Three US Growth Companies With Insider Ownership And A Minimum 21% Earnings Growth

As the U.S. stock market experiences uplifts with notable gains in major indices like the Nasdaq, driven by significant milestones such as Amazon's market cap reaching $2 trillion, investors are keenly watching for opportunities that combine growth potential with strong insider commitment. Companies with high insider ownership and robust earnings growth are particularly compelling, as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.8% | 84.4% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's review some notable picks from our screened stocks.

Lindblad Expeditions Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings, Inc. operates globally, offering marine and adventure travel experiences with a market capitalization of approximately $470.02 million.

Operations: The company generates revenue primarily through its marine expeditions and land experiences, totaling approximately $400.22 million and $179.55 million respectively.

Insider Ownership: 31.4%

Earnings Growth Forecast: 114.0% p.a.

Lindblad Expeditions Holdings, a growth company with significant insider ownership, recently expanded its fleet by acquiring two Galápagos expedition vessels, signaling strong commitment to this unique market. Despite a recent net loss of US$3.98 million in Q1 2024, the company is expected to become profitable within three years with forecasted earnings growth of 113.99% per year. Insider transactions in the past three months show more buying than selling, emphasizing confidence from those closest to the company's operations.

Pagaya Technologies

Simply Wall St Growth Rating: ★★★★☆☆

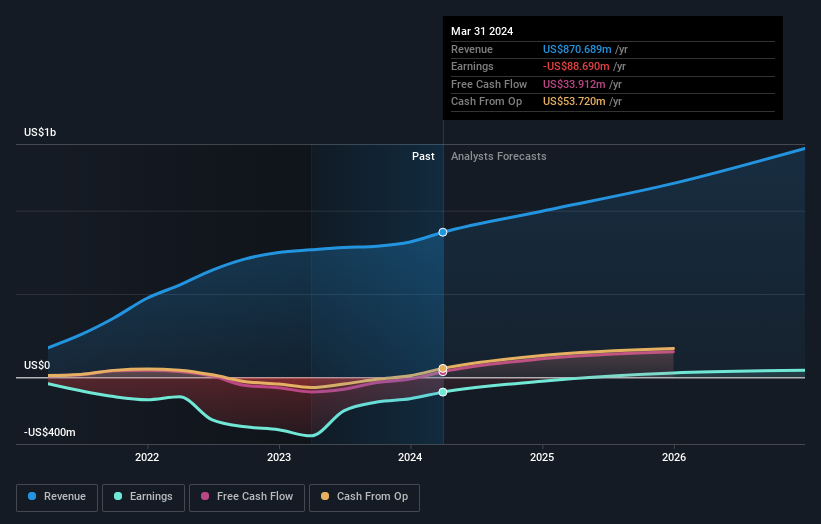

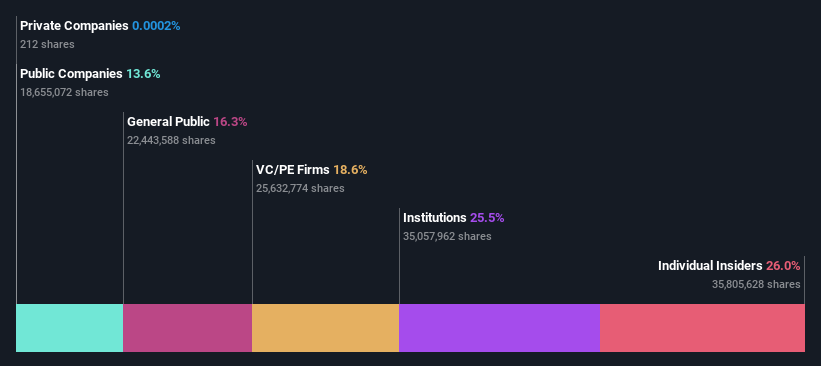

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI technology to serve financial institutions and investors globally, with a market capitalization of approximately $851.51 million.

Operations: The company generates its revenue primarily from the Software & Programming segment, totaling $870.69 million.

Insider Ownership: 19.7%

Earnings Growth Forecast: 127.6% p.a.

Pagaya Technologies, a company with significant insider buying over the past three months, is trading at 77% below its estimated fair value, indicating potential undervaluation. Despite a forecasted low return on equity of 9.2% in three years and slower than desired revenue growth at 15.9% annually, the company has managed to reduce its net loss significantly from US$60.97 million to US$21.23 million year-over-year as of Q1 2024. The firm also actively participated in multiple industry conferences, suggesting a strong focus on strategic growth through visibility and networking.

Atour Lifestyle Holdings

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited operates in the People's Republic of China, focusing on developing lifestyle brands centered around its hotel offerings, with a market capitalization of approximately $2.48 billion.

Operations: The company generates revenue primarily from its Atour Group segment, which posted CN¥5.36 billion in earnings.

Insider Ownership: 26%

Earnings Growth Forecast: 21.7% p.a.

Atour Lifestyle Holdings has recently completed a follow-on equity offering raising US$169 million, indicating active capital management. Despite substantial insider transactions and board changes, including the resignation of director Mr. Hongbin Zhou, the company demonstrates strong financial performance with significant year-over-year revenue and net income growth. Analysts predict a 50.4% potential rise in stock price and forecast earnings to grow by 21.7% annually, outpacing the US market average significantly. However, shareholder dilution occurred over the past year which may concern some investors.

Make It Happen

Unlock our comprehensive list of 185 Fast Growing US Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:LIND NasdaqCM:PGY and NasdaqGS:ATAT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance