Three ASX Dividend Stocks Offering Yields From 3.5% To 8.7%

In a week where the ASX200 saw modest gains, closing up 0.1%, sectors such as IT and financials showed strength while materials lagged slightly behind. Amidst these mixed sector performances, dividend stocks continue to attract attention for their potential to offer steady income streams in various market conditions. Given the current economic landscape, a good dividend stock typically combines reliable yield with strong fundamentals, making it an appealing choice for investors looking for stability in a fluctuating market environment.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.08% | ★★★★★☆ |

Lindsay Australia (ASX:LAU) | 6.82% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.07% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.95% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.03% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.03% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.37% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.33% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.12% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

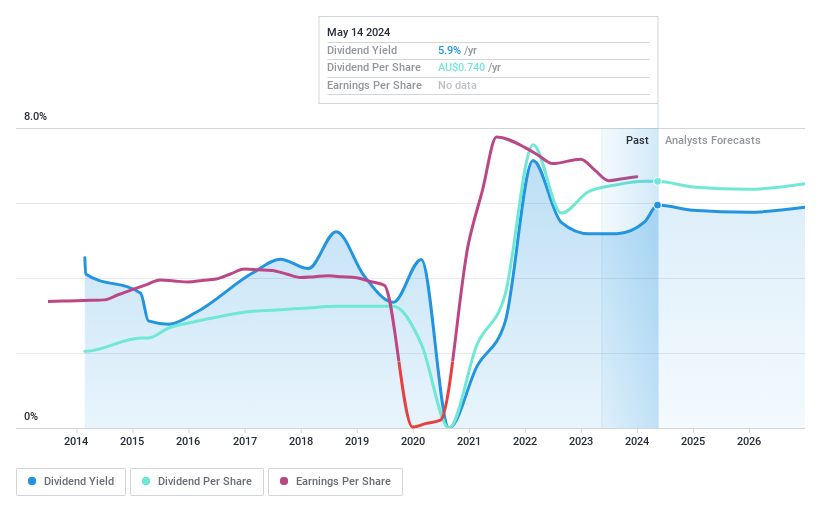

Eagers Automotive

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eagers Automotive Limited is an automotive retail company that owns and operates motor vehicle dealerships in Australia and New Zealand, with a market capitalization of approximately A$2.72 billion.

Operations: Eagers Automotive Limited generates its revenue primarily through car retailing, which amounted to A$9.85 billion.

Dividend Yield: 7.0%

Eagers Automotive has a payout ratio of 66.8%, indicating that its dividends are well-covered by earnings, though the dividend track record over the past decade has been unstable with significant volatility. The company's dividend yield stands at 7.03%, placing it in the top quartile of Australian dividend payers. Despite this, Eagers faces challenges with high debt levels and an expected decline in earnings by an average of 0.8% annually over the next three years. Recently, Eagers announced a share buyback program and is actively pursuing M&A opportunities to drive its growth strategy.

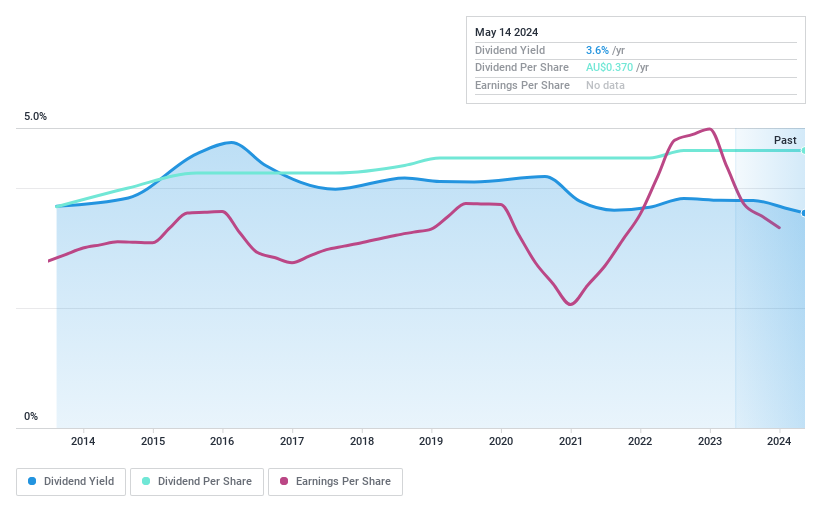

Australian United Investment

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited, a publicly owned investment manager, operates with a market capitalization of approximately A$1.29 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily from investments, totaling approximately A$58.33 million.

Dividend Yield: 3.5%

Australian United Investment has maintained steady dividend payments over the past decade, showcasing reliability. However, with a current yield of 3.55%, it falls below the top quartile in Australia's dividend market where yields average 6.56%. The dividends are not well covered by earnings, given a high payout ratio of 92.4%, though they are supported by cash flows with a cash payout ratio of 86.8%. Recently, AUI extended its buyback plan until May 2025, potentially impacting future dividend sustainability.

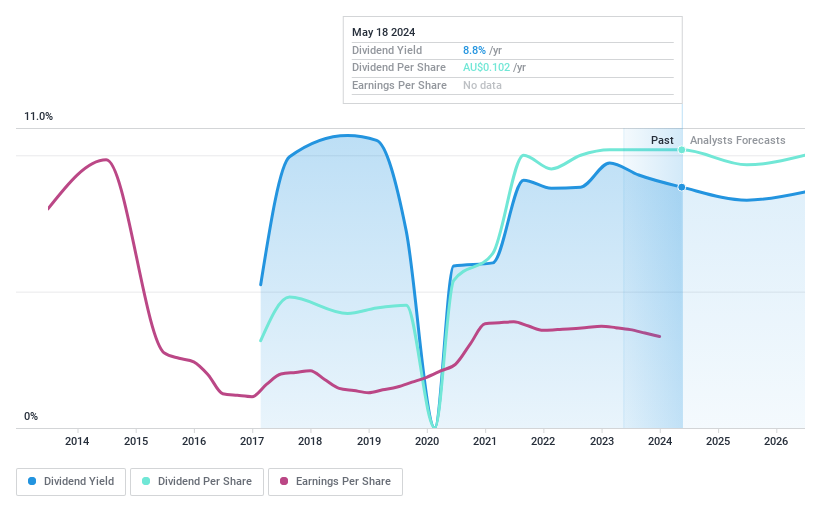

Shaver Shop Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaver Shop Group Limited is a retailer specializing in personal care and grooming products across Australia and New Zealand, with a market capitalization of A$153.28 million.

Operations: Shaver Shop Group Limited generates A$219.66 million from retail sales of specialist personal grooming products.

Dividend Yield: 8.7%

Shaver Shop Group, despite trading at 56.2% below its estimated fair value, presents a mixed outlook for dividend investors. Its dividend yield of 8.72% ranks in the top quartile of Australian payers, supported by a reasonable cash payout ratio of 52.9%. However, its dividend history over the past seven years shows volatility and inconsistency in payments. The recent retirement of director Brian Singer could influence strategic directions impacting future dividends.

Turning Ideas Into Actions

Reveal the 27 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:AUI and ASX:SSG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance