Three SEHK Stocks Estimated To Be Undervalued In July 2024

As global markets experience fluctuations with a mix of geopolitical events and economic data releases, the Hong Kong market has mirrored this trend with its own unique challenges and opportunities. In such an environment, identifying stocks that appear undervalued could offer potential avenues for investors looking to capitalize on discrepancies between current market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

China Resources Mixc Lifestyle Services (SEHK:1209) | HK$24.85 | HK$48.53 | 48.8% |

Shanghai INT Medical Instruments (SEHK:1501) | HK$26.10 | HK$47.70 | 45.3% |

China Cinda Asset Management (SEHK:1359) | HK$0.68 | HK$1.29 | 47.3% |

United Energy Group (SEHK:467) | HK$0.31 | HK$0.57 | 45.5% |

Zijin Mining Group (SEHK:2899) | HK$17.32 | HK$31.49 | 45% |

WuXi XDC Cayman (SEHK:2268) | HK$15.94 | HK$32.03 | 50.2% |

Super Hi International Holding (SEHK:9658) | HK$14.20 | HK$26.15 | 45.7% |

Vobile Group (SEHK:3738) | HK$1.18 | HK$2.32 | 49.2% |

Melco International Development (SEHK:200) | HK$5.31 | HK$10.40 | 49% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$10.80 | HK$21.67 | 50.2% |

Below we spotlight a couple of our favorites from our exclusive screener

Weimob

Overview: Weimob Inc. is an investment holding company operating in China, offering digital commerce and marketing services, with a market capitalization of approximately HK$4.40 billion.

Operations: The company generates revenue primarily through two segments: Merchant Solutions at CN¥878.28 million and Subscription Solutions at CN¥1.35 billion.

Estimated Discount To Fair Value: 30.1%

Weimob Inc., currently trading at HK$1.44, is perceived as undervalued against a fair value estimate of HK$2.05, reflecting a 29.7% discount. Recent activities include completing a follow-on equity offering raising HKD 313.01 million and amending company bylaws to potentially enhance governance structures, signaling proactive management despite recent share price volatility and shareholder dilution over the past year. Forecasted revenue growth at 12.6% annually outpaces the Hong Kong market's 7.7%, with earnings expected to surge significantly in coming years, although its Return on Equity is projected to remain modest at 7.4%.

Insights from our recent growth report point to a promising forecast for Weimob's business outlook.

Click here to discover the nuances of Weimob with our detailed financial health report.

United Energy Group

Overview: United Energy Group Limited operates as an investment holding company focused on upstream oil, natural gas, and other energy-related businesses in South Asia, the Middle East, and North Africa, with a market capitalization of approximately HK$8.04 billion.

Operations: The company's revenue is primarily derived from exploration and production, which generated HK$10.42 billion, and trading activities that contributed HK$3.17 billion.

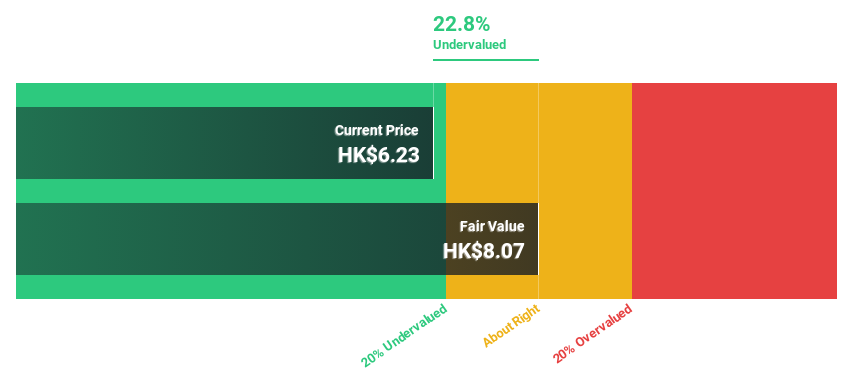

Estimated Discount To Fair Value: 45.5%

United Energy Group, with a current price of HK$0.32, is trading significantly below our fair value estimate of HK$0.57, suggesting a substantial undervaluation based on cash flows. Despite a highly volatile share price recently, its revenue growth at 8.9% annually surpasses the Hong Kong market average of 7.7%. The company's earnings are also expected to grow by 58.95% annually over the next three years as it moves towards profitability. However, concerns include an unstable dividend record and significant insider selling in recent months.

MicroPort Scientific

Overview: MicroPort Scientific Corporation is an investment holding company that manufactures and markets medical devices globally, with operations spanning the People’s Republic of China, North America, Europe, and other regions, boasting a market cap of approximately HK$9.98 billion.

Operations: MicroPort Scientific's revenue segments include Orthopedics Devices Business at $238.37 million, Neurovascular Devices Business at $94.17 million, Cardiac Rhythm Management (CRM) Business at $207.04 million, Endovascular and Peripheral Vascular Devices Business at $168.22 million, Cardiovascular Devices excluding CRM & Surgical Robot Device & Heart Valve Business at $158.88 million, Heart Valve Business at $47.52 million, Surgical Robot Devices Business at $14.81 million, and Surgical Devices Business at $7.76 million.

Estimated Discount To Fair Value: 43.3%

MicroPort Scientific, priced at HK$5.45, is assessed as trading well below its estimated fair value of HK$9.6, indicating a significant undervaluation based on cash flow analysis. The company's revenue is expected to grow by 14.9% annually, outpacing the Hong Kong market's 7.7%. Forecasted to turn profitable within three years with an anticipated profit growth rate of 71.26% annually, MicroPort shows promise despite a forecasted low return on equity of 8.1% in three years and recent board changes that saw the retirement of key non-executive directors.

Make It Happen

Unlock our comprehensive list of 43 Undervalued SEHK Stocks Based On Cash Flows by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2013SEHK:467 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance