Three UK Growth Companies With High Insider Ownership And 84% Earnings Growth

Amidst a backdrop of fluctuating global markets and heightened anticipation around US economic indicators, the United Kingdom's FTSE 100 index exhibits cautious trading behavior as investors navigate through pre-election uncertainties and regulatory developments. In such a market environment, growth companies with high insider ownership in the UK may offer appealing stability and potential for robust earnings growth, as these insiders often have a vested interest in the company’s long-term success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Getech Group (AIM:GTC) | 17.3% | 108.7% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 24.4% | 142.7% |

Afentra (AIM:AET) | 38.3% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Here's a peek at a few of the choices from the screener.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

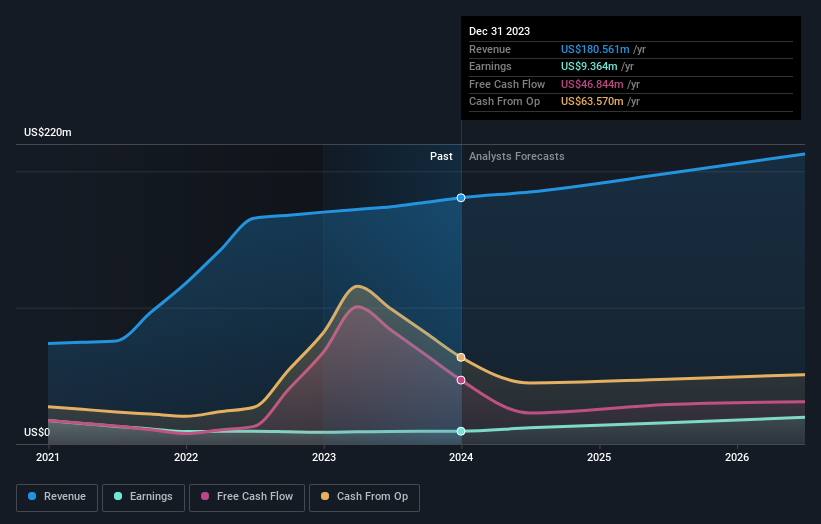

Overview: Craneware plc, a company engaged in developing, licensing, and supporting computer software for the healthcare industry primarily in the United States, has a market capitalization of approximately £814.41 million.

Operations: The company generates its revenue primarily from its healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Earnings Growth Forecast: 28.5% p.a.

Craneware, a UK-based company, has shown a robust growth trajectory with earnings increasing by 8.6% over the past year and forecasted to grow at 28.52% annually. Despite its revenue growth being slower than some industry benchmarks at 7.3% per year, it still outpaces the UK market average of 3.5%. The firm's Return on Equity is expected to be modest at 11.2%. Recently, Craneware extended its buyback plan and participated in significant industry conferences, underscoring active engagement and confidence in its strategic direction.

FD Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FD Technologies plc is a provider of software and consulting services based in the United Kingdom, operating globally with a market capitalization of approximately £0.40 billion.

Operations: The company generates revenue through two primary segments: KX, which contributes £79.15 million, and First Derivative, accounting for £169.72 million.

Insider Ownership: 12.8%

Earnings Growth Forecast: 84.4% p.a.

FD Technologies, a UK-based firm, reported a significant net loss of £40.78 million for FY 2024, a substantial increase from the previous year. Despite this setback, the company is projected to see robust earnings growth of 84.44% annually and is expected to become profitable within three years. With insider ownership aligning interests with shareholders, FD Technologies' revenue growth at 4.2% annually is anticipated to surpass the UK market average of 3.5%.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a diversified financial services provider offering banking, leasing, insurance, brokerage, and card processing solutions in Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.39 billion.

Operations: The company generates revenue from banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group, despite a high bad loans ratio of 2.1%, has shown promising financial performance with its net income rising to GEL 292.81 million from GEL 248.67 million year-over-year as of Q1 2024. The bank's earnings are expected to grow by 15.22% annually, outpacing the UK market projection of 12.5%. Additionally, TBCG's recent share buyback program worth GEL 75 million underscores its commitment to shareholder value, although concerns about its volatile share price and low allowance for bad loans at 74% persist.

Turning Ideas Into Actions

Gain an insight into the universe of 67 Fast Growing UK Companies With High Insider Ownership by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRWAIM:FDP.LSE:TBCG

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance