Three Chinese Dividend Stocks Offering Up To 5.4% Yield

Amid a backdrop of declining home prices and mixed economic signals, the Chinese market presents a complex landscape for investors. In such an environment, dividend stocks can offer a measure of stability and predictable returns, making them an attractive option for those looking to navigate the uncertainties of the Chinese economy.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.47% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.69% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.73% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.59% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.19% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.65% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.72% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.19% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.45% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.62% | ★★★★★★ |

Click here to see the full list of 224 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Shanghai International Port (Group)

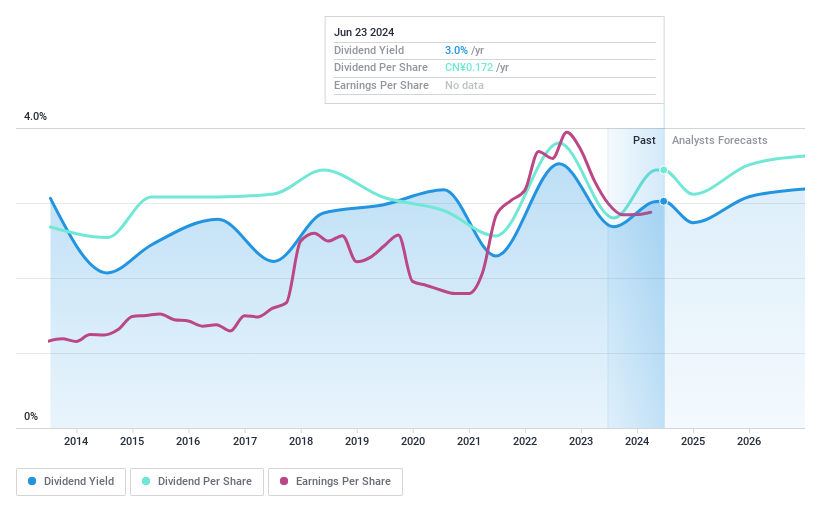

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai International Port (Group) Co., Ltd. operates as a major port services provider in China, focusing on cargo, container handling, and related services with a market capitalization of approximately CN¥132.49 billion.

Operations: The revenue for Shanghai International Port (Group) Co., Ltd. is not specified in the provided text.

Dividend Yield: 3%

Shanghai International Port (Group) Co., Ltd. has demonstrated a mixed performance in dividend reliability and sustainability. The company's dividend yield of 3.02% ranks in the top 25% of dividend payers in the Chinese market, reflecting a relatively attractive return for investors. However, its dividends have shown volatility over the past decade and are not well supported by cash flows, with a high cash payout ratio of 91.9%. Despite this, earnings cover the dividends with a lower payout ratio of 29.9%. Recent financial results indicate growth, reporting Q1 revenue for 2024 at CNY 8.95 billion and net income at CNY 3.70 billion, signaling potential stability ahead.

Bank of Nanjing

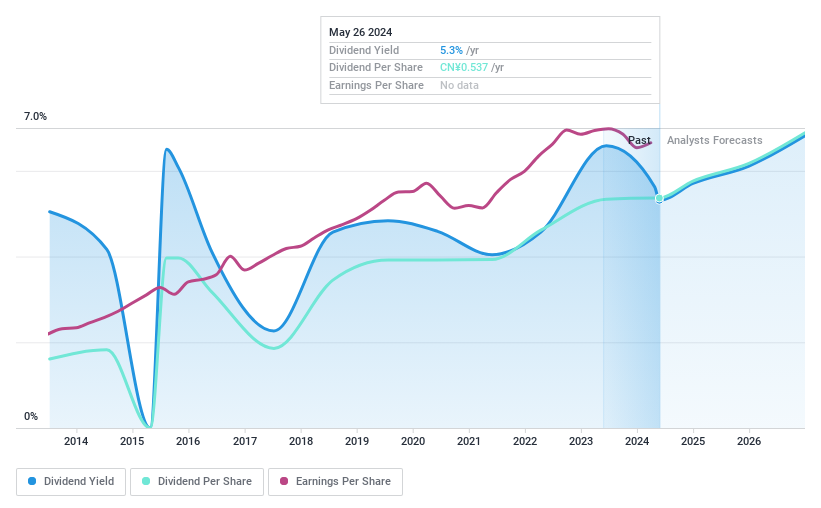

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Nanjing Co., Ltd. operates in China, offering a range of financial products and services, with a market capitalization of approximately CN¥102.09 billion.

Operations: Bank of Nanjing Co., Ltd. generates revenue through a variety of financial products and services within China.

Dividend Yield: 5.4%

Bank of Nanjing has shown a modest improvement in its financial performance, with first-quarter net income rising to CNY 5.71 billion from CNY 5.43 billion year-over-year and a slight increase in earnings per share. Despite this, dividend reliability remains a concern due to historical volatility; however, the dividends are currently well-covered by earnings with a payout ratio of 31.4%. The forecast suggests continued coverage over the next three years at a similar ratio of 30.7%, indicating potential stability in dividend payments moving forward.

China Railway Construction

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Railway Construction Corporation Limited operates in the construction sector both in Mainland China and globally, with a market capitalization of approximately CN¥109.57 billion.

Operations: China Railway Construction Corporation Limited generates its revenue primarily from construction projects within Mainland China and around the world.

Dividend Yield: 4.1%

China Railway Construction reported a slight increase in Q1 2024 earnings with net income rising to CNY 6.03 billion from CNY 5.91 billion year-over-year and consistent earnings per share. The company proposed a final dividend of RMB 0.35 per share for 2023, reflecting stability in its dividend payments over the past decade, although it faces challenges with dividends not well covered by cash flows and debt not well serviced by operating cash flow. Despite these financial pressures, the stock trades at a favorable P/E ratio of 4.9x compared to the broader Chinese market.

Key Takeaways

Dive into all 224 of the Top Dividend Stocks we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600018SHSE:601009 and SHSE:601186

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance