Three Growth Stocks With Insider Ownership As High As 34%

As global markets navigate through a relatively quiet period with anticipation for upcoming earnings reports and key economic updates, investors continue to monitor shifts in sectors like banking and technology, which have shown notable performance variations. In such an environment, growth stocks with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.2% | 48.1% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 59.8% |

Here's a peek at a few of the choices from the screener.

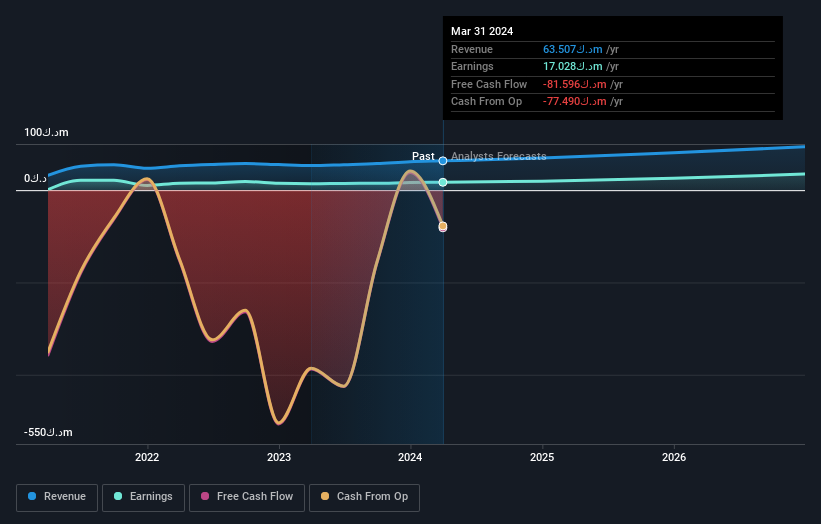

Warba Bank K.S.C.P

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warba Bank K.S.C.P., along with its subsidiaries, offers a range of banking products and services in Kuwait, other Middle Eastern countries, and globally, with a market capitalization of KWD 390.86 million.

Operations: Warba Bank's revenue is primarily generated from its corporate and retail segments, which contributed KWD 68.73 million and KWD 6.51 million respectively.

Insider Ownership: 10%

Warba Bank K.S.C.P. has demonstrated solid financial performance with a notable increase in net interest income to KWD 13.25 million and net income to KWD 4.74 million in Q1 2024, reflecting year-on-year growth. Despite lacking recent substantial insider trading activity, the bank's earnings have consistently grown by 21.3% annually over the past five years and are projected to accelerate by approximately 26% annually moving forward. Additionally, Warba Bank's revenue growth is outpacing the Kuwaiti market average, although it falls short of more aggressive benchmarks.

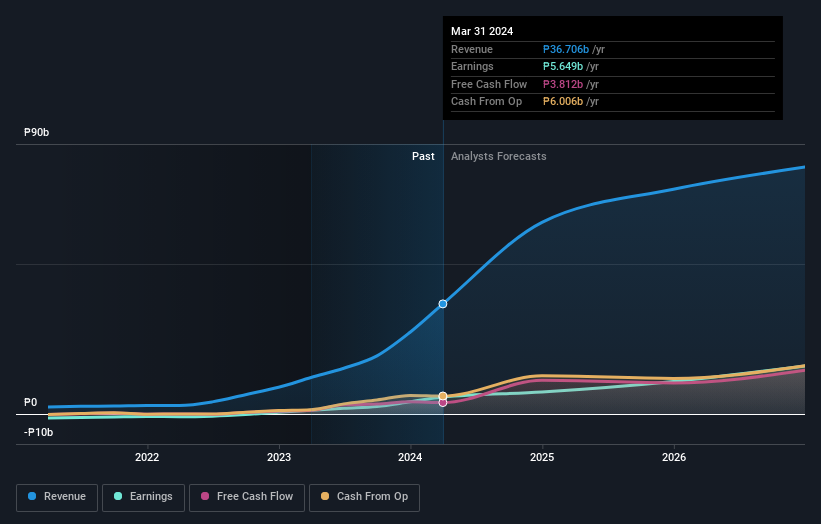

DigiPlus Interactive

Simply Wall St Growth Rating: ★★★★★★

Overview: DigiPlus Interactive Corp. operates in the Philippines, managing a diverse portfolio of businesses including general amusement, recreation enterprises, hotels, and gaming facilities, with a market capitalization of approximately ₱62.77 billion.

Operations: The company's revenue is primarily generated from its Retail Group, which contributed ₱35.68 billion, followed by the Casino Group with ₱0.46 billion, the Network and License Group at ₱0.38 billion, and the Property Group contributing ₱0.19 billion.

Insider Ownership: 12.5%

DigiPlus Interactive Corp. has shown significant growth, with first-quarter sales and revenue more than tripling year-over-year to PHP 13.53 billion and PHP 13.63 billion respectively, while net income surged to PHP 1.99 billion from PHP 424.38 million. This performance underscores a robust upward trajectory in earnings, expected to grow by approximately 38% annually over the next three years—outpacing the Philippine market significantly. Recent corporate adjustments include proposals for virtual shareholder interactions, aligning with new SEC regulations, enhancing operational flexibility amidst expansion considerations into markets with large Filipino populations.

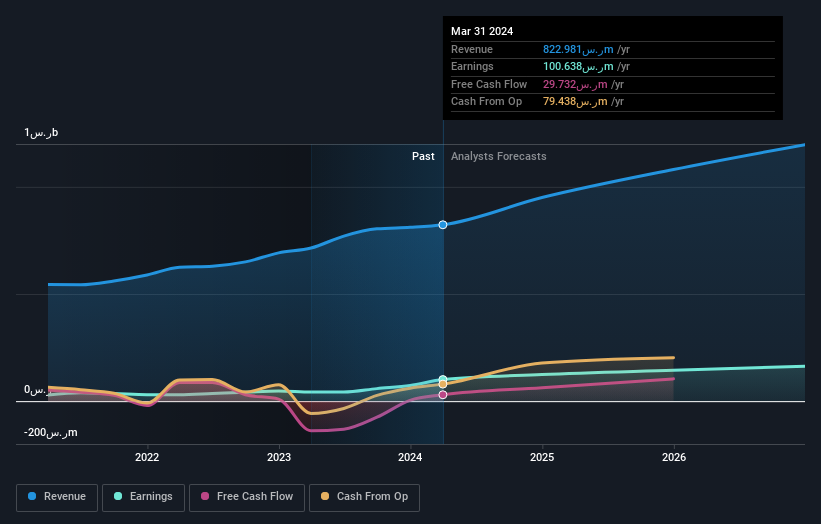

Saudi Paper Manufacturing

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saudi Paper Manufacturing Company specializes in producing and selling tissue papers within Saudi Arabia, the Gulf Cooperation Council countries, and globally, with a market capitalization of SAR 2.88 billion.

Operations: The company's revenue is primarily derived from manufacturing, which generated SAR 971.65 million, and a smaller segment in trading and others, contributing SAR 56.36 million.

Insider Ownership: 34.5%

Saudi Paper Manufacturing has demonstrated robust growth, with earnings increasing by 138.8% over the past year and forecasted to grow by 16.71% annually. Revenue is also expected to rise at 13.3% per year, outpacing the SA market's decline of -0.4%. However, its debt is not well covered by operating cash flow, indicating potential financial strain. Recent leadership changes and dividend distributions suggest active governance and shareholder return focus despite some financial concerns.

Make It Happen

Dive into all 1452 of the Fast Growing Companies With High Insider Ownership we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KWSE:WARBABANKPSE:PLUS SASE:2300 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance