Three Growth Companies On TSX With Up To 39% Insider Ownership

Amidst a backdrop of fluctuating consumer sentiment and uneven economic pressures, the Canadian market presents a complex landscape for investors. In such an environment, growth companies with high insider ownership on the TSX stand out as potentially resilient choices due to their leadership's vested interest in company performance.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 73.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.2% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 64.7% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's dive into some prime choices out of from the screener.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

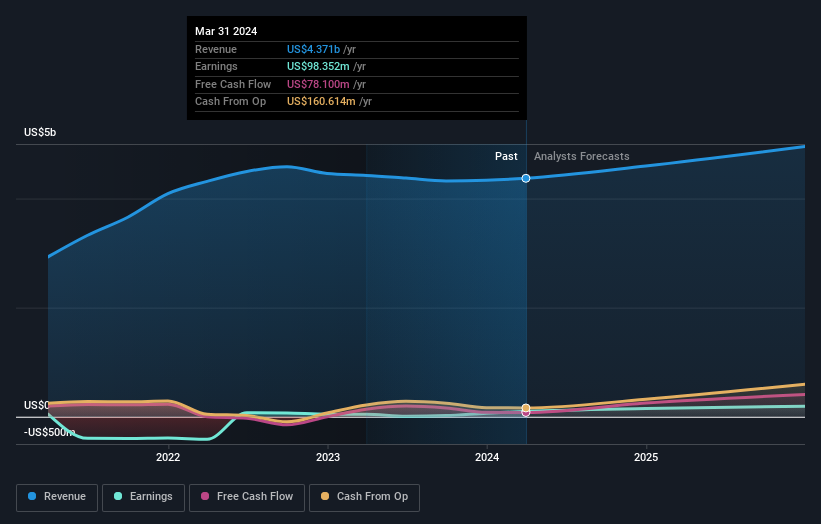

Overview: Colliers International Group Inc. is a global company offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.50 billion.

Operations: Colliers International Group's revenue is primarily generated from the Americas at CA$2.53 billion, followed by Europe, the Middle East & Africa at CA$730.10 million, Asia Pacific at CA$616.58 million, and Investment Management services contributing CA$489.23 million.

Insider Ownership: 14.2%

Colliers International Group, while trading at 56.1% below its estimated fair value, shows a promising earnings growth forecast of 38.34% annually over the next three years, outpacing the Canadian market's expected 14.6%. However, its revenue growth projection of 9.5% annually is modest compared to industry giants and is coupled with concerns about debt not being well-covered by operating cash flow. Recent activities include a significant role in marketing and potentially financing or selling a major property in Mississippi, highlighting its active engagement in substantial projects despite financial leverage issues.

goeasy

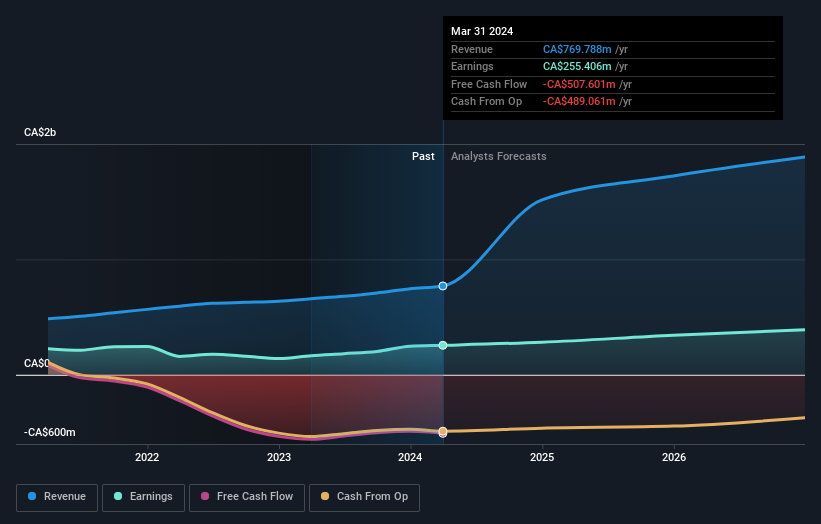

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of CA$3.18 billion.

Operations: The company generates revenue primarily through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.5%

goeasy Ltd., marked by a valuation 37.8% below its fair estimate, is positioned for notable growth with earnings expected to increase by 15.8% annually, surpassing the Canadian market forecast of 14.6%. However, its dividend coverage and debt situation raise concerns, with dividends not well-supported by cash flows and debt poorly covered by operating cash flow. Recent executive appointments aim to enhance strategic direction and operational efficiency in its financial services divisions.

Propel Holdings

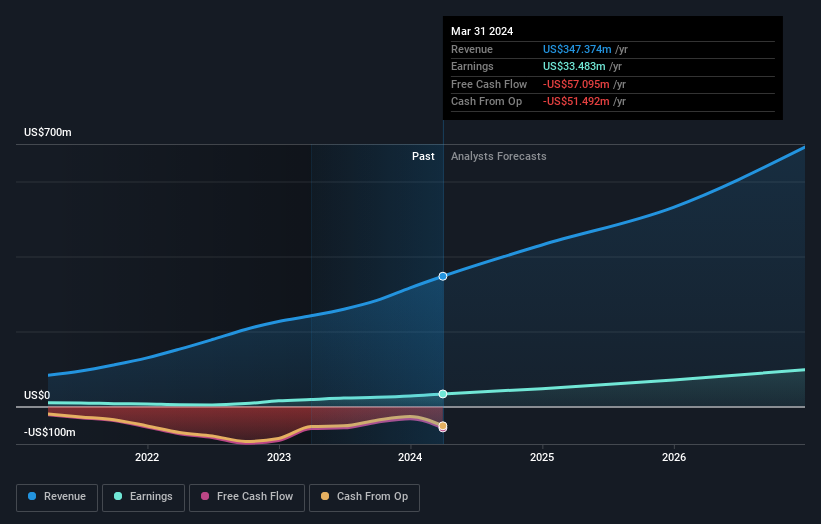

Simply Wall St Growth Rating: ★★★★★☆

Overview: Propel Holdings Inc. is a financial technology company with a market capitalization of approximately CA$774.40 million.

Operations: The company generates CA$347.37 million from offering lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 40%

Propel Holdings has demonstrated robust growth with a 79.4% increase in earnings over the past year and is expected to continue this trend, forecasting a 36.44% annual earnings growth and a 22.7% revenue increase per year, outpacing the Canadian market projections of 14.6% and 7.2%, respectively. Despite these positive indicators, there are concerns about dividend sustainability as dividends are not well covered by cash flows, and interest payments are poorly covered by earnings. Moreover, while there's been significant insider buying recently, no substantial shares have been purchased in the last three months.

Unlock comprehensive insights into our analysis of Propel Holdings stock in this growth report.

Upon reviewing our latest valuation report, Propel Holdings' share price might be too optimistic.

Summing It All Up

Unlock more gems! Our Fast Growing TSX Companies With High Insider Ownership screener has unearthed 26 more companies for you to explore.Click here to unveil our expertly curated list of 29 Fast Growing TSX Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:GSY and TSX:PRL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance