Three Growth Companies On Chinese Exchange With High Insider Ownership And Up To 44% Revenue Growth

Amidst a backdrop of fluctuating global markets, China's equities have shown resilience, with some sectors demonstrating notable growth despite broader economic pressures. In such an environment, growth companies with high insider ownership can offer unique investment appeal as these insiders often have a vested interest in the company’s long-term success.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's uncover some gems from our specialized screener.

Farsoon Technologies

Simply Wall St Growth Rating: ★★★★★☆

Overview: Farsoon Technologies, with a market cap of CN¥9.46 billion, provides industrial plastic laser sintering and metal laser melting systems across China, North America, and Europe.

Operations: The company generates CN¥629.70 million from its machinery and industrial equipment segment.

Insider Ownership: 11.1%

Revenue Growth Forecast: 44.2% p.a.

Farsoon Technologies, a growth-oriented company in China, exhibits promising financial trends with earnings and revenue forecasted to grow at 47.5% and 44.2% per year respectively, outpacing the Chinese market averages significantly. Despite its highly volatile share price over the past three months, the company has shown substantial year-over-year earnings growth of 35.6%. However, there is no recent insider trading activity to report which might concern investors looking for signals of confidence from internal stakeholders.

SG Micro

Simply Wall St Growth Rating: ★★★★☆☆

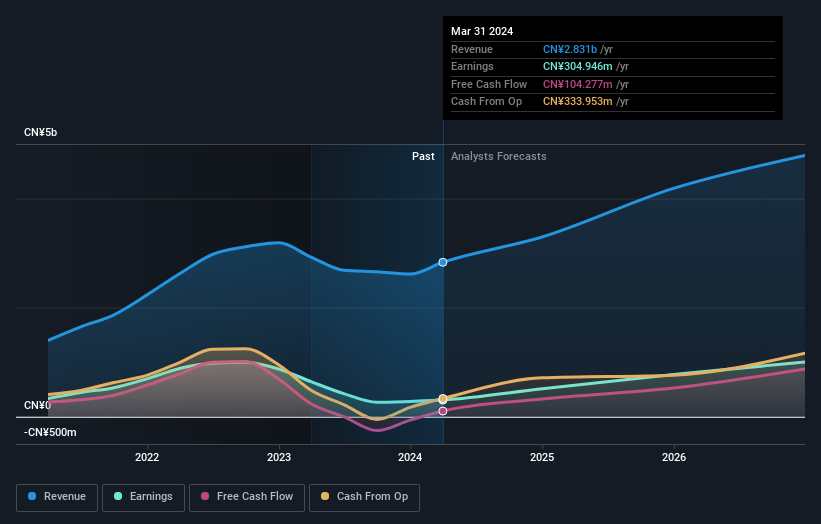

Overview: SG Micro Corp specializes in designing, marketing, and selling analog integrated circuits (ICs), mainly operating within China, with a market capitalization of approximately CN¥38.99 billion.

Operations: The company generates its revenue primarily from the integrated circuit industry, totaling approximately CN¥2.83 billion.

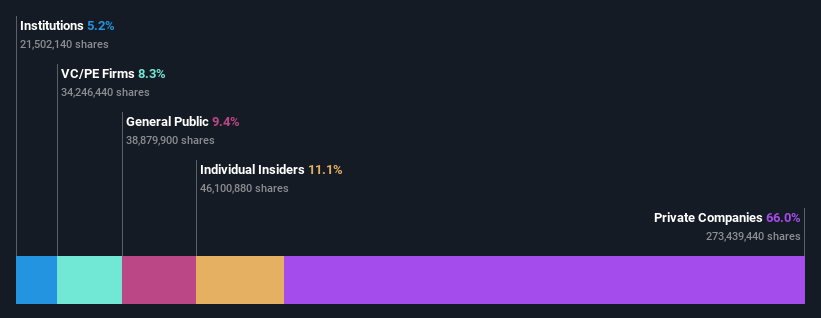

Insider Ownership: 32.8%

Revenue Growth Forecast: 19.6% p.a.

SG Micro, despite a recent dividend cut, shows robust growth prospects with earnings expected to increase by 39.5% annually over the next three years, outperforming the broader Chinese market. However, profit margins have declined from last year's 22% to 10.8%. Recent financials reveal a mixed performance with a notable drop in annual revenue and net income compared to previous years. No significant insider trading activity has been reported recently, which may raise questions about internal confidence levels.

Click to explore a detailed breakdown of our findings in SG Micro's earnings growth report.

Our expertly prepared valuation report SG Micro implies its share price may be too high.

Qingdao Huicheng Environmental Technology Group

Simply Wall St Growth Rating: ★★★★★★

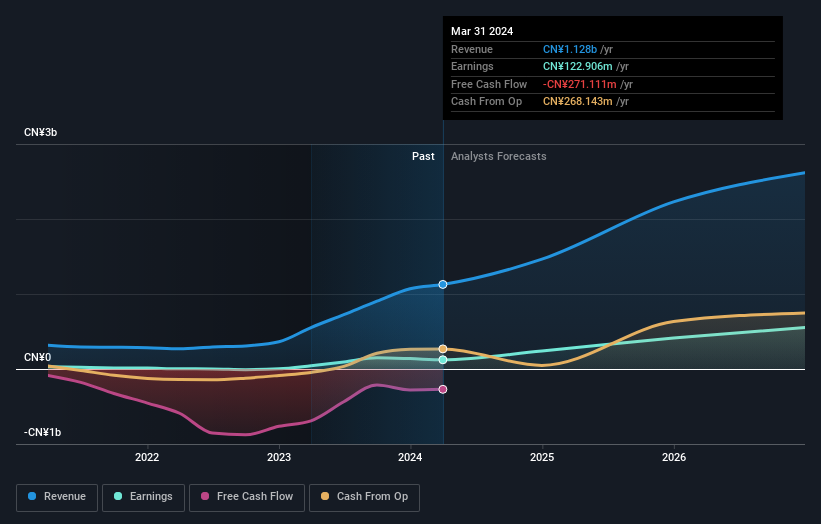

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. is a company that specializes in environmental protection technologies and services, with a market capitalization of approximately CN¥9.80 billion.

Operations: The company generates revenue through environmental protection technologies and services.

Insider Ownership: 31.9%

Revenue Growth Forecast: 30.9% p.a.

Qingdao Huicheng Environmental Technology Group has demonstrated significant growth, with revenue increasing to CNY 1.07 billion and net income surging to CNY 138.51 million this past year. The company's earnings are projected to grow by 47.9% annually, outpacing the Chinese market forecast of 22.7%. Despite a highly volatile share price and concerns about debt coverage by operating cash flow, the firm continues robust financial performance and strategic shareholder returns through consistent dividends and a recent stock split.

Next Steps

Discover the full array of 372 Fast Growing Chinese Companies With High Insider Ownership right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688433 SZSE:300661 and SZSE:300779.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance