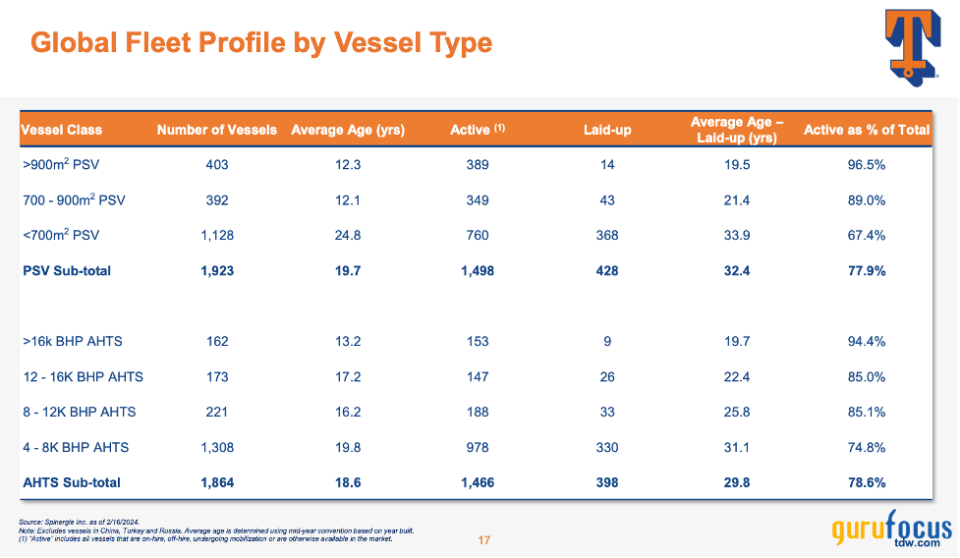

On the supply side, the OSV market faces significant constraints due to a record-low newbuilding order book and an aging fleet. The age of many vessels approaches or exceeds 25 years - meaning the maintenance costs are higher and the supply of new vessels is limited. The fleet of Tidewater is relatively young. The average age is 11.80 years, much younger than the market median for platform supply vessels of almost 20 years and for anchor handling tug supply vessels of 18.60 years. It is projected that by 2035, there will be approximately 1,260 OSVs, making up 41 % of the total global fleet, over 25 years old. Supply constraints tend to be also exacerbated by a lack of competent personnel, which makes experienced operators such as Tidewater even more valuable.

Source: Tidewater's presentation

Exceptional first-quarter operating performance

In 2024, Tidewater enjoyed a remarkable first-quarter performance with revenue up 6.10% to $321.20 million compared to $302.70 million in the prior quarter. Net income was $47 million, equivalent to 89 cents per share. Higher average day rates resulted in a gradual improvement in the gross margin to 47.5% from 47.2% in the fourth quarter as average day rates rose by 8.30% to $19,563 from $18,066. The company's adjusted Ebitda increased to $139 million from $131.3 million during the same quarter last year.

Looking ahead, Tidewater is optimistic about the offshore market's prospects, driven by constructive leading indicators and persistent tightness in vessel supply. CEO Quintin Kneen expressed this optimism, stating:

"We are very pleased with the performance of the business during the first quarter, and we remain optimistic on the continued pace of offshore activity acceleration as a result of the constructive leading indicators we observed during the first quarter, coupled with the persistent tightness in vessel supply and lack of new build activity."

Strong capital structure

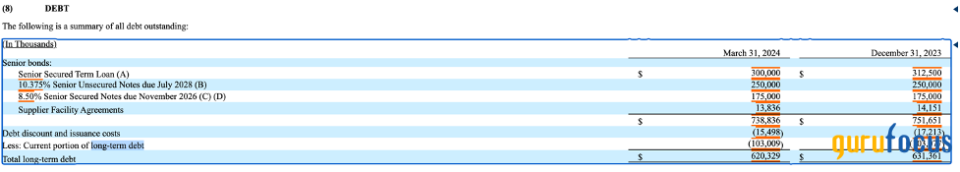

In the first quarter, the company's shareholder equity exceeded $1 billion, with $280.8 million in cash as well as cash equivalents. The overall debt reached a total of $443 million. With a debt-to-equity ratio of just 0.44, this was a very reasonable level. Only $100 million needed to be paid within this year, with the remaining balance due in 2026 and 2028. In 2023, the company has produced over $300 million in Ebitda and currently has $280 million in cash, so I believe the debt obligation is not a significant concern.

Huge potential upside

Tidewater continues to be positive about its financial prospects in 2024 and expects to generate $1.42 billion in revenue for the entire year, a 40% increase from 2023. The company anticipates a significant increase in revenue as well as profit margins in the last two quarters, with projected gross and Ebitda margins of 52% and 45%. Day rates are projected to increase by around $4,000 per day compared to the previous year as a result of a limited supply of vessels and a rise in offshore operations. Tidewater currently has a huge backlog of $1.10 billion and is contemplating contracting up to 75% of available vessel days for 2024. This move could contribute to the company's financial stability and set the scene for potential growth in 2025.

The company's Ebitda multiples have fluctuated significantly over the last year, ranging from 13.70 to 24. On average, its Ebitda multiple settled at 19. At the time of writing, the market currently values Tidewater at 16.20 times EBITDA. It is estimated that Tidewater will reach a 45% Ebitda margin by 2024, equivalent to $635 million. If we use an average Ebitda multiple of 19, Tidewater should have an enterprise value of around $12 billion. With a net debt-to-Ebitda ratio of approximately 0.75, the net debt is projected to be $444.50 million. After taking into account total debt, the equity worth of Tidewater is estimated to be $11.56 billion, which is 110% higher than the current trading price.

The bottom line

With the increasing demand for offshore oil rigs and OSVs due to consistently high oil prices, Tidewater is on the verge of a unique and significant opportunity. Due to strong financial results in the last two years along with a solid capital foundation, Tidewater is in a prime position to take advantage of the increasing need for OSVs. This demand is being fueled by substantial investments in deep-water exploration and consistently high utilization rates.

The company's strong competitive position in a challenging supply market is bolstered by its young fleet, seasoned operations and a robust backlog. Tidewater's promising Ebitda growth outlook along with strategic market position allow it to be an attractive investment option with a potential 110% upside, assuming existing market conditions as well as high oil prices persist.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance