Three Value Stocks With Discounts Ranging From 18.9% To 43.5% Below Intrinsic Estimates

As global markets navigate through a period of mixed performances and economic uncertainties, investors continue to seek opportunities that offer potential value. In such an environment, identifying stocks that are trading below their intrinsic estimates could provide a strategic advantage for those looking to enhance their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sparebanken Vest (OB:SVEG) | NOK131.60 | NOK262.49 | 49.9% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥14.25 | CN¥29.30 | 51.4% |

Calibre Mining (TSX:CXB) | CA$1.81 | CA$3.61 | 49.8% |

Arcadis (ENXTAM:ARCAD) | €59.30 | €118.51 | 50% |

Macromill (TSE:3978) | ¥872.00 | ¥1651.15 | 47.2% |

PSI Software (XTRA:PSAN) | €21.90 | €43.65 | 49.8% |

InPost (ENXTAM:INPST) | €16.36 | €32.60 | 49.8% |

Levima Advanced Materials (SZSE:003022) | CN¥13.73 | CN¥27.48 | 50% |

Lumi Gruppen (OB:LUMI) | NOK12.90 | NOK25.80 | 50% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$247.61 | US$494.74 | 50% |

We're going to check out a few of the best picks from our screener tool

Celsius Holdings

Overview: Celsius Holdings, Inc. is a global company that develops, markets, and distributes functional energy drinks and liquid supplements, with a market capitalization of approximately $13.48 billion.

Operations: The company generates its revenue primarily from the sale of non-alcoholic beverages, totaling $1.41 billion.

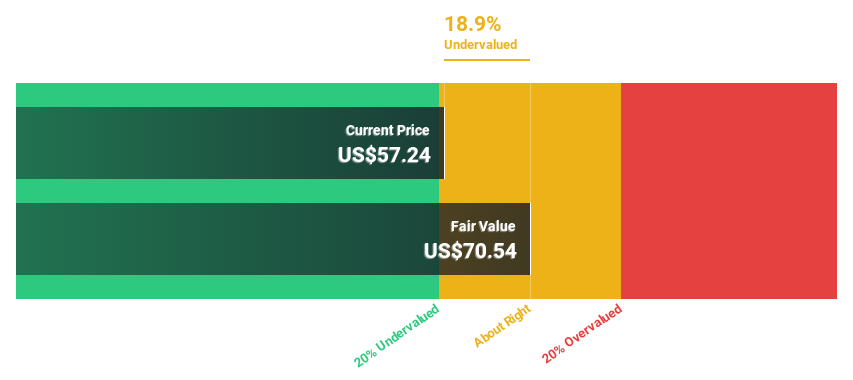

Estimated Discount To Fair Value: 18.9%

Celsius Holdings is trading below its estimated fair value by 18.9%, priced at US$57.24 against a fair value of US$70.54, indicating potential undervaluation based on cash flows. Despite this, the company shows robust growth prospects with earnings and revenue expected to grow at 21.7% and 19.9% per year respectively, outpacing the US market averages significantly. However, there has been significant insider selling in the past quarter which might raise concerns about its future performance stability.

Equifax

Overview: Equifax Inc. is a data, analytics, and technology company with a market capitalization of approximately $29.22 billion.

Operations: The company generates revenue through three primary segments: International at $1.27 billion, Workforce Solutions at $2.32 billion, and U.S. Information Solutions at $1.76 billion.

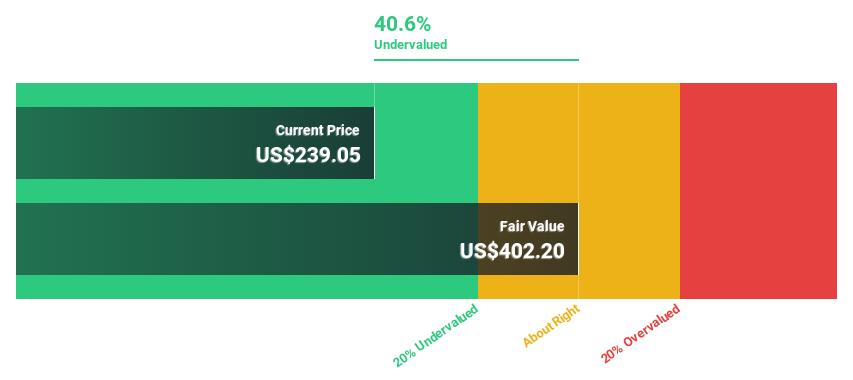

Estimated Discount To Fair Value: 43.5%

Equifax is perceived as undervalued based on discounted cash flow analysis, trading at US$239.96 against a fair value of US$424.69, suggesting more than 20% undervaluation. It's set for robust earnings growth, forecasted at 22.1% annually over the next three years, outstripping the US market prediction of 14.7%. However, despite these strong growth prospects and a high forecasted return on equity (23.4%), Equifax carries a high level of debt which could pose financial risks.

According our earnings growth report, there's an indication that Equifax might be ready to expand.

Delve into the full analysis health report here for a deeper understanding of Equifax.

Zhongji Innolight

Overview: Zhongji Innolight Co., Ltd. specializes in researching, developing, producing, and selling optical communication transceiver modules and optical devices within China, with a market capitalization of approximately CN¥159.90 billion.

Operations: The company generates revenue primarily from the sale of optical communication transceiver modules and optical devices.

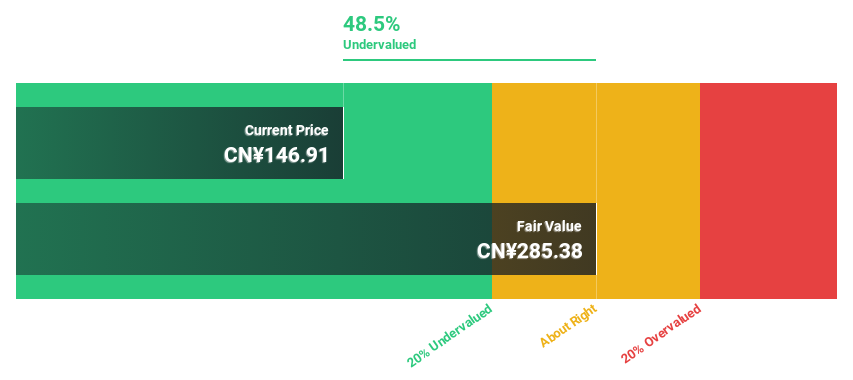

Estimated Discount To Fair Value: 35.8%

Zhongji Innolight appears undervalued based on cash flow metrics, trading at CN¥145.61 versus a fair value estimate of CN¥223.61, indicating a significant undervaluation. The company's earnings have surged by 133.4% over the past year with expectations of continued growth at 30.83% annually over the next three years, outpacing the Chinese market's forecast of 22.2%. Recent dividend increases and a stock split reflect positive financial maneuvers, yet its share price remains highly volatile which may concern some investors.

Seize The Opportunity

Unlock our comprehensive list of 953 Undervalued Stocks Based On Cash Flows by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:CELH NYSE:EFX and SZSE:300308.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance