Three Japanese Exchange Growth Companies With High Insider Ownership And Up To 72% Earnings Growth

Amid a backdrop of mixed performances in global markets, Japan's stock market has shown resilience with the Nikkei 225 Index posting modest gains. This environment underscores the potential value of investing in growth-oriented companies, particularly those with high insider ownership, which can signal confidence in the company’s future from those closest to its operations.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 80.9% |

Let's review some notable picks from our screened stocks.

Fujio Food Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc. operates a chain of restaurants both in Japan and internationally, with a market capitalization of approximately ¥67.72 billion.

Operations: The company generates its revenue primarily through its restaurant operations across domestic and international markets.

Insider Ownership: 29.6%

Earnings Growth Forecast: 72.8% p.a.

Fujio Food Group is poised for notable growth, with earnings expected to increase by 72.84% annually. The company's revenue is also projected to expand at 6.2% per year, outpacing the Japanese market's average of 4.1%. This growth comes as Fujio Food Group approaches profitability within the next three years, a rate considered above average market growth. Despite these positives, there is no significant insider buying or selling reported in the past three months, and data on return on equity forecasts remains unclear.

Stella Chemifa

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stella Chemifa Corporation, with a market capitalization of ¥50.64 billion, specializes in the manufacture and sale of inorganic fluorine compounds both domestically in Japan and internationally.

Operations: The company's operations focus on the production and sale of inorganic fluorine compounds across domestic and international markets.

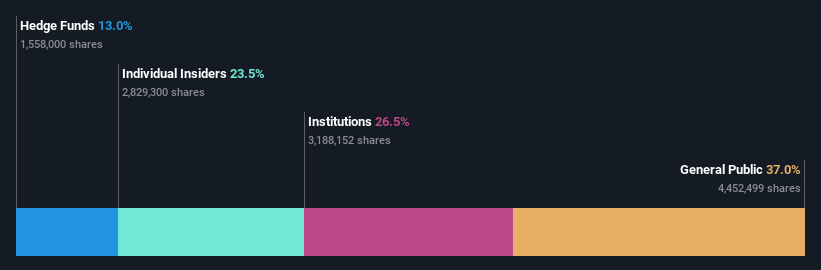

Insider Ownership: 23.5%

Earnings Growth Forecast: 24% p.a.

Stella Chemifa is set for robust growth, with its earnings forecast to climb by 24% annually over the next three years, outperforming the Japanese market's 8.8% expected rate. The company anticipates JPY 34.5 billion in revenues and a profit of JPY 2.6 billion by March 2025. Despite trading at a significant discount to its estimated fair value, concerns persist about dividend sustainability as it is not well-covered by earnings or cash flows.

Japan Investment Adviser

Simply Wall St Growth Rating: ★★★★★☆

Overview: Japan Investment Adviser Co., Ltd. operates in Japan, offering a range of financial solutions with a market capitalization of approximately ¥90.42 billion.

Operations: The company generates revenue through diverse financial solutions.

Insider Ownership: 27.6%

Earnings Growth Forecast: 45.9% p.a.

Japan Investment Adviser is poised for substantial growth, with earnings expected to surge by 45.9% annually over the next three years, significantly outpacing the broader Japanese market's 8.8%. This growth is supported by a robust revenue increase of 25% per year. However, challenges include shareholder dilution in the past year and debt levels that are not well-covered by operating cash flow. Recent executive changes suggest strategic shifts that could impact future performance.

Make It Happen

Click here to access our complete index of 100 Fast Growing Japanese Companies With High Insider Ownership.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2752 TSE:4109 and TSE:7172.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance