Three US Growth Companies With Insider Ownership Exceeding 13%

As the U.S. markets recently hit fresh highs, with the Nasdaq and S&P 500 climbing to record levels, investor interest in growth-oriented companies remains robust. In this context, companies with high insider ownership can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially leading to more prudent decision-making and long-term strategic planning in a buoyant market environment.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

We'll examine a selection from our screener results.

Atlassian

Simply Wall St Growth Rating: ★★★★★☆

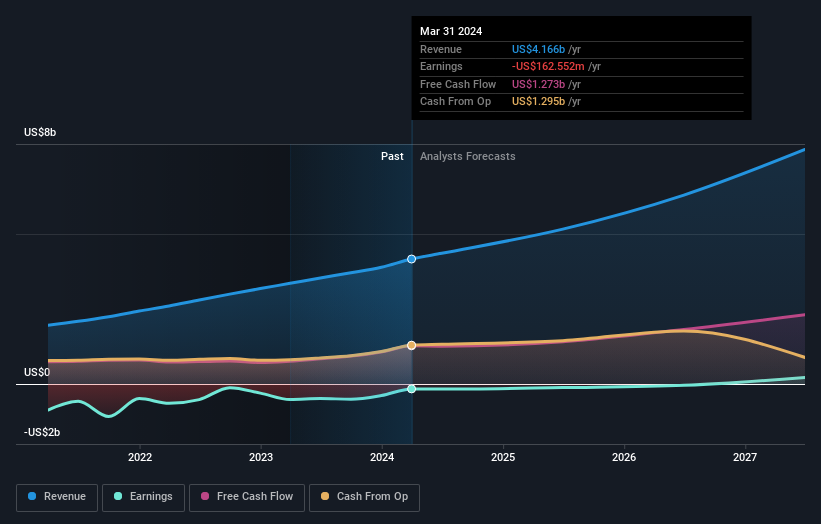

Overview: Atlassian Corporation operates globally, designing, developing, licensing, and maintaining a range of software products with a market capitalization of approximately $47.44 billion.

Operations: The company generates its revenue primarily from software and programming, totaling approximately $4.17 billion.

Insider Ownership: 39.2%

Atlassian, a growth-focused firm with substantial insider ownership, recently expanded its debt portfolio by issuing US$1 billion in senior notes to bolster financial flexibility. Despite this leverage increase, the company's recent earnings report shows a significant recovery, transitioning from a net loss to generating US$12.75 million in net income for Q3 2024. Insider activities have been balanced over the past quarter with no substantial buying or selling reported. Atlassian continues to innovate, notably through AI integrations within its software suite which could enhance long-term value creation despite current revenue growth (16.8% annually) trailing aggressive market benchmarks.

Get an in-depth perspective on Atlassian's performance by reading our analyst estimates report here.

Upon reviewing our latest valuation report, Atlassian's share price might be too pessimistic.

Zscaler

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $29.99 billion.

Operations: The company generates revenue primarily through its subscription services to its cloud platform and related support services, totaling approximately $2.03 billion.

Insider Ownership: 38.1%

Zscaler, a cybersecurity firm, is poised for significant growth with expected revenue increases of 18.6% annually and becoming profitable within three years. Despite high insider selling recently, its strategic partnerships and product innovations underscore its growth trajectory. Recent collaborations with companies like Google and SecureDynamics enhance its service offerings in the cybersecurity space, aiming to address complex security challenges efficiently. However, shareholder dilution over the past year raises concerns about equity value erosion amidst these expansions.

Dive into the specifics of Zscaler here with our thorough growth forecast report.

Our expertly prepared valuation report Zscaler implies its share price may be too high.

Palantir Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. specializes in developing software platforms for the intelligence community, aiding in counterterrorism across the U.S., the U.K., and globally, with a market capitalization of approximately $57.57 billion.

Operations: The company generates revenue through two main segments: Commercial, which brought in $1.07 billion, and Government, contributing $1.27 billion.

Insider Ownership: 13.4%

Palantir Technologies, despite a forecast of low return on equity at 17% in three years, is expected to see its earnings grow by 24.4% annually, outpacing the US market's 14.7%. Revenue growth is also robust at 16% per year, exceeding the US market average of 8.6%. However, shareholder dilution occurred last year and revenue growth forecasts fall below the high-growth benchmark of 20%. Recent significant contracts like the $19 million ARPA-H deal underscore its expanding influence in data analytics for health outcomes.

Summing It All Up

Navigate through the entire inventory of 183 Fast Growing US Companies With High Insider Ownership here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:TEAM NasdaqGS:ZS and NYSE:PLTR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance