Three-bedder at The Windsor sold at $2.7 mil profit

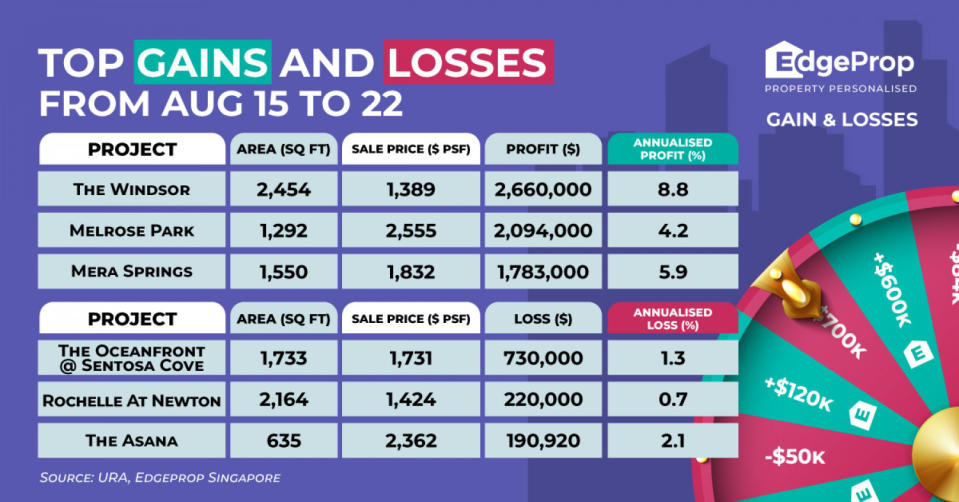

SINGAPORE (EDGEPROP) - The sale of a three-bedroom maisonette at The Windsor was the most profitable condo resale transaction during the week of Aug 15 to 22, based on caveats lodged with URA. The 2,454 sq ft unit changed hands for $3.41 million ($1,389 psf) on Aug 16. It had been purchased by the seller in August 2005 for $750,000 ($306 psf), which means they raked in a profit of $2.66 million. This works out to a capital gain of 355% over a holding period of 18 years.

This is the most profitable resale transaction that has taken place at The Windsor to date. It surpasses the previous record set in June 2020, when a 2,497 sq ft unit fetched $2.45 million ($981 psf). The seller had purchased the unit for $860,000 ($344 psf) in August 2005, which means they made a gain of $1.59 million.

The 2,454 sq ft unit at The Windsor fetched $3.41 million ($1,389 psf) on Aug 16 (Picture: Albert Chua/The Edge Singapore)

The Windsor is a freehold development on Onatorio Avenue, off Upper Thomson Road in District 20, that was completed in 1987. It has 159 residences comprising nine townhouses at 2,497 sq ft each, three-bedroom apartments ranging from 936 to 1,797 sq ft, and maisonettes of 1,819 to 3,853 sq ft each. Besides the unit sold on Aug 16, there has been only one other resale transaction at The Windsor to date this year. In March, a 2,013 sq ft unit fetched $2.95 million ($1,466 psf).

Read also: Living large in the city at Midtown Modern

The second most profitable condo resale transaction during the week in review was the sale of a three-bedroom apartment at Melrose Park. The 1,292 sq ft unit on the eighth floor was sold for $3.3 million ($2,555 psf) on Aug 18. The seller had bought the unit from the developer for $1.206 million ($934 psf) in February 1999. Hence, they netted a gain of $2.094 million or 174% over a holding period of 24½ years.

This is the sixth most profitable resale transaction recorded at Melrose Park, based on caveats lodged. The most profitable transaction occurred in September 2021, when a 5,231 sq ft penthouse was sold for $7.39 million ($1,412 psf). The seller had purchased the penthouse in June 1999 from the developer for $4.3 million ($822 psf), which means they made a profit of $3.089 million.

Melrose Park is a 999-year leasehold property by CapitaLand located on Kellock Road, off River Valley Road in prime District 10. The 170-unit development was completed in 2000. It is in the River Valley residential enclave, located across the road from Great World City shopping centre which is linked to Great World MRT Station on the Thomson-East Coast Line. The development comprises two 19-storey residential blocks and its unit mix includes three- to four-bedroom units ranging from 1,292 to 3,412 sq ft. Each block also has six penthouse units on the 19th floor that range from 3,606 to 5,231 sq ft.

On the other hand, the most unprofitable transaction during the week in review took place at The Oceanfront @ Sentosa Cove. A three-bedder measuring 1,733 sq ft changed hands for $3 million ($1,731 psf) on Aug 15. It was purchased by the seller for $3.73 million ($2,152 psf) in July 2007. Thus, they made a loss of $730,000 or 20% after holding the unit for slightly more than 16 years.

A 1,733 sq ft unit at The Oceanfront @ Sentosa Cove changed hands for $3 million ($1,731 psf) on Aug 15, leading to a loss of $730,000 (Picture: Samuel Isaac Chua/The Edge Singapore)

The Oceanfront @ Sentosa Cove is a 99-year leasehold condo in the exclusive Sentosa Cove residential enclave. A joint project by City Developments and TID (a joint venture between Hong Leong Holdings and Mitsui Fudosan), it was completed in 2010. The waterfront condo has 264 units housed in five towers between 12 and 15 storeys high. Residences include two-, three- and four-bedders of 1,216 to 4,284 sq ft. There are also penthouses of 2,745 to 8,095 sq ft.

The development has seen a number of transactions occur below purchase price in the last year, based on caveats lodged. Data compiled on EdgeProp Research shows that The Oceanfront @ Sentosa Cove has registered 10 such transactions (including the transaction on Aug 15) since January 2022. The units, measuring from 1,480 to 1,731 sq ft, incurred losses ranging from $51,120 to $1.87 million. The most unprofitable resale transaction recorded at The Oceanfront @ Sentosa Cove was the sale of a 3,025 sq ft unit in November 2020 for $5.66 million ($1,871 psf), which incurred a $2.205 million loss.

Read also: Do international schools give a boost to prices of nearby condos?

Check out the latest listings for The Windsor, Melrose Park, The Oceanfront @ Sentosa Cove, Condominium properties

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Do international schools give a boost to prices of nearby condos?

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance