Three US Stocks Estimated To Be Below Their Fair Value In June 2024

Amidst a buoyant U.S. market with the Nasdaq leading gains and Amazon reaching a $2 trillion market cap, investors are keenly observing shifts and opportunities across various sectors. In this context, identifying stocks that are potentially undervalued becomes crucial, offering a strategic advantage in navigating through prevailing economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Noble (NYSE:NE) | $44.79 | $87.98 | 49.1% |

Selective Insurance Group (NasdaqGS:SIGI) | $91.10 | $179.41 | 49.2% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.48 | $32.38 | 49.1% |

Marriott Vacations Worldwide (NYSE:VAC) | $83.09 | $162.76 | 49% |

Associated Banc-Corp (NYSE:ASB) | $20.00 | $39.33 | 49.2% |

AppLovin (NasdaqGS:APP) | $80.48 | $159.01 | 49.4% |

Hexcel (NYSE:HXL) | $62.57 | $122.96 | 49.1% |

XPeng (NYSE:XPEV) | $8.24 | $16.09 | 48.8% |

Wallbox (NYSE:WBX) | $1.27 | $2.53 | 49.8% |

Hecla Mining (NYSE:HL) | $4.85 | $9.51 | 49% |

Here's a peek at a few of the choices from the screener

Li Auto

Overview: Li Auto Inc. is a company based in the People’s Republic of China, specializing in the electric vehicle market with a market capitalization of approximately $19.67 billion.

Operations: The company generates its revenue primarily from the auto manufacturing segment, totaling CN¥130.70 billion.

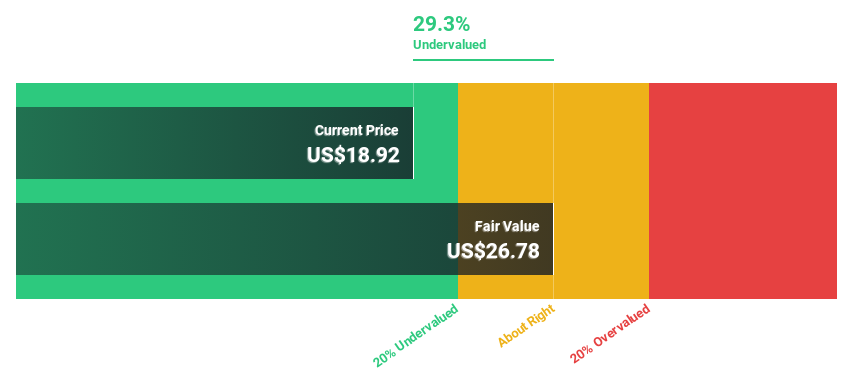

Estimated Discount To Fair Value: 29.3%

Li Auto, trading at US$18.92, is valued below our fair value estimate of US$26.78, indicating potential undervaluation based on discounted cash flows. Despite recent operational missteps leading to lowered vehicle delivery forecasts and legal challenges impacting investor confidence, the company's financial outlook remains robust with significant expected annual revenue growth of 20.5% and earnings growth projected at 21.39% per year over the next three years. However, shareholder dilution has occurred in the past year, and its Return on Equity is forecasted to be low at 19.5% in three years' time.

Nutanix

Overview: Nutanix, Inc. operates as a provider of enterprise cloud platforms across various global regions, with a market capitalization of approximately $13.18 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling approximately $2.10 billion.

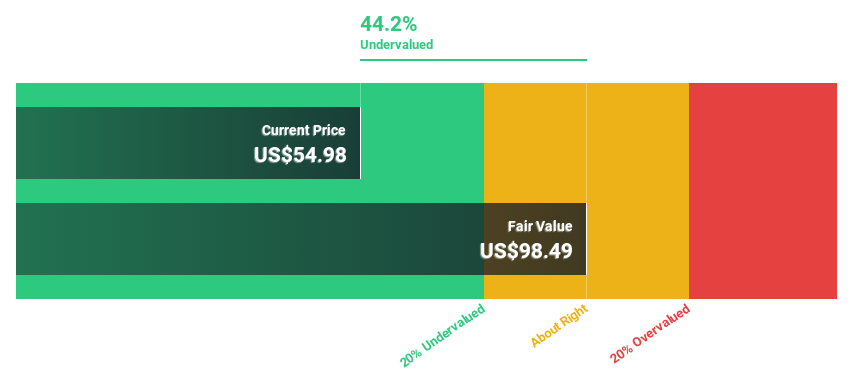

Estimated Discount To Fair Value: 44.2%

Nutanix, priced at US$54.98, trades significantly below the calculated fair value of US$98.49, suggesting a potential undervaluation based on discounted cash flow analysis. The company is poised for robust growth with revenues expected to increase by 13.9% annually, outpacing the US market forecast of 8.6%. Additionally, Nutanix's transition to profitability within three years aligns with an anticipated earnings surge of 82.69% per year and a projected exceptional Return on Equity of 108.5%. However, shareholder dilution has been noted over the past year.

XPeng

Overview: XPeng Inc. is a company based in the People’s Republic of China that focuses on designing, developing, manufacturing, and marketing smart electric vehicles (EVs), with a market capitalization of approximately $7.50 billion.

Operations: The company generates CN¥33.19 billion from its auto manufacturing segment.

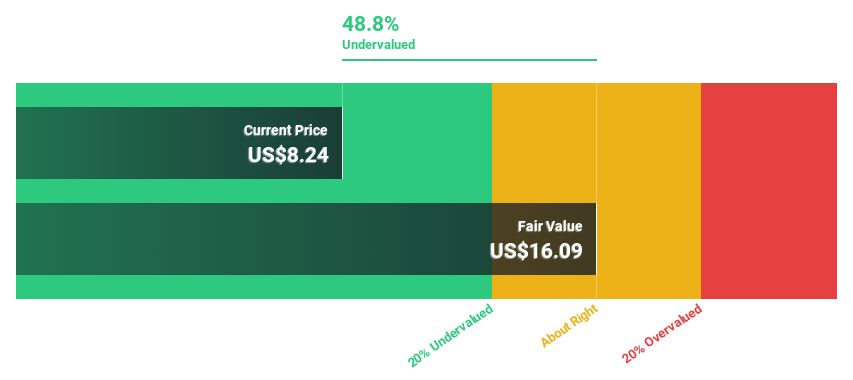

Estimated Discount To Fair Value: 48.8%

XPeng, priced at US$8.24, is significantly undervalued based on discounted cash flow analysis, with an estimated fair value of US$16.09. The company's recent earnings report shows a reduced net loss and a promising increase in revenue to CNY 6.55 billion from CNY 4.03 billion year-over-year. XPeng forecasts robust vehicle deliveries and revenue growth for Q2 2024, reflecting strong market demand and operational improvements despite its low forecasted Return on Equity of 0.9% in three years' time.

Make It Happen

Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 182 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:LI NasdaqGS:NTNX and NYSE:XPEV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance