Three Growth Companies With High Insider Ownership And 72% Earnings Growth

As global markets exhibit mixed signals with technological sectors reaching new heights and traditional industries facing challenges, investors are keenly observing market trends and economic indicators. In this context, growth companies with high insider ownership can offer unique investment opportunities, as they often signal strong confidence from those who know the company best—its insiders.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

Elliptic Laboratories (OB:ELABS) | 31.3% | 124.6% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

Vow (OB:VOW) | 31.8% | 97.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Underneath we present a selection of stocks filtered out by our screen.

Med Life

Simply Wall St Growth Rating: ★★★★☆☆

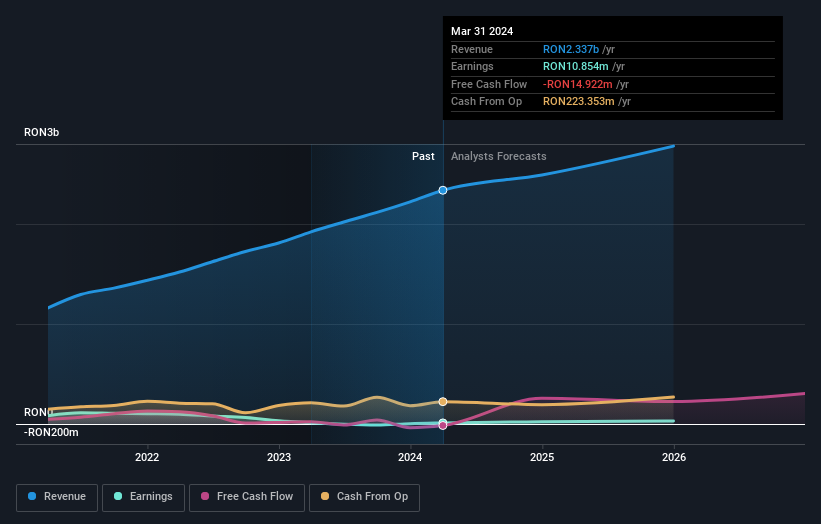

Overview: Med Life S.A. is a private healthcare provider operating in multiple Romanian cities including Bucharest, Cluj, and Timisoara, with a market capitalization of RON 2.61 billion.

Operations: Med Life S.A.'s revenue is segmented into clinics (RON 879.25 million), corporate services (RON 275.69 million), hospitals (RON 523.05 million), pharmacies (RON 58.89 million), stomatology (RON 121.76 million), and laboratories (RON 241.77 million).

Insider Ownership: 39.2%

Earnings Growth Forecast: 51.2% p.a.

Med Life, a growth company with high insider ownership, is trading at 32% below its estimated fair value and shows promising financial trends. Despite challenges in covering interest payments with earnings and the impact of large one-off items on its results, Med Life reported significant year-over-year increases in sales and revenue for Q1 2024. Earnings are expected to grow by 51.17% annually over the next three years, outpacing both its own previous performance and market growth projections.

Dive into the specifics of Med Life here with our thorough growth forecast report.

Our valuation report here indicates Med Life may be undervalued.

Saudi Paper Manufacturing

Simply Wall St Growth Rating: ★★★★☆☆

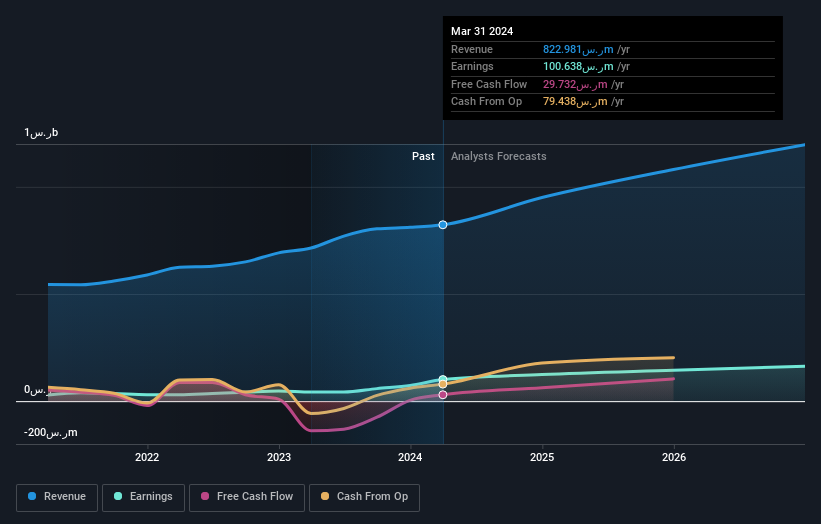

Overview: Saudi Paper Manufacturing Company specializes in producing and selling tissue papers, serving markets in the Kingdom of Saudi Arabia, Gulf Cooperation Council countries, and internationally, with a market capitalization of SAR 2.88 billion.

Operations: The company generates its revenue primarily through manufacturing, which contributed SAR 971.65 million, and a smaller segment from trading and others, adding SAR 56.36 million.

Insider Ownership: 34.5%

Earnings Growth Forecast: 16.7% p.a.

Saudi Paper Manufacturing has demonstrated robust growth with a significant 138.8% earnings increase last year and forecasts suggesting a 16.71% annual earnings growth rate. Despite this, its debt is poorly covered by operating cash flow, indicating potential financial strain. Recent leadership changes could influence strategic direction, enhancing governance structures and potentially impacting future performance. The company's revenue is expected to grow at 13.3% annually, outpacing the broader Saudi market's contraction of 0.3%.

Sri Trang Agro-Industry

Simply Wall St Growth Rating: ★★★★☆☆

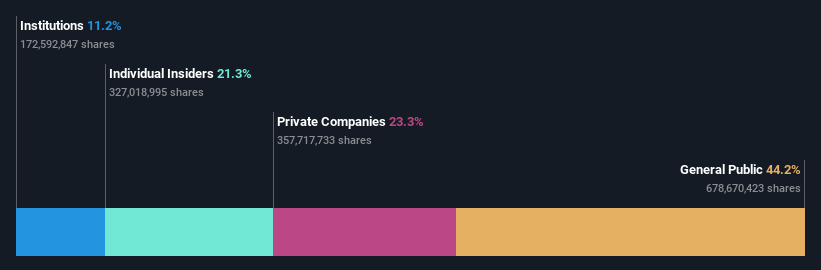

Overview: Sri Trang Agro-Industry Public Company Limited operates in the production and distribution of natural rubber products, serving markets in Thailand, China, the United States, Singapore, Japan, and other international locations with a market capitalization of approximately THB 36.40 billion.

Operations: The company's revenue is primarily derived from two segments: gloves, generating THB 20.63 billion, and natural rubbers, contributing THB 68.89 billion.

Insider Ownership: 21.3%

Earnings Growth Forecast: 72.9% p.a.

Sri Trang Agro-Industry is navigating a challenging phase with a recent net loss of THB 329.7 million, contrasting sharply with the prior year's profit. Despite this setback, the company maintains a dividend, recently confirming a payout totaling THB 1.54 billion. Forecasted to return to profitability within three years, its revenue growth at 14.2% annually is expected to outstrip Thailand's market average of 6.6%. However, its dividends are currently not well-supported by earnings or cash flow, and it faces low projected return on equity at 4.8%.

Where To Now?

Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1489 more companies for you to explore.Click here to unveil our expertly curated list of 1492 Fast Growing Companies With High Insider Ownership.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BVB:M SASE:2300 and SET:STA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance