Tian An China Investments And Two More Hong Kong Dividend Stocks To Consider

Amid a backdrop of global economic uncertainties and fluctuating markets, Hong Kong's Hang Seng Index recently reflected a downturn, shedding 2.84% as noted in recent data. In such times, dividend stocks like Tian An China Investments can offer investors potential stability and regular income streams, making them worthy of consideration for those looking to mitigate risk while maintaining exposure to market opportunities.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.68% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.72% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.81% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.96% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.02% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.57% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.84% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.30% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.18% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.62% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Tian An China Investments

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited operates as an investment holding company, focusing on property investment, development, and management in the People's Republic of China, Hong Kong, the United Kingdom, and Australia, with a market cap of approximately HK$5.78 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily through property development at HK$1.53 billion, followed by property investment at HK$591.38 million, and healthcare services contributing HK$394.15 million.

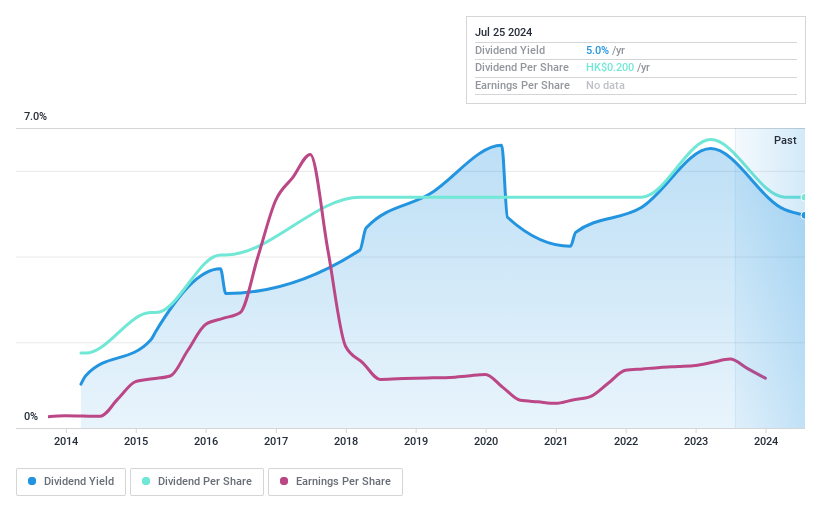

Dividend Yield: 5.1%

Tian An China Investments has maintained a stable dividend over the past decade, with recent increases reflecting a commitment to shareholder returns. Despite a lower yield of 5.08% compared to Hong Kong's top dividend payers, its dividends are well-supported by both earnings and cash flows, with payout ratios of 24.1% and 16.9%, respectively. The company's P/E ratio stands at an attractive 4.7x, below the market average of 9.7x, indicating potential undervaluation relative to peers. Recent board changes could signal strategic shifts but aren't directly impacting dividend policies as yet.

China Overseas Grand Oceans Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Overseas Grand Oceans Group Ltd. operates as an investment holding company, focusing on the investment, development, and leasing of real estate properties in the People's Republic of China and Hong Kong, with a market capitalization of approximately HK$7.94 billion.

Operations: China Overseas Grand Oceans Group Ltd. generates revenue primarily through property investment and development, amounting to CN¥56.08 billion, and property leasing, contributing CN¥0.24 billion.

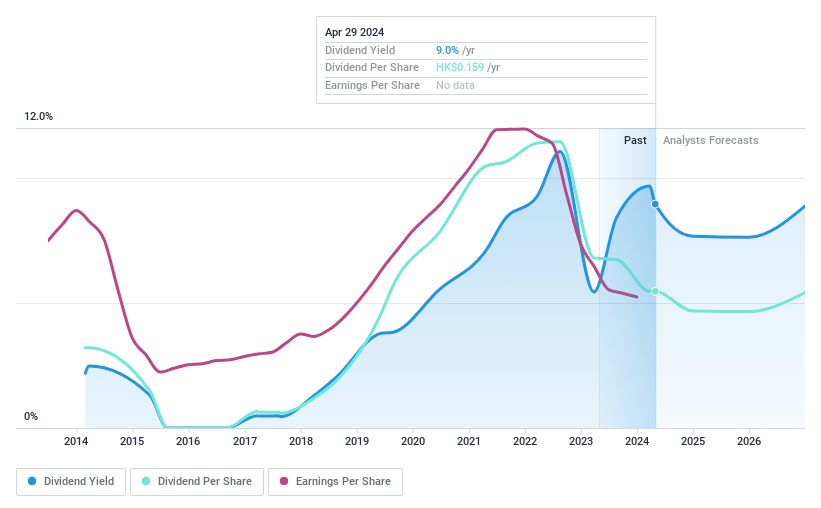

Dividend Yield: 7.1%

China Overseas Grand Oceans Group Limited faces challenges with declining property sales and earnings, as evidenced by a significant drop in contracted sales and GFA year-on-year for early 2024. Despite these pressures, the company maintains a low P/E ratio of 3.2x, suggesting valuation below Hong Kong market norms. Dividend reliability is questionable due to volatility over the past decade and recent cuts; however, dividends are well-covered by earnings with a payout ratio of 22.5% and cash flows (cash payout ratio at 5.8%). Recent executive changes and auditor switch may influence future strategic directions but have yet to impact dividend policies directly.

China Mobile

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Mobile Limited operates as a telecommunications and information services provider in Mainland China and Hong Kong, with a market capitalization of approximately HK$1.66 trillion.

Operations: China Mobile Limited generates approximately CN¥1.02 billion in revenue from its telecommunications and information related businesses.

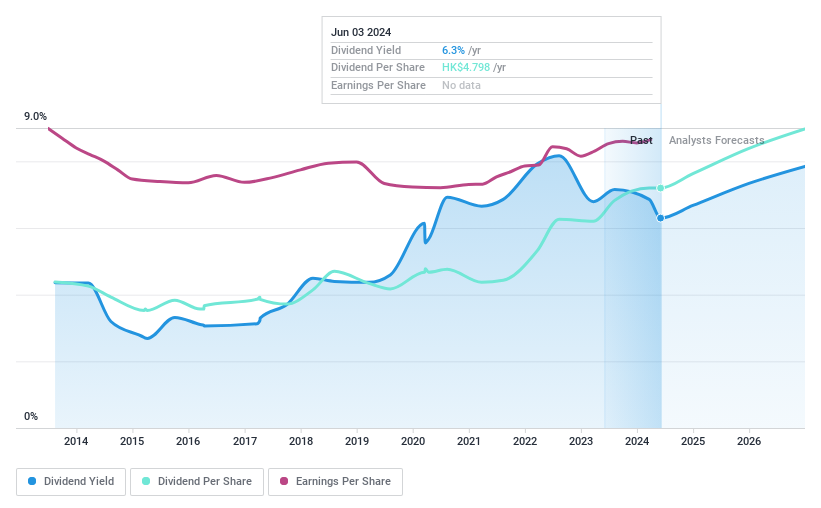

Dividend Yield: 6.3%

China Mobile offers a stable dividend yield of 6.3%, consistently paid over the past decade, with growth in dividend payments during this period. Despite a lower yield compared to the top quartile of Hong Kong dividend stocks at 7.64%, its dividends are well-supported by earnings and cash flows, with payout ratios at 70.3% and 89% respectively. Recent leadership changes with Mr. He Biao's appointment as CEO could signal strategic shifts but have not yet impacted its solid dividend distribution framework, evidenced by recent financial performance showing steady revenue and net income growth in Q1 2024.

Turning Ideas Into Actions

Gain an insight into the universe of 92 Top Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:28SEHK:81SEHK:941 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance