Three Leading UK Dividend Stocks With Yields Up To 7.6%

The United Kingdom stock market has shown robust performance, with a 7.7% increase over the past year and earnings projected to grow by 13% annually. In this context, dividend stocks that offer substantial yields can be particularly appealing to investors looking for both growth and income.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.76% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.46% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.37% | ★★★★★☆ |

DCC (LSE:DCC) | 3.42% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.75% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.63% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.62% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 5.83% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.71% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.57% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

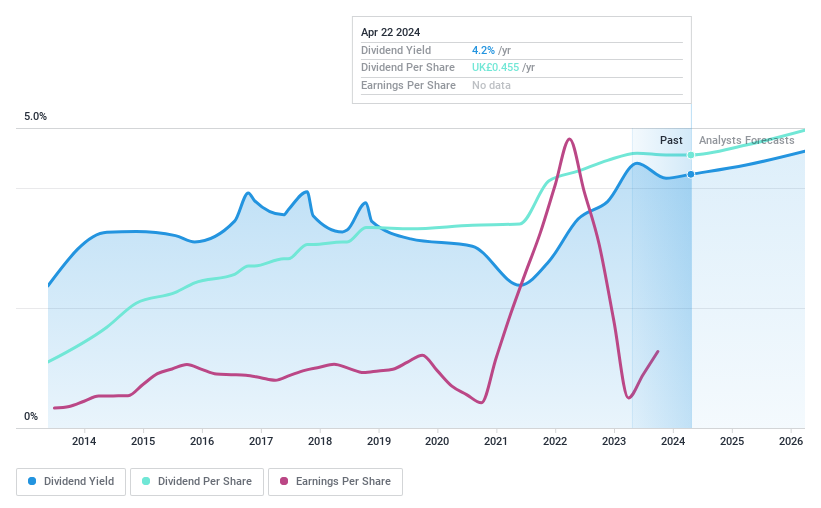

Big Yellow Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group, identified as the UK's brand leader in self-storage, operates with a market capitalization of approximately £2.43 billion.

Operations: Big Yellow Group generates its revenue primarily through the provision of self-storage and related services, totaling £199.62 million.

Dividend Yield: 3.6%

Big Yellow Group Plc showcased a robust financial performance in FY 2024, with sales rising to £199.62 million and net income surging to £239.83 million, significantly higher than the previous year. The company's dividends are well-supported, evidenced by a stable ten-year track record and coverage by both earnings (81.4% payout ratio) and cash flows (84.2% cash payout ratio). Despite this strength, its dividend yield of 3.63% remains below the top quartile in the UK market, suggesting potential concerns about its attractiveness relative to other high-yield options.

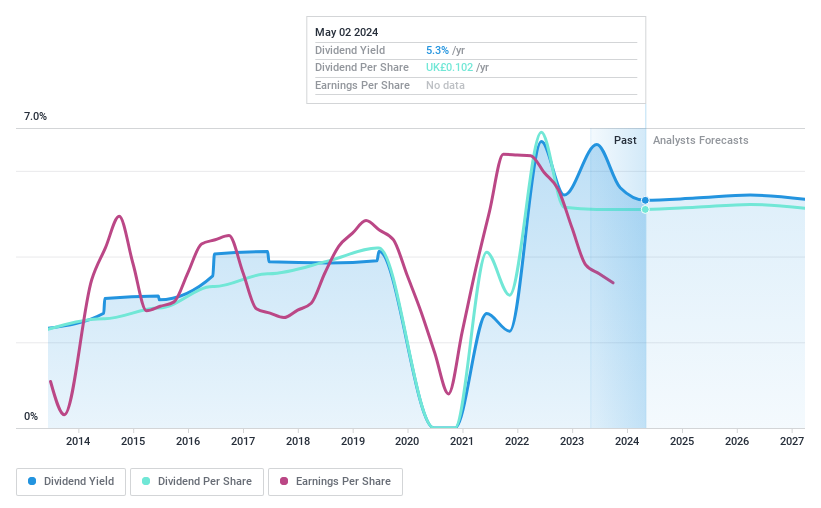

Norcros

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc is a company that develops, manufactures, and markets bathroom and kitchen products in the United Kingdom and South Africa, with a market capitalization of approximately £195.34 million.

Operations: Norcros plc generates £422.70 million in revenue from its building products segment.

Dividend Yield: 4.7%

Norcros plc anticipates FY24 underlying operating profit to align with market expectations, despite a revenue drop to £390 million from £441 million in 2023. The company's dividend history reveals instability, with volatile payments over the past decade. However, dividends are sustainably covered by earnings and cash flows, with payout ratios of 60.2% and 30.4%, respectively. Yet, its dividend yield of 4.68% falls short of the top UK dividend payers' average of 5.6%.

Navigate through the intricacies of Norcros with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Norcros' share price might be too pessimistic.

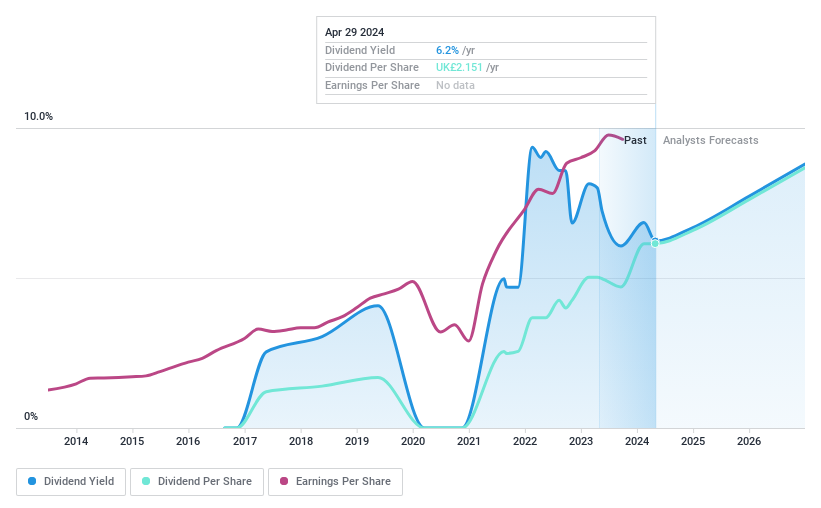

TBC Bank Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates in the financial sector, offering a range of services including banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan with a market cap of approximately £1.48 billion.

Operations: TBC Bank Group PLC generates revenue through diverse financial activities such as banking, leasing, insurance, brokerage, and card processing in Georgia, Azerbaijan, and Uzbekistan.

Dividend Yield: 7.6%

TBC Bank Group has shown a promising dividend profile, with a yield of 7.63%, ranking in the top 25% of UK dividend stocks. Recent financials indicate robust growth, with net interest income and net income rising to GEL 442.84 million and GEL 292.81 million respectively in Q1 2024. The dividends are well-covered by earnings at a payout ratio of 33.5%. However, its short dividend history and high bad loans ratio (2.1%) may raise concerns about long-term sustainability and financial health.

Click to explore a detailed breakdown of our findings in TBC Bank Group's dividend report.

Our valuation report here indicates TBC Bank Group may be undervalued.

Make It Happen

Unlock more gems! Our Top Dividend Stocks screener has unearthed 51 more companies for you to explore.Click here to unveil our expertly curated list of 54 Top Dividend Stocks.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BYGLSE:NXRLSE:TBCG and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance