Three Solid Dividend Stocks For July 2024

As global markets exhibit mixed signals with record highs in major indices and cooling economic indicators such as manufacturing and service sector activities, investors might find stability in dividend stocks. These stocks not only offer potential income through dividends but also provide an opportunity to participate in the equity growth of financially solid companies, making them appealing during uncertain economic times.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.79% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.16% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.49% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.43% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.78% | ★★★★★★ |

James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

Innotech (TSE:9880) | 4.03% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

City Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City Bank PLC operates in Bangladesh, offering a range of financial products and services, with a market capitalization of approximately BDT 27.75 billion.

Operations: City Bank PLC generates its revenue from a variety of financial products and services within Bangladesh.

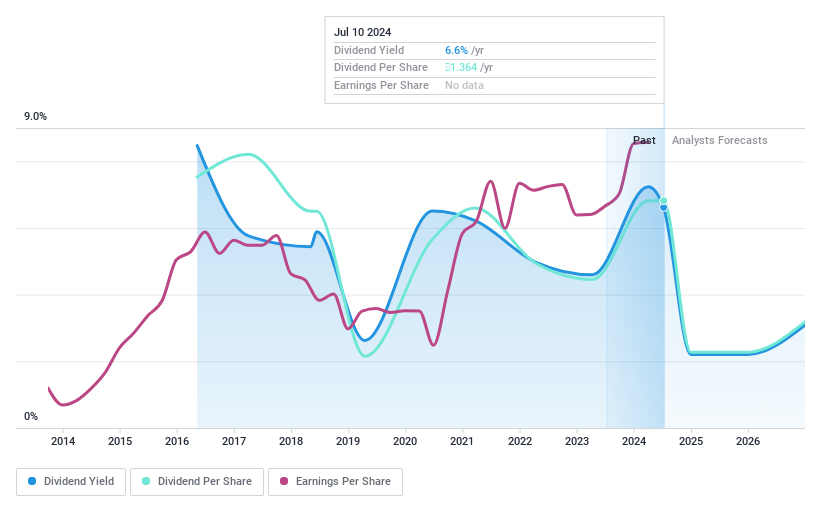

Dividend Yield: 6.6%

City Bank's dividend sustainability is questionable with an unstable track record and volatile payments over its 8-year history of dividends. Despite a low payout ratio of 28.6%, which suggests current earnings adequately cover dividends, the bank has experienced fluctuations in dividend amounts. Additionally, while dividends are projected to be well-covered by earnings in three years (11.5% payout ratio), City Bank's high level of bad loans at 3.6% raises concerns about its financial health, potentially impacting future dividend reliability.

Atlas Honda

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atlas Honda Limited, primarily operating in Pakistan, engages in the manufacturing and marketing of motorcycles, spare parts, and engine oil with a market capitalization of approximately PKR 78.63 billion.

Operations: Atlas Honda Limited generates PKR 148.42 billion in revenue from its auto manufacturing segment.

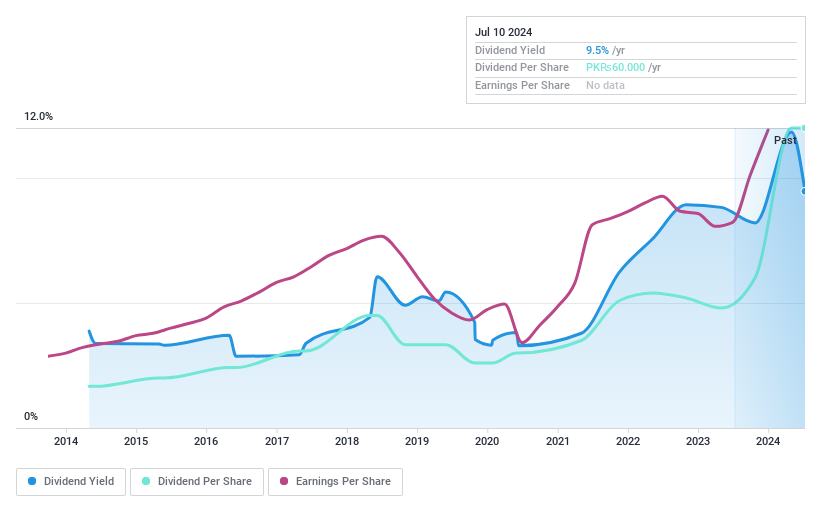

Dividend Yield: 9.5%

Atlas Honda has shown a 39% growth in earnings over the past year, yet its dividend history is marked by volatility and unreliability, with significant annual drops exceeding 20%. Despite this, dividends are reasonably covered by both earnings and cash flows, with payout ratios of 50.3% and 64.8%, respectively. However, its dividend yield of 9.47% remains below the top-tier market average of 11.42%. The company's price-to-earnings ratio stands favorable at 10.6x compared to the industry average of 17.8x.

Skellerup Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Skellerup Holdings Limited, with a market cap of NZ$788.21 million, specializes in designing, manufacturing, marketing, and distributing engineered products for a range of specialist industrial and agricultural applications.

Operations: Skellerup Holdings Limited generates its revenue primarily through two segments: the agricultural sector contributing NZ$108.62 million and the industrial sector providing NZ$217.78 million.

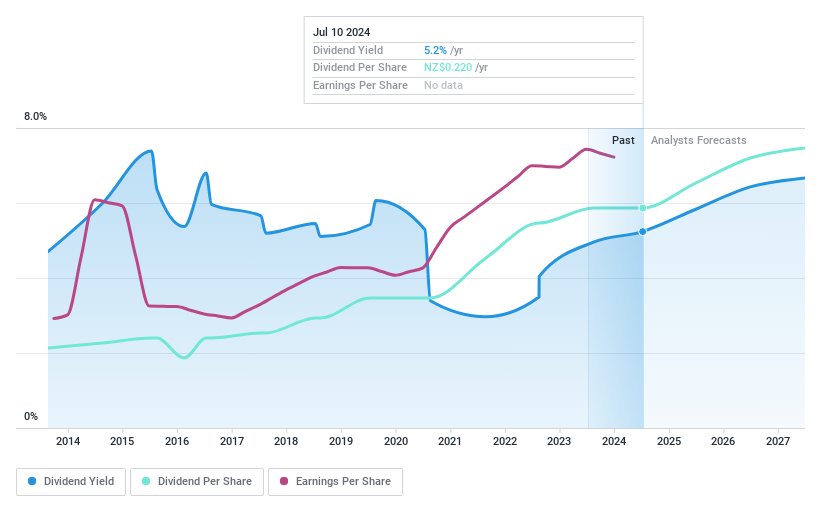

Dividend Yield: 5.2%

Skellerup Holdings has a mixed track record with dividends, showing both growth and volatility over the past decade. While the dividend yield of 5.24% is lower than many top NZ dividend payers, its payments are well-supported by earnings and cash flows, with payout ratios at 89% and 70.4%, respectively. However, despite earnings projected to rise by 6.23% annually, the overall stability and reliability of dividends may concern investors looking for consistent income streams.

Next Steps

Discover the full array of 2007 Top Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DSE:CITYBANKKASE:ATLH NZSE:SKL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance