Three UK Exchange Stocks Estimated To Be Trading Between 20.9% And 39.9% Below Their Intrinsic Value

Amid a landscape of cautious trading and regulatory scrutiny within the United Kingdom's financial markets, investors are navigating through a period marked by anticipation of US inflation data and political uncertainties. In such an environment, identifying stocks that appear to be trading below their intrinsic value could offer attractive opportunities for those looking to invest in potentially undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £25.70 | £48.88 | 47.4% |

Kier Group (LSE:KIE) | £1.37 | £2.71 | 49.5% |

Morgan Advanced Materials (LSE:MGAM) | £3.15 | £6.10 | 48.3% |

Mercia Asset Management (AIM:MERC) | £0.295 | £0.58 | 49.5% |

Deliveroo (LSE:ROO) | £1.275 | £2.48 | 48.6% |

John Wood Group (LSE:WG.) | £1.973 | £3.93 | 49.8% |

Loungers (AIM:LGRS) | £2.66 | £5.25 | 49.4% |

Elementis (LSE:ELM) | £1.47 | £2.80 | 47.4% |

M&C Saatchi (AIM:SAA) | £1.99 | £3.97 | 49.8% |

Aston Martin Lagonda Global Holdings (LSE:AML) | £1.548 | £2.95 | 47.5% |

We're going to check out a few of the best picks from our screener tool

Restore

Overview: Restore plc operates primarily in the United Kingdom, offering services to offices and workplaces across both public and private sectors, with a market capitalization of approximately £345.05 million.

Operations: The company generates revenue through two main segments: Secure Lifecycle Services (£107 million) and Digital & Information Management (£170.10 million).

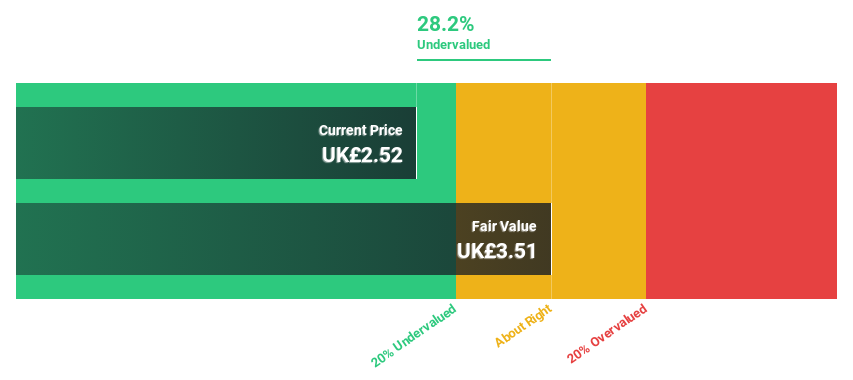

Estimated Discount To Fair Value: 28.2%

Restore is currently trading at £2.52, significantly below the estimated fair value of £3.51, reflecting a 28.2% undervaluation. Despite challenges in covering interest payments with earnings and a low forecasted Return on Equity of 11.6%, Restore's financial outlook shows promise with expected profitability within three years and revenue growth projected at 3.9% annually, outpacing the UK market average of 3.5%. However, its dividend sustainability is questionable as it's not well covered by earnings.

Hostelworld Group

Overview: Hostelworld Group plc is an online travel agent specializing in the hostel market globally, with a market capitalization of approximately £210.19 million.

Operations: The company generates €93.26 million in revenue from providing software and data processing services.

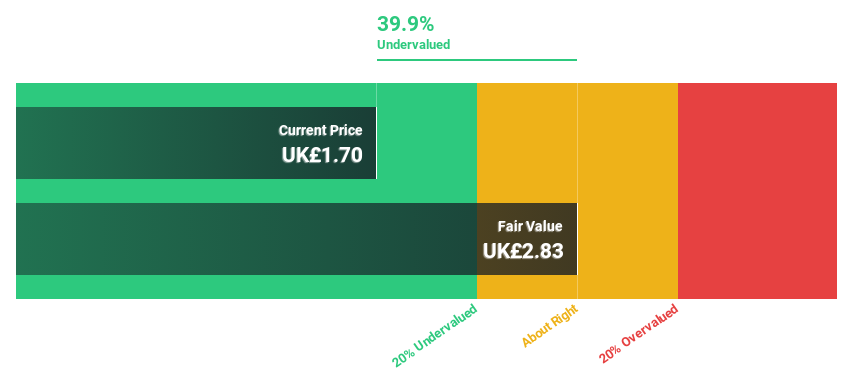

Estimated Discount To Fair Value: 39.9%

Hostelworld Group, with a significant expected earnings growth of 24% per year, is trading at £1.7, markedly below the fair value estimate of £2.83, indicating an undervaluation of nearly 40%. Despite this potential, concerns arise from substantial insider selling and low forecasted Return on Equity at 15.6%. Recent board changes could signal strategic shifts, enhancing governance but the impact remains to be seen.

Victrex

Overview: Victrex plc specializes in the manufacture and sale of polymer solutions globally, with a market capitalization of approximately £1.03 billion.

Operations: The company generates its revenue primarily from two segments: Medical (£59.10 million) and Sustainable Solutions (£229.80 million).

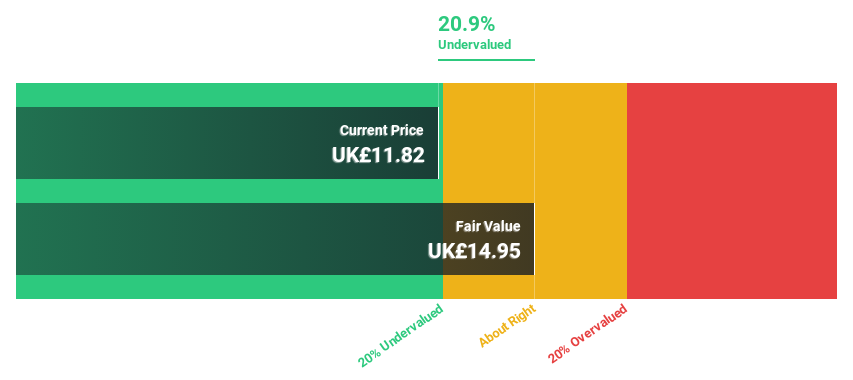

Estimated Discount To Fair Value: 20.9%

Victrex plc's recent financial performance shows a decline, with half-year sales dropping to £139.3 million from £162.2 million and net income falling significantly to £2.7 million. Despite this downturn, the company maintains its interim dividend at 13.42 pence per share. Analysts believe Victrex is trading below fair value by over 20%, signaling potential undervaluation based on discounted cash flows (DCF). Additionally, while revenue growth projections are modest at 7.1% annually, earnings are expected to surge by 35.1% per year, outpacing the UK market average.

Insights from our recent growth report point to a promising forecast for Victrex's business outlook.

Click to explore a detailed breakdown of our findings in Victrex's balance sheet health report.

Next Steps

Discover the full array of 64 Undervalued UK Stocks Based On Cash Flows right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:RST LSE:HSW and LSE:VCT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance