Three Growth Companies With High Insider Ownership And Minimum 16% Revenue Increase

Amidst a backdrop of fluctuating global markets, with recent data showing mixed signals on inflation and economic growth, investors continue to seek stable opportunities for capital appreciation. Companies with high insider ownership often signal strong confidence in the business’s prospects from those who know it best, making them particularly compelling in times of narrow market advances and significant sector-specific tailwinds.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 30.1% |

Gaming Innovation Group (OB:GIG) | 13.2% | 36.2% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

Let's review some notable picks from our screened stocks.

Duc Giang Chemicals Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duc Giang Chemicals Group Joint Stock Company, operating in Vietnam, specializes in the production of industrial chemical products with a market capitalization of approximately ₫46.14 billion.

Operations: The company primarily focuses on the production of industrial chemicals.

Insider Ownership: 31.4%

Revenue Growth Forecast: 17.1% p.a.

Duc Giang Chemicals Group is trading 15.7% below its estimated fair value, with earnings forecasted to grow by 22.37% annually. Although its revenue growth of 17.1% per year is slightly below the Vietnamese market average of 17.2%, it remains robust compared to many global peers. The company's Return on Equity is expected to be high at 28.8% in three years, indicating efficient management and profitability potential despite recent dips in quarterly net income and basic earnings per share as reported in the first quarter of 2024 results.

Shenzhen United Winners Laser

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen United Winners Laser Co., Ltd. is a company that manufactures and sells laser welding equipment both in China and internationally, with a market capitalization of approximately CN¥5.35 billion.

Operations: The firm generates its revenue through the sale of laser welding equipment across domestic and international markets.

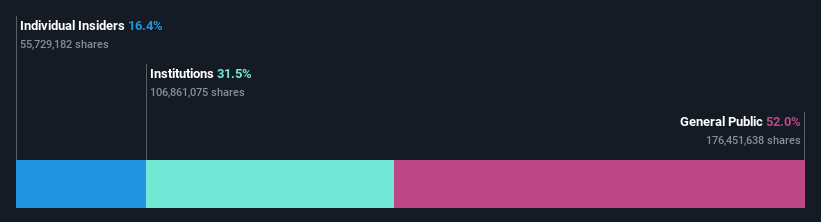

Insider Ownership: 16.4%

Revenue Growth Forecast: 16.3% p.a.

Shenzhen United Winners Laser Co., Ltd. is experiencing robust earnings growth, projected at 31.1% annually, outpacing the Chinese market's 22.7%. However, its profit margins have declined from 10.6% to 6.5% over the past year, signaling potential efficiency issues. The company's revenue growth forecast of 16.3% also exceeds the market average of 13.9%. Recent activities include a significant private placement raising nearly CNY 990 million and a modest quarterly dividend payment, reflecting ongoing capital and shareholder return strategies despite a dip in quarterly net income and earnings per share from continuing operations.

Dongguan Mentech Optical & Magnetic

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. is a company specializing in the development, production, and sale of optical and magnetic components with a market capitalization of approximately CN¥5.21 billion.

Operations: The revenue segments for the company are detailed in millions of Chinese Yuan (CN¥), but specific figures were not provided in the text.

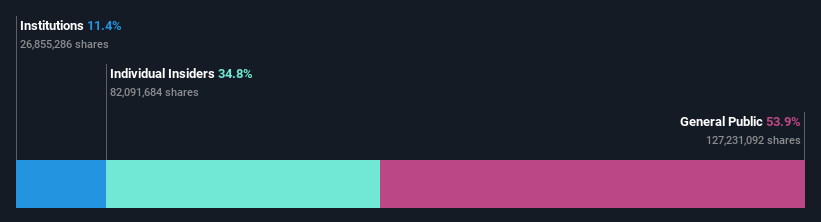

Insider Ownership: 34.8%

Revenue Growth Forecast: 30.8% p.a.

Dongguan Mentech Optical & Magnetic, while facing a challenging period with a significant revenue drop from CNY 2.32 billion to CNY 1.92 billion and shifting from net income to a net loss of CNY 259.34 million, still shows potential for recovery with earnings expected to grow significantly. The company has high insider ownership but noted no major insider buying or selling in the past three months, suggesting stability in shareholder confidence despite recent financial performance downturns.

Taking Advantage

Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1438 more companies for you to explore.Click here to unveil our expertly curated list of 1441 Fast Growing Companies With High Insider Ownership.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include HOSE:DGC SHSE:688518 and SZSE:002902.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance