Three Growth Companies With High Insider Ownership And 24% Revenue Growth

As global markets navigate through a landscape marked by fluctuating inflation rates and cautious central bank policies, investors continue to seek stable investment opportunities. Companies with high insider ownership and strong revenue growth can be particularly appealing, as they often signal confidence from those closest to the business in its prospects and management.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Gaming Innovation Group (OB:GIG) | 21.6% | 36.2% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

Vow (OB:VOW) | 31.8% | 97.6% |

Here we highlight a subset of our preferred stocks from the screener.

Vietnam International Commercial Bank

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vietnam International Commercial Joint Stock Bank, operating under the ticker HOSE:VIB, offers a range of banking products and services to both organizations and individuals, with a market capitalization of approximately ₫56.82 billion.

Operations: The bank's revenue from banking activities totals approximately ₫16.82 billion.

Insider Ownership: 16%

Revenue Growth Forecast: 24% p.a.

Vietnam International Commercial Joint Stock Bank, a growth company with high insider ownership, faces challenges and opportunities. Its earnings are forecasted to grow by 12.61% annually, underperforming the broader Vietnamese market's 18.4% expectation. Despite trading at 43% below estimated fair value and growing revenue at a robust 24% per year—outpacing the market rate of 17%—the bank struggles with a high bad loans ratio of 3.2% and an unstable dividend track record, recently affirming dividends amidst fluctuating earnings reports from Q1 2024.

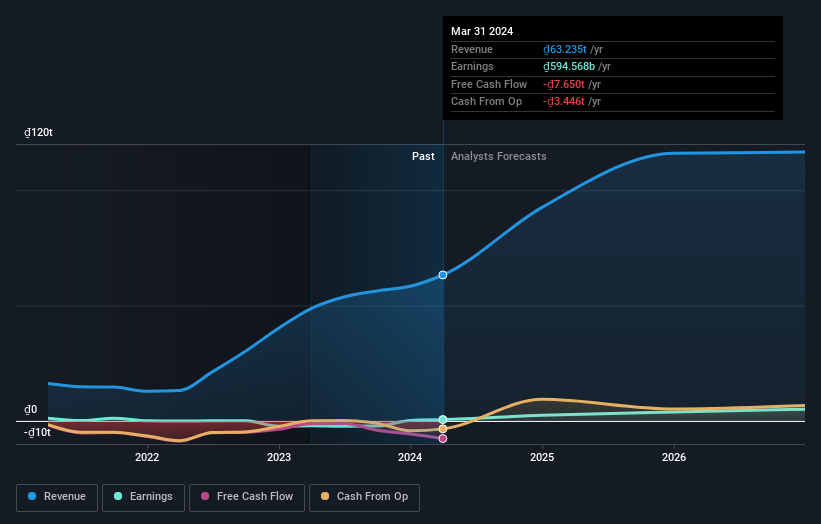

VietJet Aviation

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VietJet Aviation Joint Stock Company operates in passenger and cargo air transportation, along with related support services, boasting a market capitalization of approximately ₫58.82 trillion.

Operations: The company generates revenue primarily through passenger and cargo air transportation, alongside airline-related support services.

Insider Ownership: 38.8%

Revenue Growth Forecast: 19.9% p.a.

VietJet Aviation, despite a low forecasted return on equity of 18.9% in three years, reported a substantial increase in Q1 2024 earnings with revenue reaching VND 17.79 billion, up from VND 12.90 billion year-over-year, and net income soaring to VND 536.18 million from VND 172.21 million. The company's earnings are expected to grow by a significant 53% annually over the next three years, outpacing Vietnam's market growth projections in both revenue and earnings growth rates.

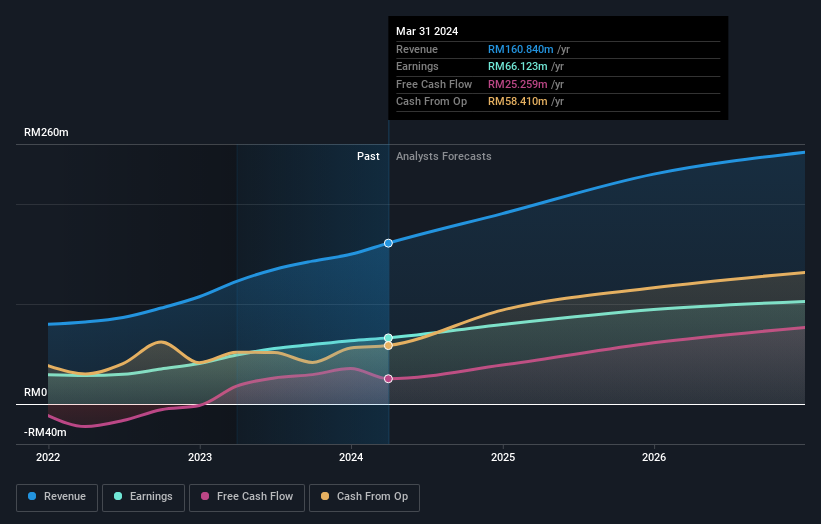

ITMAX System Berhad

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITMAX System Berhad, an investment holding company based in Malaysia, specializes in the supply, installation, and management of public space networked systems, with a market capitalization of approximately MYR 2.51 billion.

Operations: The company primarily generates its revenue from the supply, installation, and management of networked systems in public spaces across Malaysia.

Insider Ownership: 10.7%

Revenue Growth Forecast: 16.1% p.a.

ITMAX System Berhad, with high insider ownership, reported a robust first quarter in 2024 with sales reaching MYR 45.84 million, up from MYR 34.68 million the previous year. Net income rose to MYR 18.03 million from MYR 15.19 million, reflecting a solid earnings growth of 34.7% over the past year. The company's earnings and revenue are forecasted to grow at annual rates of 15.6% and 16.1% respectively, outperforming the Malaysian market projections of 12.1% for earnings and 6% for revenue growth.

Turning Ideas Into Actions

Discover the full array of 1474 Fast Growing Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include HOSE:VIBHOSE:VJCKLSE:ITMAX and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance