Three US Stocks Estimated To Be Trading At Discounts Ranging From 26.7% To 40.7%

As the Nasdaq and S&P 500 continue to reach new heights, reflecting a robust appetite for equities among investors, the hunt for value becomes increasingly challenging yet potentially rewarding. In this climate, identifying stocks that are trading below their intrinsic value could offer attractive opportunities for those looking to invest in assets with potential upside.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

SouthState (NYSE:SSB) | $76.02 | $151.58 | 49.8% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.20 | $31.78 | 49% |

Selective Insurance Group (NasdaqGS:SIGI) | $91.81 | $179.33 | 48.8% |

USCB Financial Holdings (NasdaqGM:USCB) | $12.12 | $23.49 | 48.4% |

Hexcel (NYSE:HXL) | $64.74 | $128.96 | 49.8% |

Viant Technology (NasdaqGS:DSP) | $10.345 | $20.09 | 48.5% |

Vasta Platform (NasdaqGS:VSTA) | $3.08 | $6.01 | 48.8% |

HealthEquity (NasdaqGS:HQY) | $83.56 | $165.65 | 49.6% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $248.68 | $495.30 | 49.8% |

Hecla Mining (NYSE:HL) | $5.18 | $10.35 | 50% |

Let's dive into some prime choices out of from the screener

Evercore

Overview: Evercore Inc., along with its subsidiaries, functions as an independent investment banking advisory firm globally, with a market capitalization of approximately $9.30 billion.

Operations: The firm generates revenue primarily through two segments: Investment Management, which brought in $71.76 million, and Investment Banking & Equities, contributing $2.36 billion.

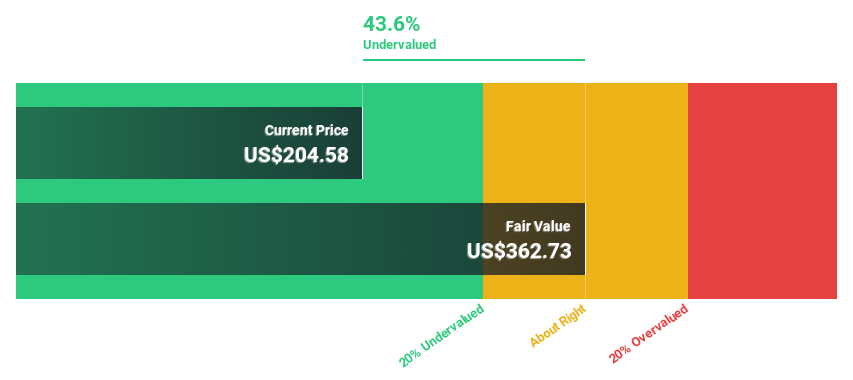

Estimated Discount To Fair Value: 40.7%

Evercore is significantly undervalued based on discounted cash flow analysis, with its current trading price of US$211 well below the estimated fair value of US$355.65. Despite recent drops from several Russell 1000 indices and shareholder dilution over the past year, Evercore's financial outlook remains robust. The company's earnings are expected to grow by 28.9% annually, outpacing the US market forecast of 14.7%. However, profit margins have declined from last year, reflecting some operational challenges amidst its growth trajectory.

Live Nation Entertainment

Overview: Live Nation Entertainment, Inc. is a global live entertainment company with a market capitalization of approximately $21.78 billion.

Operations: The company generates revenue primarily through three segments: concerts, which brought in $19.36 billion, ticketing at $3.00 billion, and sponsorship & advertising contributing $1.14 billion.

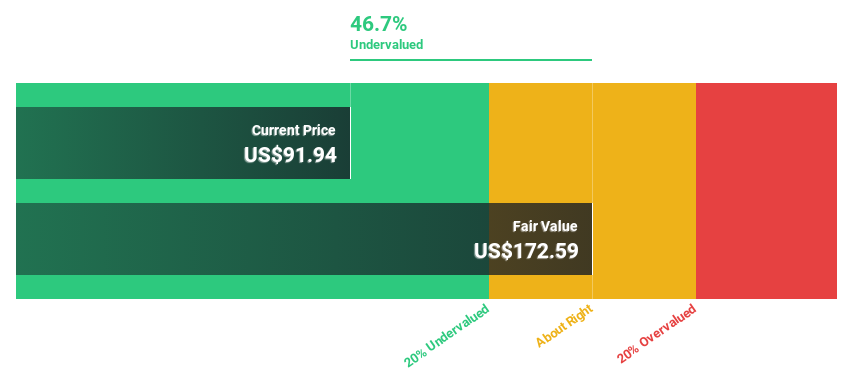

Estimated Discount To Fair Value: 37.2%

Live Nation Entertainment, priced at US$94.79, appears undervalued against a fair value estimate of US$151.01, reflecting a 37.2% discount. This valuation comes despite its robust forecasted earnings growth at 26.8% annually over the next three years and a high expected return on equity of 38.8%. However, revenue growth projections are modest at 6.9% per year, trailing the broader US market expectation of 8.7%. Recent legal challenges and exclusion from several Russell indices could impact investor sentiment.

Dive into the specifics of Live Nation Entertainment here with our thorough financial health report.

XPO

Overview: XPO, Inc. is a global logistics provider offering freight transportation services across the United States, North America, France, the UK, other parts of Europe, and internationally, with a market capitalization of approximately $12.46 billion.

Operations: The company's revenue is primarily generated from two segments: European Transportation at $3.08 billion and North American Less-Than-Truckload at $4.77 billion.

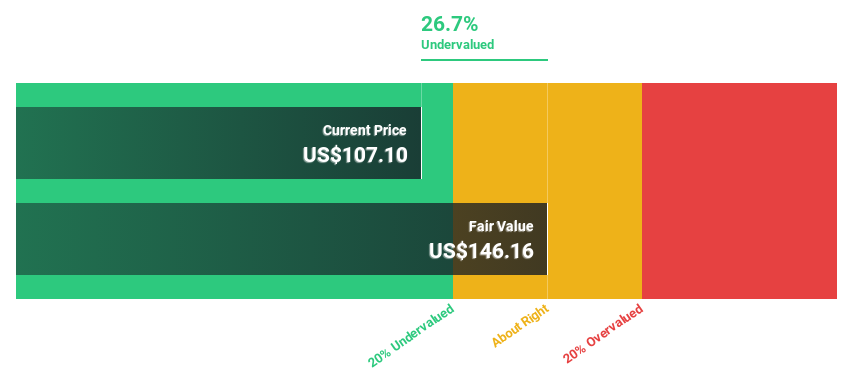

Estimated Discount To Fair Value: 26.7%

XPO, Inc. is currently trading at US$107.1, significantly below the calculated fair value of US$146.16, suggesting a potential undervaluation of 26.7%. This discrepancy is supported by a robust earnings growth forecast of 23.68% annually, outpacing the broader US market's expectation of 14.7%. However, its revenue growth projection lags at 6.3% per year against a market rate of 8.7%. Recent index changes and board adjustments may influence market perceptions but underscore its dynamic position in the sector.

Our growth report here indicates XPO may be poised for an improving outlook.

Click here and access our complete balance sheet health report to understand the dynamics of XPO.

Where To Now?

Get an in-depth perspective on all 183 Undervalued US Stocks Based On Cash Flows by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:EVR NYSE:LYV and NYSE:XPO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance