Three ASX Growth Companies With High Insider Ownership And At Least 10% Revenue Growth

Amidst a buoyant Australian market where the ASX200 recently closed up by 0.68% with all sectors in the green, investors are keenly observing various market movements and trends. In such an environment, growth companies with high insider ownership can be particularly compelling, as this often signals strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Underneath we present a selection of stocks filtered out by our screen.

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

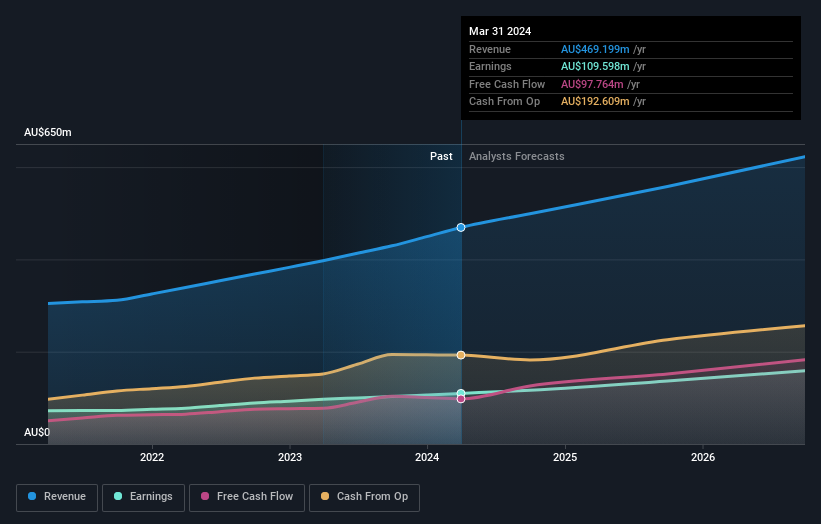

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.48 billion.

Operations: The company generates revenue primarily from mine operations, totaling approximately A$339.32 million.

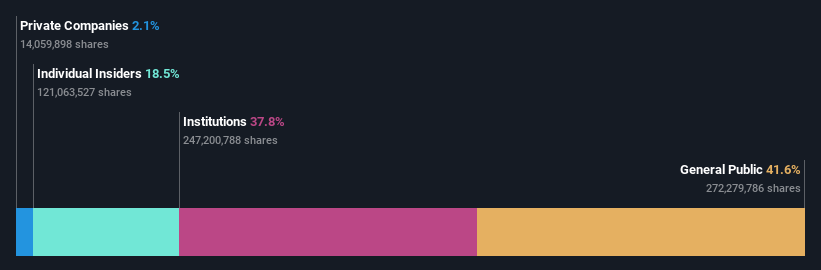

Insider Ownership: 18.5%

Revenue Growth Forecast: 19.4% p.a.

Emerald Resources is positioned intriguingly within the Australian growth sector, with its earnings expected to rise by 22.8% annually, outpacing the broader market's 13.9%. Despite substantial earnings growth and a notable 53.4% increase over the past year, revenue projections slightly lag high-growth benchmarks at 19.4% annually. Additionally, shareholder dilution has occurred over the last year and insider trading activity has been minimal, reflecting mixed signals for investors focused on high insider ownership and robust financial expansion.

Nanosonics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is an infection prevention company operating both in Australia and internationally, with a market capitalization of approximately A$939.29 million.

Operations: The company generates revenue primarily from its healthcare equipment segment, amounting to A$164.07 million.

Insider Ownership: 15.1%

Revenue Growth Forecast: 10.1% p.a.

Nanosonics, trading at 28% below its estimated fair value, shows promising growth prospects with earnings expected to increase by 24.23% annually. Despite this robust forecast, its revenue growth is slower at 10.1% per year but still outpaces the Australian market average of 5.3%. Insider activity includes more buying than selling in recent months, though volumes were not large. However, its projected Return on Equity of 12.5% in three years suggests modest future profitability relative to some peers.

Delve into the full analysis future growth report here for a deeper understanding of Nanosonics.

Our expertly prepared valuation report Nanosonics implies its share price may be too high.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally, with a market capitalization of approximately A$5.91 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services at A$83.83 million, and consulting services totaling A$68.13 million.

Insider Ownership: 12.3%

Revenue Growth Forecast: 11.1% p.a.

Technology One, a prominent Australian software company, demonstrates solid growth with its recent half-year earnings increasing to A$48 million from A$41.28 million the previous year. The company's revenue also rose to A$240.83 million, reflecting a strong market presence. Despite a high Price-To-Earnings ratio of 53.9x compared to the industry average of 62.6x, Technology One's expected profit growth at 14.3% per year slightly outpaces the broader Australian market forecast of 13.9%. However, its revenue growth projection of 11.1% per year is robust but not exceptional when benchmarked against high-growth standards (above 20%). Additionally, there has been no significant insider trading activity in the past three months, which might raise questions about insider confidence despite substantial ownership.

Make It Happen

Navigate through the entire inventory of 91 Fast Growing ASX Companies With High Insider Ownership here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:NAN and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance