Thermo Fisher's (TMO) New Buyouts Aid Growth, FX Issues Stay

Thermo Fisher TMO gains from strong end-market performances. International issues continue to hamper overall growth. The stock carries a Zacks Rank #3 (Hold) currently.

Within the pharma and biotech end market, of late, Thermo Fisher’s biosciences and bioproduction businesses have significantly expanded their capacity to meet global vaccine manufacturing requirements. Additionally, the pharma services business has been providing pharma and biotech customers with the services they need to develop and produce vaccines and therapies globally.

In terms of the latest update, within the end market, the company delivered strong growth in its electron microscopy business as well as in the research and safety market channel. The company continues to witness improvements in the biotech funding environment and the stimulus program announced by China.

Thermo Fisher’s business strategy primarily includes expansion through strategic acquisition of technologies and businesses that augment the company’s existing products and services. As a result of these acquisitions, Thermo Fisher recorded significant goodwill and indefinite-lived intangible assets (primarily tradenames) on its balance sheet, which amounted to nearly $44.02 billion and $1.24 billion, respectively, as of Dec 31, 2023.

A few of its recent strategic acquisitions that are likely to drive future growth include its October announced plan to acquire Olink Holdings for $26.00 per common share in cash. The acquisition is expected to enhance Thermo Fisher’s capabilities in the high-growth proteomics market with the addition of highly differentiated solutions. Through acquisition, the company expects to deliver $125 million in adjusted operating income synergies in year five, driven by revenue synergies and cost efficiencies.

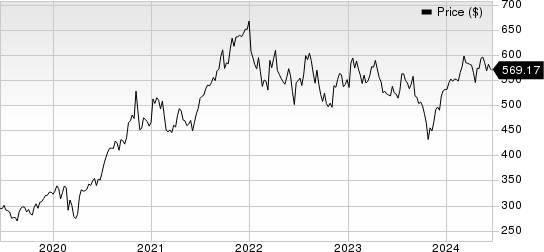

Thermo Fisher Scientific Inc. Price

Thermo Fisher Scientific Inc. price | Thermo Fisher Scientific Inc. Quote

In August 2023, Thermo Fisher acquired CorEvitas. The buyout advanced Thermo Fisher’s clinical research capabilities with a leading regulatory-grade registry platform.

In June 2023, Thermo Fisher acquired MarqMetrix. The acquisition of MarqMetrix is an excellent strategic fit for Thermo Fisher as it adds highly complementary Raman-based in-line PAT to Thermo Fisher’s portfolio.

On the flip side, the challenging macroeconomic scenario and slower economic recovery in China continue to hurt Thermo Fisher's growth. The company has been witnessing headwinds in the government and academic markets. Moreover, many countries in Europe are also going through a tough time that might impact their academic budgets. Thermo Fisher remains cautious since its growth could further moderate if the economic scenario worsens.

In the first quarter of 2024, North America declined in the mid-single digits, while Europe, Asia-Pacific and China declined in the low single digits. Our estimate suggests that the Asia Pacific region will decline by 0.9%, while North America is expected to decline by 0.5% in 2024.

Thermo Fisher's selling, general and administrative expenses also rose 5.2% in the first quarter of 2024.

Further, as Thermo Fisher’s international sales continue to grow, exposure to fluctuations in currency exchange rates affects its financial results.

In 2023, currency translation had an unfavorable effect of $0.02 billion on revenues due to the strengthening of the U.S. dollar relative to other currencies in which the company sells products and services.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD. While Hims & Hers Health sports a Zacks Rank #1 (Strong Buy), Medpace and ResMed carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has surged 196.9% in the past year. Estimates for the company’s earnings have moved from 18 cents to 19 cents for 2024 and remained constant at 33 cents for 2025 in the past seven days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share have remained constant at $11.29 in the past 30 days. Shares of the company have surged 78.9% in the past year compared with the industry’s 5.9% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Estimates for ResMed’s fiscal 2024 earnings per share have remained constant at $7.70 in the past 30 days. Shares of the company have declined 2.1% in the past year compared with the industry’s fall of 2.3%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance