Three Solid UK Dividend Stocks Offering Up To 5.1% Yield

As the UK market navigates through political uncertainties with upcoming elections and regulatory changes, investors remain vigilant, reflecting a cautious optimism in the FTSE 100's slight uptick. In such a climate, dividend stocks can be particularly appealing for those looking for stable returns amidst market fluctuations.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.68% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.33% | ★★★★★☆ |

DCC (LSE:DCC) | 3.55% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.87% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.88% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.42% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.42% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.74% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

London Security

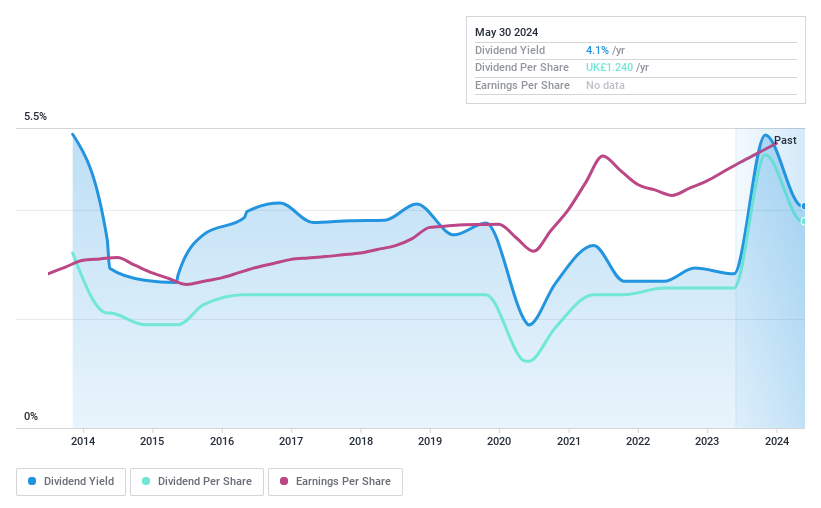

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries, with a market capitalization of approximately £386.19 million.

Operations: London Security plc generates revenue primarily through the provision and maintenance of fire protection and security equipment, totaling £219.71 million.

Dividend Yield: 3.9%

London Security's dividend history shows inconsistency, with significant fluctuations over the past decade. Despite this, its dividends are currently well-supported, covered by earnings with a payout ratio of 65.3% and cash flows at 79.8%. However, its dividend yield of 3.94% is below the top quartile in the UK market. The company recently affirmed a final dividend of £0.42 per share for 2023, maintaining last year's level, payable on July 12 to shareholders registered by June 14.

M.P. Evans Group

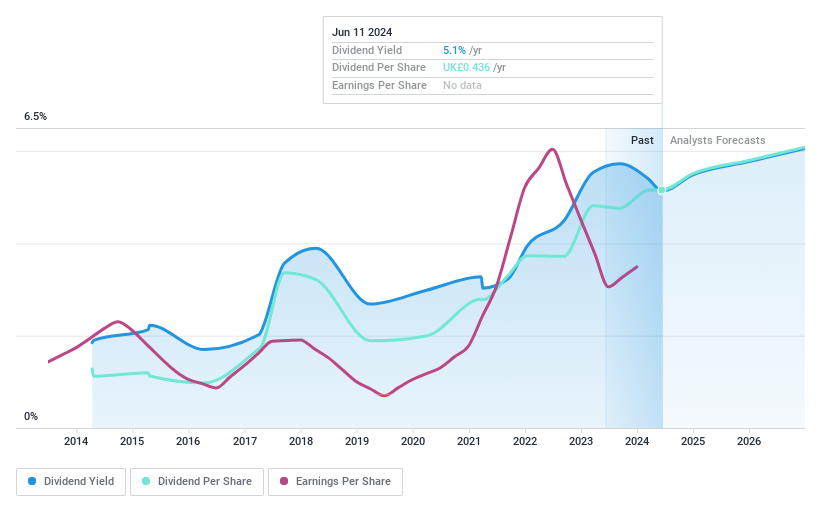

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC operates oil palm plantations in Indonesia and Malaysia, with a market capitalization of approximately £452.70 million.

Operations: M.P. Evans Group PLC generates $307.32 million from its Indonesian plantation operations.

Dividend Yield: 5.1%

M.P. Evans Group's dividend outlook is mixed, with a history of volatility over the past decade and a current yield of 5.11%, which is below the top 25% of UK dividend payers. Despite this, dividends are reasonably covered by both earnings and cash flows, with payout ratios at 58.7% and 64.5%, respectively. Recent operational results show an increase in crop production and crude palm oil output, suggesting potential for future revenue growth which could support ongoing dividend payments despite past inconsistencies.

Get an in-depth perspective on M.P. Evans Group's performance by reading our dividend report here.

Our valuation report unveils the possibility M.P. Evans Group's shares may be trading at a discount.

Kingfisher

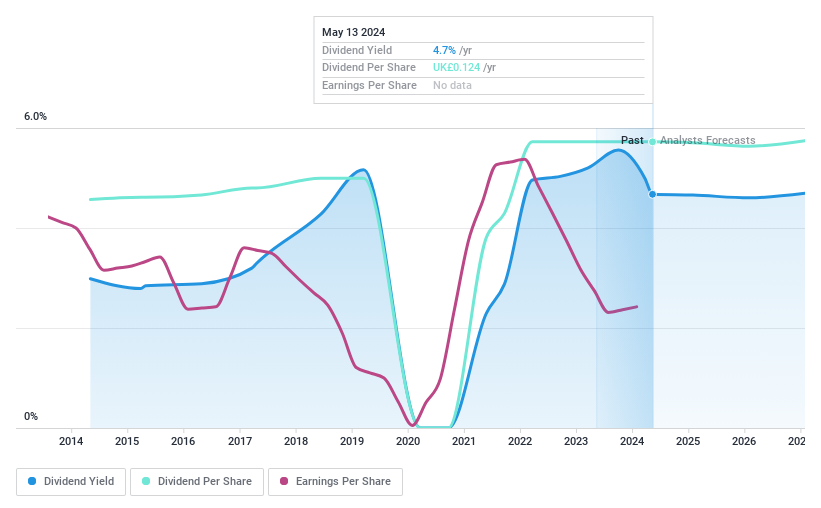

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingfisher plc operates as a retailer of home improvement products and services in the United Kingdom, Ireland, France, and other international locations, with a market capitalization of approximately £4.59 billion.

Operations: Kingfisher plc generates £12.98 billion in revenue from the sale of home improvement products and services across its primary markets.

Dividend Yield: 5%

Kingfisher's dividend profile shows complexity with a 10-year history of both growth and volatility, reflecting an unstable dividend track record. Despite this, the dividends are supported by a reasonable payout ratio of 68.2% and a low cash payout ratio of 23.9%, indicating coverage from both earnings and cash flows. The company's P/E ratio stands at 13.3x, below the UK market average, suggesting valuation attractiveness amidst its peers. Recent executive changes could influence future financial strategies as new CFO Bhavesh Mistry brings extensive retail finance experience to the role starting no earlier than January 2025.

Turning Ideas Into Actions

Get an in-depth perspective on all 56 Top Dividend Stocks by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:LSCAIM:MPE LSE:KGF

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance